Question: Need help with the last part in finding F. Everything else is right. *** Will rate for a correct detailed solution. Thank you *** Note:

Need help with the last part in finding F. Everything else is right. *** Will rate for a correct detailed solution. Thank you ***

Note: answer is not -100.34

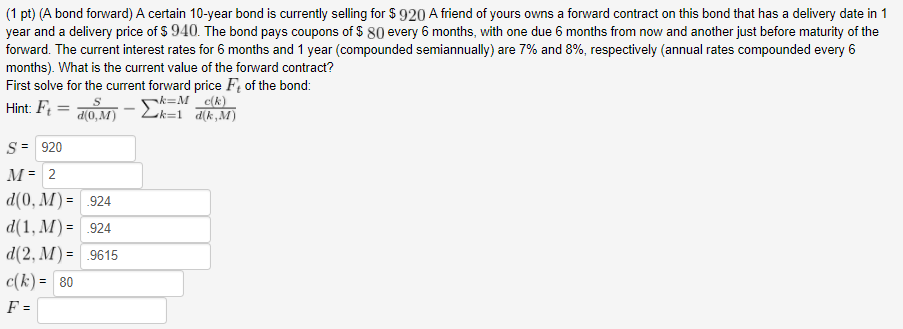

(1 pt) (A bond forward) A certain 10-year bond is currently selling for S 920 A friend of yours owns a forward contract on this bond that has a delivery date in 1 year and a delivery price of S 940. The bond pays coupons of $ 80 every 6 months, with one due 6 months from now and another just before maturity of the forward The current interest rates for 6 months and 1 year (compounded semiannually) are 7% and 8%, respectively (annual rates compounded every 6 months). What is the current value of the forward contract? First solve for the current forward price Ft of the bond: Hint: Ft d(O,M) Hint: F S = | 920 d(0, M)924 d(1, M)924 d(2, M) = .9615 c(k)= 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts