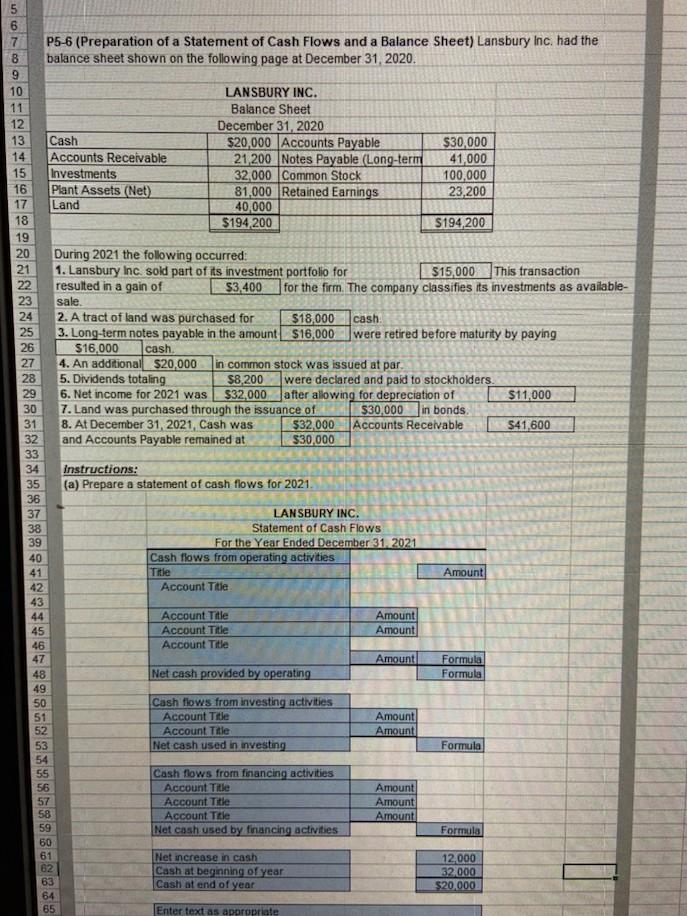

Question: need help with the last bit please Non P5-6 (Preparation of a Statement of Cash Flows and a Balance Sheet) Lansbury Inc. had the balance

need help with the last bit please

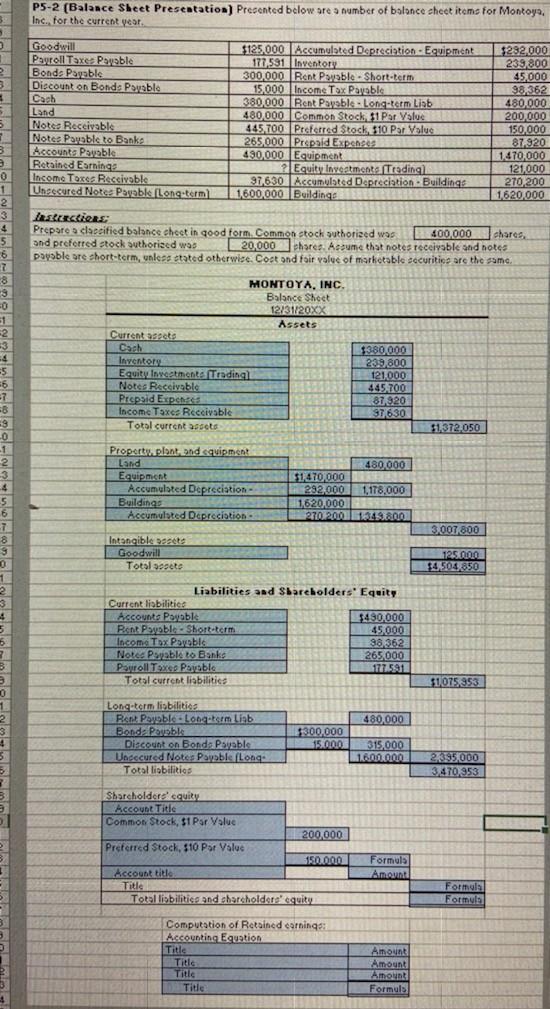

Non P5-6 (Preparation of a Statement of Cash Flows and a Balance Sheet) Lansbury Inc. had the balance sheet shown on the following page at December 31, 2020. 5 6 7 8 9 10 11 12 13 14 15 16 17 Cash Accounts Receivable Investments Plant Assets (Net) Land LANSBURY INC. Balance Sheet December 31, 2020 $20,000 Accounts Payable 21200 Notes Payable (Long-term 32,000 Common Stock 81,000 Retained Earnings 40.000 $194 200 $30,000 41,000 100,000 23,200 18 S194,200 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 During 2021 the following occurred: 1. Lansbury Inc. sold part of its investment portfolio for $15,000 This transaction resulted in a gain of $3,400 for the firm. The company classifies its investments as available- sale 2. A tract of land was purchased for $18,000 cash 3. Long-term notes payable in the amount $16,000 were retired before maturity by paying $16,000 cash, 4. An additional $20,000 in common stock was issued at par 5. Dividends totaling $8,200 were declared and paid to stockholders. 6. Net income for 2021 was $32,000 after allowing for depreciation of $11,000 7. Land was purchased through the issuance of $30,000 in bonds 8. At December 31, 2021, Cash was $32000 Accounts Receivable $41,600 and Accounts Payable remained at $30,000 38 Instructions: (a) Prepare a statement of cash flows for 2021. LANSBURY INC. Statement of Cash Flows For the Year Ended December 31, 2021 Cash flows from operating activities Title Account Title Amount 39 40 41 42 43 44 45 46 47 48 49 50 51 Account Title Account Title Account Title Amount Amount Amount Net cash provided by operating Formula Formula Cash flows from investing activities Account Title Account Title Net cash used in investing Amount Amount 52 Formula 53 54 55 56 57 58 59 60 61 62 63 64 65 Cash flows from financing activities Account Title Account Title Account Title Net cash used by financing activities Amount Amount Amount Formula Net increase in cash Cash at beginning of year Cash at end of year 12,000 32.000 $20,000 Enter text as appropriate 3 1 2 3 3 5 5 7 3 P5-2 (Balance Sheet Presentation) Presented below are a number of balance sheet items for Montoys, Inc. for the current year. Goodwill $125,000 Accumulated Depreciation Equipment $232.000 Payroll Taxe Payable 177,531 Inventory 239.800 Bonds Payable 300,000 Rent Payable - Short-term 45,000 Discount on Bonds Payable 15000 Income Tax Payable 98.362 Cach 380,000 Rent Payable. Long-term Liab 480.000 Land 480.000 Common Stock 51 Par Value 200,000 Note Receivable 445700 Profetred Stock, 110 Par Value 150,000 Nota Payable to Banke 265.000 Prepaid Expenses 87920 Accounts Payable 430,000 Equipment 22222 1470,000 Retained Earnings ? Equity Investments Trading 121,000 Income Taxes Receivable 37,630 Accumulated Depreciation Buildings 270 200 Unsecured Notca Payable long term 1600,000 Buildings 1620.000 0 1 1 2 3 4 5 ISRCECIRE Prepare a claseified balance cheet in good form Common stock authorised was 400.000 chares, and preferred stock Suthorised was 20,000 hores. Asume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of marketable securities are the same MONTOYA, INC. Balance Sheet 12/31/20xx Assets Current arests Cash Inventory Equity Investments Trading Notes Receivable Prepaid Expenses Income Taxes Receivable Total current assets $380.000 239,800 121.000 445 700 87 320 87630 51.372.050 7 8 3 0 51 -2 3 & 5 6 7 8 9 -0 -1 2 3 4 5 6 7 8 3 0 1 2 3 4 5 6 2 B 3 0 1 2 3 + 5 Propertw. plant and equipment Land Equipment Accumulated Depreciation - Buildings Accumulated Depreciation - 480.000 $1,470,000 292,000 1,178,000 1620.000 270.2008 3.001 800 Intangible sets Goodwill Total sets 11250 $4504850 Liabilities and Sbarcholders' Equity Current liabilities Accounts Payable $430,000 Pont Payable Short-term . 45.000 Income Tax Payable 88 362 Notes Payable to Banks 265000 Payroll Texco Pejable 17751 Total current liabilities 1075 353 480,000 Long term lisbilities Ron Payable - Longterm Liab Bonda Paula Discount on Bonda Payable Unsecured Notes Payable Long Total liabilities 1300.000 15.00 315.000 0.000 1 22395,000 3470.953 Shareholders' cquity Account Title Common Stock, S1 Par Value 200.000 Preferred Stock, $10 Par Value 150.000 Account title Title Totallisbilities and charcholderesquity Formula Amit 3 Formala Formula Computation of Retained earnings: Accounting Equation Title Title Title Title Amount Amount Amount Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts