Question: Need HELP with the implementation statement. Phoenix Risen Incorporated (PRI Inc.) EXECUTIVE SUMMARY Phoenix Risen Incorporated (PRI Inc.) is a privately held corporation operating a

Need HELP with the implementation statement.

Phoenix Risen Incorporated (PRI Inc.)

EXECUTIVE SUMMARY

Phoenix Risen Incorporated (PRI Inc.) is a privately held corporation operating a retail department store. It was founded in 1943 by two brothers, Pierre, and Marcel Legault.

PRI's business model focuses on high quality, Canadian made products. The company believes in treating its staff well and that the customer is always right.

Its most recent acquisition was Cinder, which targets a different market segment. It was acquired to expand PRI's customer base in Canada. Cinder's business model focuses on consumer goods at an affordable price.

In the last few years PRI has had a few struggles. One of which is its lack of focus on Cinder. Another is its confusing image as PRI focuses on quality while Cinder focuses on affordability.

Online shopping is another source of its headaches. The company is late in increasing its online presence to target millennials who now have increasing buying power. Millennials are known to research heavily and shop online, which PRI is looking to capture.

The executives at PRI are also debating whether to implement a major overhaul of the company or stay the course.

Various options were raised in the last board meeting including giving up the flagship store in Vancouver and accepting a sale leaseback option; option to give up suburban stores and focus on downtown locations. An opportunity has recently come up to acquire Sparky Limited which focuses on the younger market, smaller stores, and quality products.

A study was completed to target a few of these options. The presentation herein focuses on the decision to proceed with the following options:

- Sale Leaseback and closure of underperforming stores

- Adoption of the Grocery Store model for Cinder

- Implementation of Online Infrastructure

- Retirement options for James and Stephen along with ownership transfer to Maggie

Sparky Limited should not be acquired

INTRODUCTION

This analysis will go over the issues that Phoenix Risen Incorporated is facing. Starting with the real estate strategy. The second strategy that will be discussed is the decision to acquire Sparky Inc. or not. The third strategy to be discussed is whether or not Cinder Inc will implement a grocery store department in its stores. The fourth strategy to be discussed is Phoenix Risen's online brand and infrastructure. The fifth and final strategy to be discussed is the retirement plan of James and Stephen, as well as the passing of ownership to Maggie.

PROBLEM STATEMENT

Below is a list of the issues facing Phoenix Rising Inc.:

Real Estate

The first major issue at hand is the real estate portfolio of PRI Inc. The company wants to figure out whether to sell some of the properties, particularly the Vancouver location and enter into a leaseback option.

It is also considering whether to close a number of underperforming stores, particularly the ones in suburban areas. Closing the stores should not have an impact to foot traffic.

Another issue raised is whether the company should set up a Real Estate Investment Trust (REIT) and pool all the properties it owns.

Acquisitions

The second major issue posted by PRI's executives is whether to incorporate more acquisitions. Sparky Limited is up for acquisition and it may assist PRI Inc. in its ability to target the younger market with quality products, but on a lower budget.

Cinder was acquired a few years back; however, the leaders at PRI believe the company has largely ignored this subsidiary. PRI executives want a clearer strategy for Cinder.

Technology

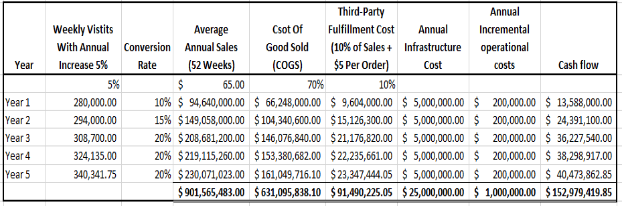

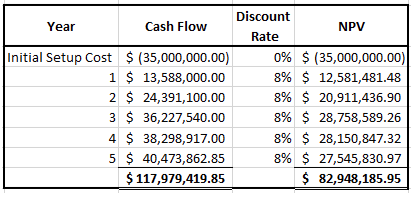

Leaders in PRI want to investigate increasing its online presence and invest in online infrastructure. They also want a performance measurement tool to keep track of performance and a return on investment of 8% over the next few years.

Retirement

James and Stephen want to retire. They also want some ownership to pass on to Maggie; however, they want to ensure that Maggie does not have more ownership of the company than others. The company wants to find out how to accomplish this.

COMPREHENSIVE ANALYSIS:

The issues and concerns affecting PRI have highlighted in the problem statements is ability to stay current and grow in its current environment. We will use SWOT (strength, weakness, opportunities, and threats) analysis,value chain analysis and financial analysis to evaluate PRI's position in the industry to better understand how these issues it's facing can be addressed. In addition to this, a further analysis of each business will be conducted.

SWOT Analysis: PRI's management should consider using SWOT analysis as the first step towards understanding factors affecting its internal and external environments. Here, the strengths and weaknesses in its internal environment along with the opportunities and threats that exist in its external environment form a basis for understanding PRI's position in the industries (retail and real estate management). Based on this, the management then creates business models to grow the company.

Strengths: Here are the strengths that the company should leverage on:

- Fighting brand strategy for its retail business which offers both high-end products through Phoenix and more affordable ones through Cinder.

- Non-specialty stores where customers can buy all their goods in one location.

- Brand recognition and customer loyalty

- Reputation of working mostly with Canadian based manufacturers.

Weakness: The management should steer away or minimize these weaknesses:

- The majority of the retail business's customer base consists of older demographics.

- Underperforming real estate portfolio and stores, tech,

- High costs due to mostly buying retail products from Canadian manufacturers.

- High cost of refurbishing properties in its real estate portfolio.

- Potential security breach

Opportunities: Should capitalize on untapped market opportunities some of which are listed below:

- Adoption of e-commerce to expand current share of the market

- Increase advertising to create more awareness of the new directions for all its businesses..

- Constant customers' fashion trends/lifestyle changes give room for growth.

- Consolidate its real estate portfolio into a Real Estate Income Trust (REIT) for proper management and growth of real estate side of business

Threats:

- Intense competition in the industries

- Threat of new entrants into the industry due to low barriers to entry-the major national chain expanded into Cinder's market.

- High bargaining power of customers given the other alternative options they have.

- Threat of substitute products

- High bargaining power of suppliers as PRI has limited suppliers since most of their products are manufactured in Canada.

Real estate

The most optimal option for real estate is a combination of two strategies:

- Sell the Vancouver real estate and enter into a sale leaseback agreement

- Give up the underperforming leased suburban locations Edmonton and Montreal.

The company should sell the Vancouver location and enter into a sale leaseback agreement with the new owner. Entering into this agreement will lead to two things: Firstly, the company will save 50% of the cost of leasehold improvement (total cost 2.4MM), and secondly, the sale of the property will free up some equity from the property that PRI can use for other capital expenditures.

This option has huge advantages. The leasehold improvements are estimated to increase the Vancouver location's sales by 20%.

In addition, the company should give up the underperforming suburban locations currently being leased. Edmonton and Montreal are the underperformers, with sales of only $91 and $98 per square feet, respectively. These two locations are currently leased (second Montreal location is urban, owned). For comparison, Vancouver brings in $125 per square feet.

Once both these options are combined, sales are estimated to be at 240MM with net income at approximately 5MM given savings in lease cost along with cost of sales for the two underperformers. (Exhibit # xx)

Should PRI decide to only consider one option (the sale of the Vancouver location), net earnings will be a tad lower at 4MM.

Although the forecasted net income will be much lower than 2015, the cash that will be received from the proceeds of the Vancouver sale can be used for other capital investment purposes or be kept by the company in short term investments to earn additional interest while waiting for the right opportunity. Approximate cash to be received is 157MM, which is the fair market value for the property. The Vancouver property is free and clear.

Additional savings include the planned leaseholds for the two underperforming locations which will no longer have to be earmarked for.

Finally, once the Vancouver location is sold, the company may consider packaging three of its remaining owned properties -- Toronto, Calgary, Montreal, Winnipeg into a REIT. PRI now has a specialization in retail properties, having owned a number. The ownership of these properties, can then be placed in the REIT, rent it out to PRI and the owners can then take dividends to pay themselves off of the REIT. This then becomes more advantageous for the owners for tax purposes.

Cinder

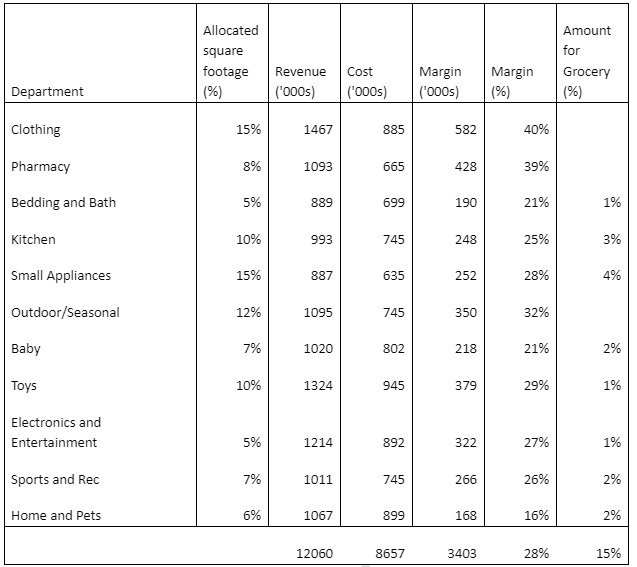

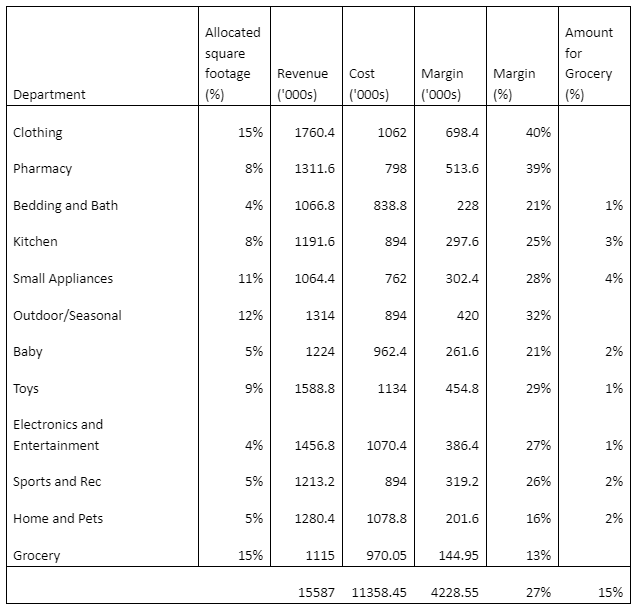

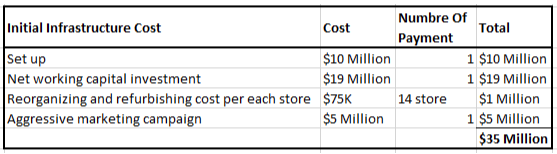

Cinder has come to a standstill. It is in a position where the company has to to decide whether to adapt or be left behind. The only way to compete is to add the grocery department in every store. Adding the grocery store department will increase operating costs by $350,000.00 per store and will require 15% of the store's total square footage. The grocery store department is expected to add $1,115,000.00 in sales with a gross margin of 13%. This results in a net income of $144,950.00 per store. However, the extra operating costs will need to be absorbed as well. If the extra operating costs of $350,000.00 are absorbed solely by the grocery store department it would result in a loss of $205,050.00. However, the grocery store department will be sharing costs with the rest of the store, especially the departments that the grocery department is sharing with. The grocery store will also bring in an extra 20% in sales around the other departments. The grocery store department can not take up more than 25% of an existing department's square footage.

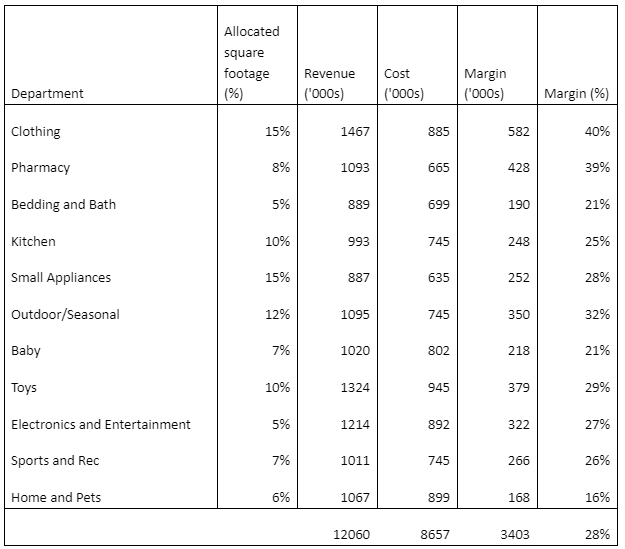

This exhibit shows how Cinder currently operates.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts