Question: Need help with the last empty yellow boxes. Variable Manufacturing Unit Cost 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Lamp Kit Labor Variable

Need help with the last empty yellow boxes.

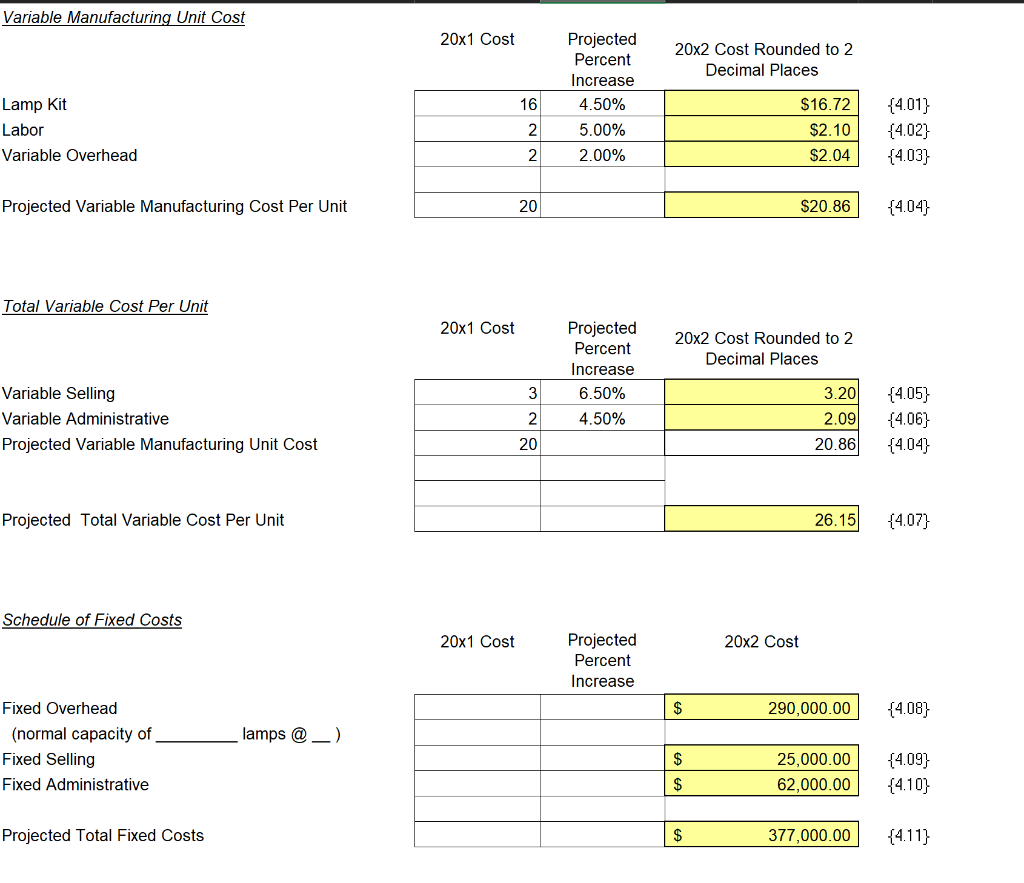

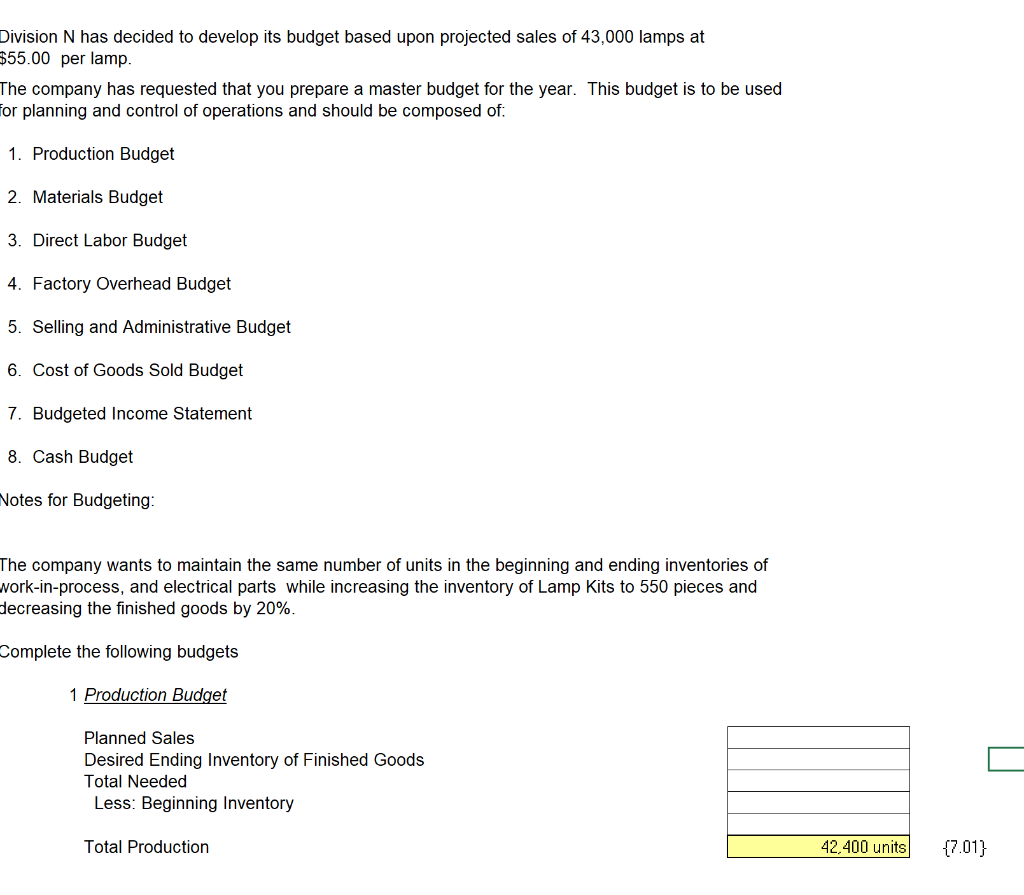

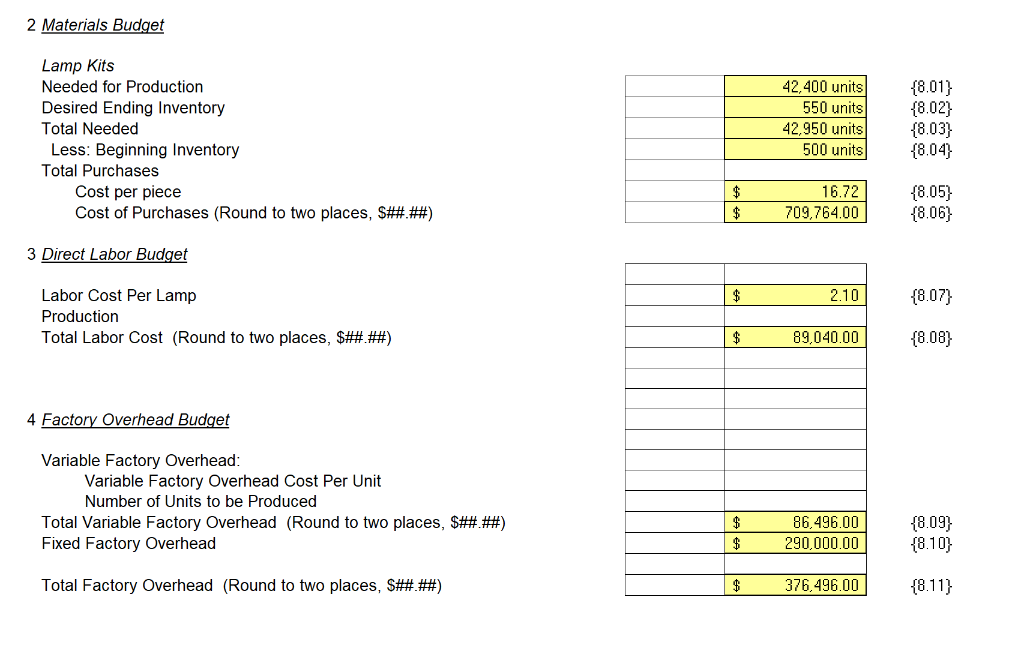

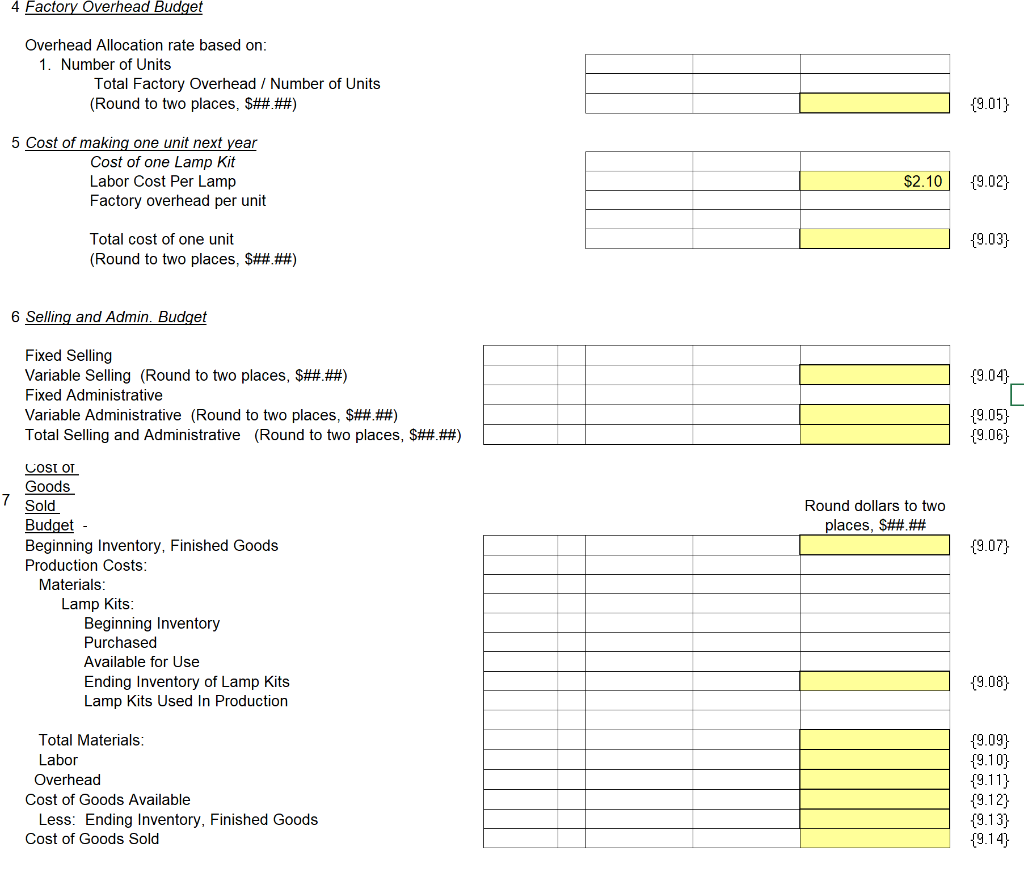

Variable Manufacturing Unit Cost 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Lamp Kit Labor Variable Overhead 16 2 Projected Percent Increase 4.50% 5.00% 2.00% $16.72 $2.10 $2.04 {4.01} {4.02) {4.03} 2 Projected Variable Manufacturing Cost Per Unit 20 $20.86 {4.04 Total Variable Cost Per Unit 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Projected Percent Increase 6.50% 4.50% 3 Variable Selling Variable Administrative Projected Variable Manufacturing Unit Cost 2 3.20 2.09 20.86 {4.05) {4.06} {4.04} 20 Projected Total Variable Cost Per Unit 26.15 {4.07) Schedule of Fixed Costs 20x1 Cost 20x2 Cost Projected Percent Increase $ 290,000.00 {4.08} lamps @_) Fixed Overhead (normal capacity of Fixed Selling Fixed Administrative $ 25,000.00 62,000.00 {4.09} {4.10} $ Projected Total Fixed Costs $ 377,000.00 {4.11} Division N has decided to develop its budget based upon projected sales of 43,000 lamps at 555.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 550 pieces and decreasing the finished goods by 20%. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Total Production 42,400 units {7.01} 4 Factory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, $##.##) {9.01} 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit $2.10 {9.02} Total cost of one unit (Round to two places, $##.##) {9.03) 6 Selling and Admin. Budget {9.04) Fixed Selling Variable Selling (Round to two places, $##.##) Fixed Administrative Variable Administrative (Round to two places, $####) Total Selling and Administrative (Round to two places, $##.##) {9.05} {9.06} Round dollars to two places, S##.## {9.07) COSI OL Goods Sold Budget Beginning Inventory, Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production {9.08) Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold {9.09) {9.10} {9.11} (9.12) (9.13) {9.14) Variable Manufacturing Unit Cost 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Lamp Kit Labor Variable Overhead 16 2 Projected Percent Increase 4.50% 5.00% 2.00% $16.72 $2.10 $2.04 {4.01} {4.02) {4.03} 2 Projected Variable Manufacturing Cost Per Unit 20 $20.86 {4.04 Total Variable Cost Per Unit 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Projected Percent Increase 6.50% 4.50% 3 Variable Selling Variable Administrative Projected Variable Manufacturing Unit Cost 2 3.20 2.09 20.86 {4.05) {4.06} {4.04} 20 Projected Total Variable Cost Per Unit 26.15 {4.07) Schedule of Fixed Costs 20x1 Cost 20x2 Cost Projected Percent Increase $ 290,000.00 {4.08} lamps @_) Fixed Overhead (normal capacity of Fixed Selling Fixed Administrative $ 25,000.00 62,000.00 {4.09} {4.10} $ Projected Total Fixed Costs $ 377,000.00 {4.11} Division N has decided to develop its budget based upon projected sales of 43,000 lamps at 555.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 550 pieces and decreasing the finished goods by 20%. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Total Production 42,400 units {7.01} 4 Factory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, $##.##) {9.01} 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit $2.10 {9.02} Total cost of one unit (Round to two places, $##.##) {9.03) 6 Selling and Admin. Budget {9.04) Fixed Selling Variable Selling (Round to two places, $##.##) Fixed Administrative Variable Administrative (Round to two places, $####) Total Selling and Administrative (Round to two places, $##.##) {9.05} {9.06} Round dollars to two places, S##.## {9.07) COSI OL Goods Sold Budget Beginning Inventory, Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production {9.08) Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold {9.09) {9.10} {9.11} (9.12) (9.13) {9.14)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts