Question: need help with the last part Preparing Entries for a Secured Borrowing and Subsequent Collections and Payments A note payable was executed by Sterling Inc.

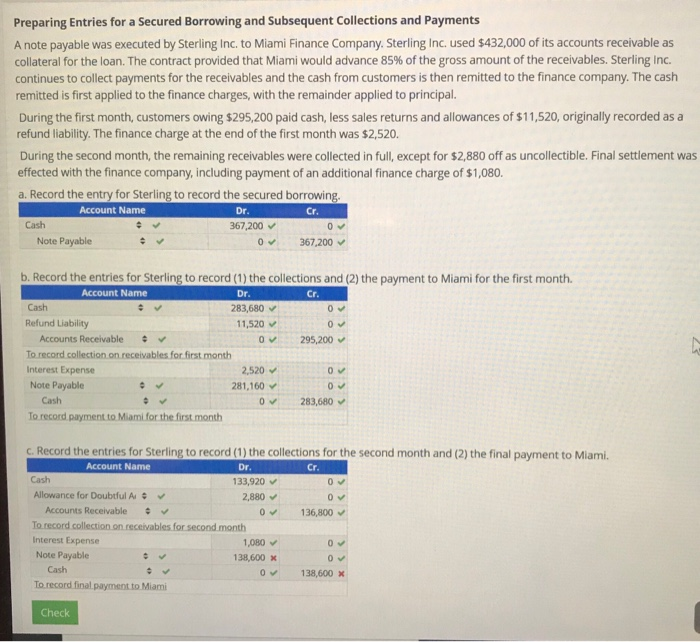

Preparing Entries for a Secured Borrowing and Subsequent Collections and Payments A note payable was executed by Sterling Inc. to Miami Finance Company. Sterling Inc. used $432,000 of its accounts receivable as collateral for the loan. The contract provided that Miami would advance 85% of the gross amount of the receivables. Sterling Inc. continues to collect payments for the receivables and the cash from customers is then remitted to the finance company. The cash remitted is first applied to the finance charges, with the remainder applied to principal. During the first month, customers owing $295,200 paid cash, less sales returns and allowances of $11,520, originally recorded as a refund liability. The finance charge at the end of the first month was $2,520. During the second month, the remaining receivables were collected in full, except for $2,880 off as uncollectible. Final settlement was effected with the finance company, including payment of an additional finance charge of $1,080. Cr. a. Record the entry for Sterling to record the secured borrowing. Account Name Dr. Cash 367,200 0 Note Payable O 367,200 b. Record the entries for Sterling to record (1) the collections and (2) the payment to Miami for the first month. Account Name Dr. Cr. Cash 283,680 Refund Liability 11,520 Accounts Receivable O 295,200 To record collection on receivables for first month Interest Expense 2,520 Note Payable 281,160 Cash 0 283,680 To record payment to Miami for the first month O c. Record the entries for Sterling to record (1) the collections for the second month and (2) the final payment to Miami. Account Name Dr. Cr. Cash 133,920 Allowance for Doubtful A. 2,880 Accounts Receivable . 0 136,800 To record collection on receivables for second month Interest Expense 1,080 Note Payable 138,600 x Cash o 138,600 x To record final payment to Miami Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts