Question: Need help with the following problem. It has do to do with accounting, Corp. Tax. I would appreciate step-by-step instructions. Thank you. ellook 12. Problem

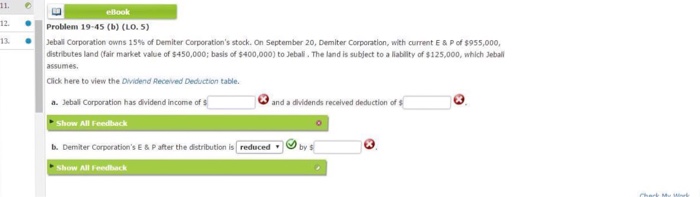

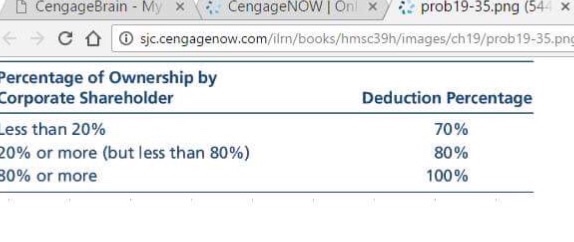

ellook 12. Problem 19-45 (b) (10.5) 13. Jeball Corporation owns 15% of Demiter Corporation's stock-On September 20, Demiter Corporation, with cument E & p of S 955,000, distrtutes landfair market value of S450,000; basis of $400,000) to Jebali . The land is subject to a liabilty of S 125,000, which Jebal assumes Click here to view the Dividend Received Deduction table. a. Jebal Corporation has dividend income of s and a dividends recelved deduction of Show All Feedtback b. Demiter Corporation's E & P after the distribution is | reduced by Show All Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts