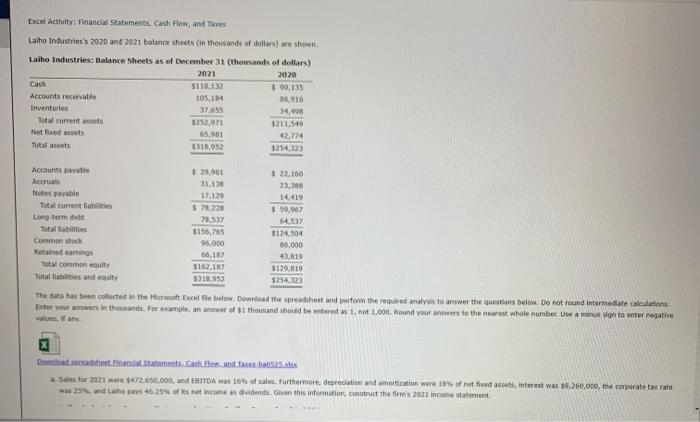

Question: need help with the incorrect ones Excel Activity: Financial Statements, Cash Flow, and The Laiho Industries's 2020 and 2021 balance sheets in thousands of dollars)

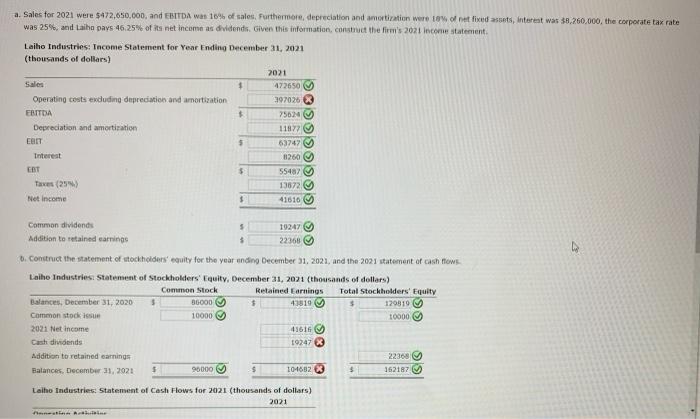

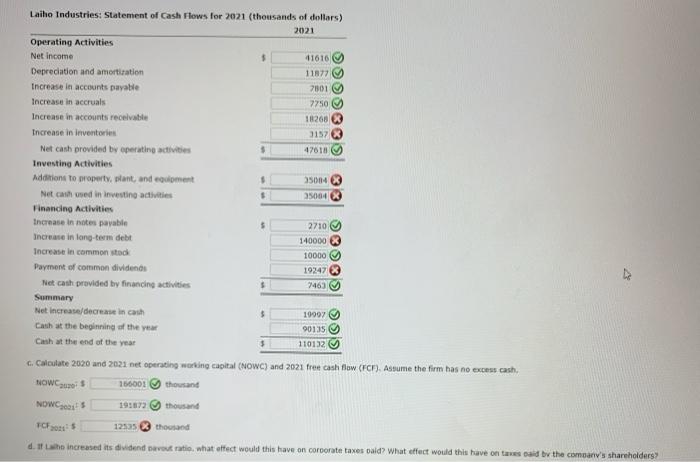

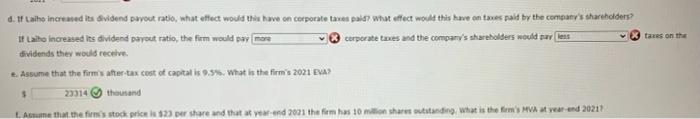

Excel Activity: Financial Statements, Cash Flow, and The Laiho Industries's 2020 and 2021 balance sheets in thousands of dollars) are shown Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $110.132 $ 90,135 Accounts receivable 105,11 6,16 Inventories 37.655 1,98 Total current at 3252,071 211,549 Need assets 65.981 42,724 Total acts $310.952 3254,323 Accounts payable $ 29,901 $ 22,100 Acorus 31.10 23,388 Notes ayable 27.129 14.410 Total current 5.78,220 $50,007 Long-term det 78.337 54.53 Totales 3155,765 1124.504 Commonstad 95,000 16,000 Hendamine 65,18 43,810 Totalcommon equity 5162 167 $129,810 Total des and equity $310.053 254,123 The data as been collected in the Microsoft Excel te below. Download the readheet and perform the required analysis to answer the questions below. Do not found intermediate allations Enter your answers in thousands. For example, an nuwer of $1 thousand should be entered as 1. not 1,000. Round your answers to the nearest whole numbers and in to enter negative values any. Downlohet mandalas. Take 525. Sales for 1021 were $472.650,000, and FITDA W 10% of sales. Furthermore, depreciation and mortization were one fixed assets, interest was $8.260,000, the corporate tax rate 25 and Laos 46,25% of its income dividends. Gre this information, construct the firmy 2021 income statement a. Sales for 2021 were $472,650,000, and EBITDA was 10% of sales. Furthermore, depreciation and amortization were to be fixed assets, interest was $8.260,000, the corporate tax rate was 25%, and Laiha pays 46.25% of its net income as dividends. Given this information, construct the firm's 2021 Income statement. Laiho Industries: Tncome Statement for Year Ending December 31, 2021 (thousands of dollars) 2021 Sales + 472650 Operating costs exduding depreciation and amortization 397026 X EBITDA $ 7562M Depreciation and amortization 1187 EBIT $ 63747 Interest 1260 ET $ 55487 Taxes (25) 13672 Net Income $ 41610 Common dividends $ 19247 Addition to retained earnings $ 22368 D. Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows Laihe Industries Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars) Common Stock Retained Earnings Total Stockholders' Equity Balances, December 31, 2020 5 36000 $ 43819 $ 120319 Common stock 10000 10000 2021 Net income 45616 Cash dividends 19247 Addition to retained earnings 22368 Balances. December 31, 2021 $ 90000 $ 1046823 $ 162187 Laiho Industries. Statement of Cash Flows for 2021 (thousands of dollars) 2021 3 Laiho Industries: Statement of Cash Flows for 2021 (thousands of dollars) 2021 Operating Activities Net income $ 41610 Depreciation and amortization 11877 Increase in accounts payable 7301 Increase in accruals 7750 Increase in accounts receivable 18260 Tricrease in inventories 3157 Net cash provided by operating activities $ 47618 Investing Activities Addition to property, plant, and evoment 35064 Netched in investing activities 35004 Financing Activities Increase in its payable $ 2710 Increase in long-term debt 140000 X Increase in common stoc 10000 Payment of common dividends 19247 Net cash provided by financing activities $ 7463 Summary Net Increase/decrease in cash $ 10007 Cath at the beginning of the year 90135 Cath at the end of the year 5 110132 6. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCI). Assume the firm has no excess cash, NOW: 160001 thousand NOW! 195672 thousand 12535 TCF thogad d. the increased its dividend Davet ratio, what affect would this have on corporate taxes paid? What effect would this have on tascaid by the company's shareholders taxes on the d. If tiho increased its dividend payout ratio, what effect would the have on corporate taxes paid? what effect would this have on twespaid by the company's shareholders It Laiho increased les dividend payout ratio, the firm would pay more corporate taxes and the company's shareholders would say tens dividends they would receive e. Assume that the firm's after-tax cost of capital is 0.5%. What is the firm's 2021 EVA? 23314 thousand $ Lume that the firstock price 52 per share and that year-end 2001 the firm has 10 million share outstanding what is the firm's HVA at year end 20211

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts