Question: Need help with the following develop various budgets based onthe given data. The given datais the top half, the work I've tried to complete (might

Need help with the following develop various budgets based onthe given data. The given datais the top half, the work I've tried to complete (might be wrong, please verify my numbers) begins below with the sales and production budgets.

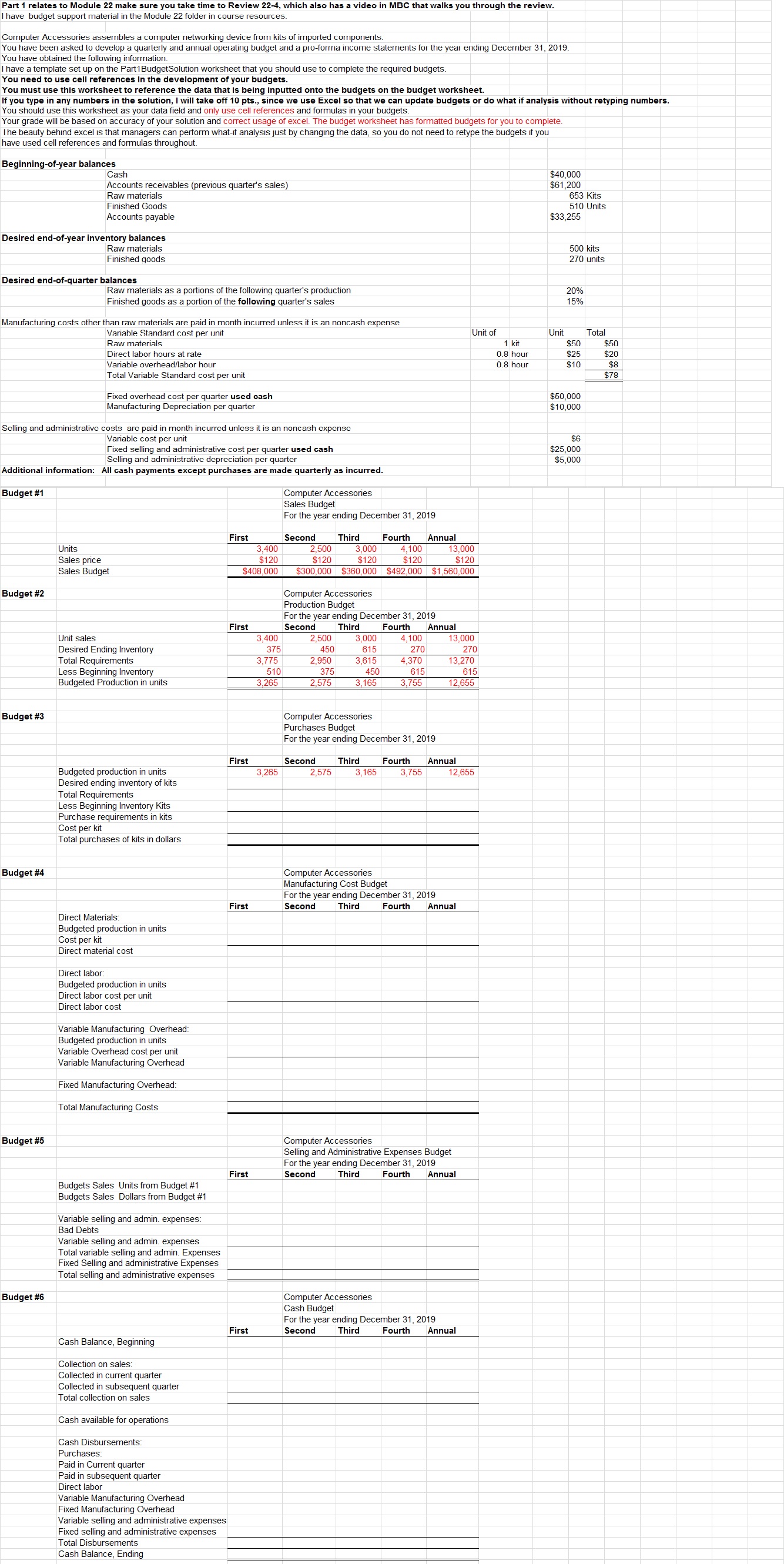

Part 1 relates to Module zz make sure you take time to Review 42" 2-4, which also deo in MBC that walks you through the rey have budget support material in the Module 22 folder in course resources, Corripuler Accessories assembles a computer networking device from kits of imported components. You have been asked lo develop a quarterly and annual operaling budgel and a pro-forma income statements for the year ending December 31, 2019 You have ublained the following information. have a template set up on the P he Part1BudgetSolution worksheet that you should use to complete the required budgets. You need to use cell references In the development of your budgets. You must use this worksheet to reference the data that is being inputted onto the budgets on the budget worksheet. If you type in any numbers in the solution, I will take off 10 pts., since we use Excel so that we can update budgets or do what if analysis without retyping numbers. You should use this worksheet as your data field and only use cell references and formulas in your budgets. Your grade will be based on accuracy of your solution and correct usage of excel. The budget worksheet has formatted budgets for you to complete. The beauty behind excel is that managers can perform what-if analysis just by changing the data, so you do not need to retype the budgets if you have used cell references and formulas throughout. Beginning-of-year balances Cash $40,000 Accounts receivables (previous quarter's sales) $61,200 Raw materials 653 Kits Finished Goods 510 Units Accounts payable 33,255 Desired end-of-year inventory balances Raw materials 500 kits Finished goods 270 units Desired end-of-quarter balances Raw materials as a portions of the following quarter's production 20% Finished goods as a portion of the following quarter's sales 15% Manufacturing costs other than raw materials are paid in month incurred unless it is an noncash expense Variable Standard cost per unit Unit of Unit Total Raw materials $50 $50 Direct labor hours at rate 0.8 hour $25 Variable overhead/labor hour 0.8 hour $10 $20 Total Variable Standard cost per unit $78 Fixed overhead cost per quarter used cash $50,000 Manufacturing Depreciation per quarter $10.000 Selling and administrative costs arc paid in month incurred unless it is an noncash cxpcnsc Variable cost per unit $6 Fixed selling and administrative cost per quarter used cash $25,000 Selling and administrative depreciation per quarter $5,000 Additional information: All cash payments except purchases are made quarterly as incurred. Computer Accessories Sales Budget For the year ending December 31, 2019 First Second Third Fourth Annual Units 3,400 2,500 Sales price OZLS $120 3,000 $120 13,000 $120 Sales Budge $408,000 $300,000 $360,000 $492,000 $1,560,000 Budget #2 Computer Accessories Production Budget For the year ending December 31, 2019 First Second Third Fourth Annual Unit sales 3,400 2,500 3,000 4,100 13,000 Desired Ending Inventory 375 615 27 Total Requirements 3,775 2,950 3,615 3,270 Less Beginning Inventory 510 375 615 Budgeted Production in units 615 3,265 2,575 3,165 3,755 12.655 Budget #3 Computer Accessories Purchases Budget For the year ending December 31, 2019 First Second Third Fourth Annual Budgeted production in units 2,575 3,165 3.755 12,655 Desired ending inventory of kits Total Requirements Less Beginning Inventory Kits Purchase requirements in kits Cost per kit Total purchases of kits in dollars Budget #4 Computer Accessories Manufacturing Cost Budget For the year ending December 31, 2019 First Second Third Fourth Annual Direct Materials: Budgeted production in units Cost per kit Direct material cost Direct labor: Budgeted production in units Direct labor cost per unit Direct labor cost Variable Manufacturing Overhead Budgeted production in units Variable Overhead cost per unit Variable Manufacturing Overhead Fixed Manufacturing Overhead: Total Manufacturing Costs Budget #5 Computer Accessories Selling and Administrative Expenses Budget For the year ending December 31, 2019 First Second Third Fourth Annual Budgets Sales Units from Budget #1 Budgets Sales Dollars from Budget #1 Variable selling and admin. expenses Bad Debts Variable selling and admin. expenses Total variable selling and admin. Expenses Fixed Selling and administrative Expenses Total selling and administrative expenses Budget #6 Computer Accessories Cash Budget For the year ending December 31, 2019 First Second Third Fourth Annual Cash Balance, Beginning Collection on sales: Collected in current quarter Collected in subsequent quarter Total collection on sales Cash available for operations Cash Disbursements: Purchases: Paid in Current quarter Paid in subsequent quarter Direct labor Variable Manufacturing Overhead Fixed d Manufacturing Overhead Variable selling and administrative expenses Fixed selling and administrative expenses Total Disbursements Cash Balance, Ending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts