Question: Need help with the marks in red :( Alex and Bess have been in partnership for many years. The partners, who share profits and losses

Need help with the marks in red :(

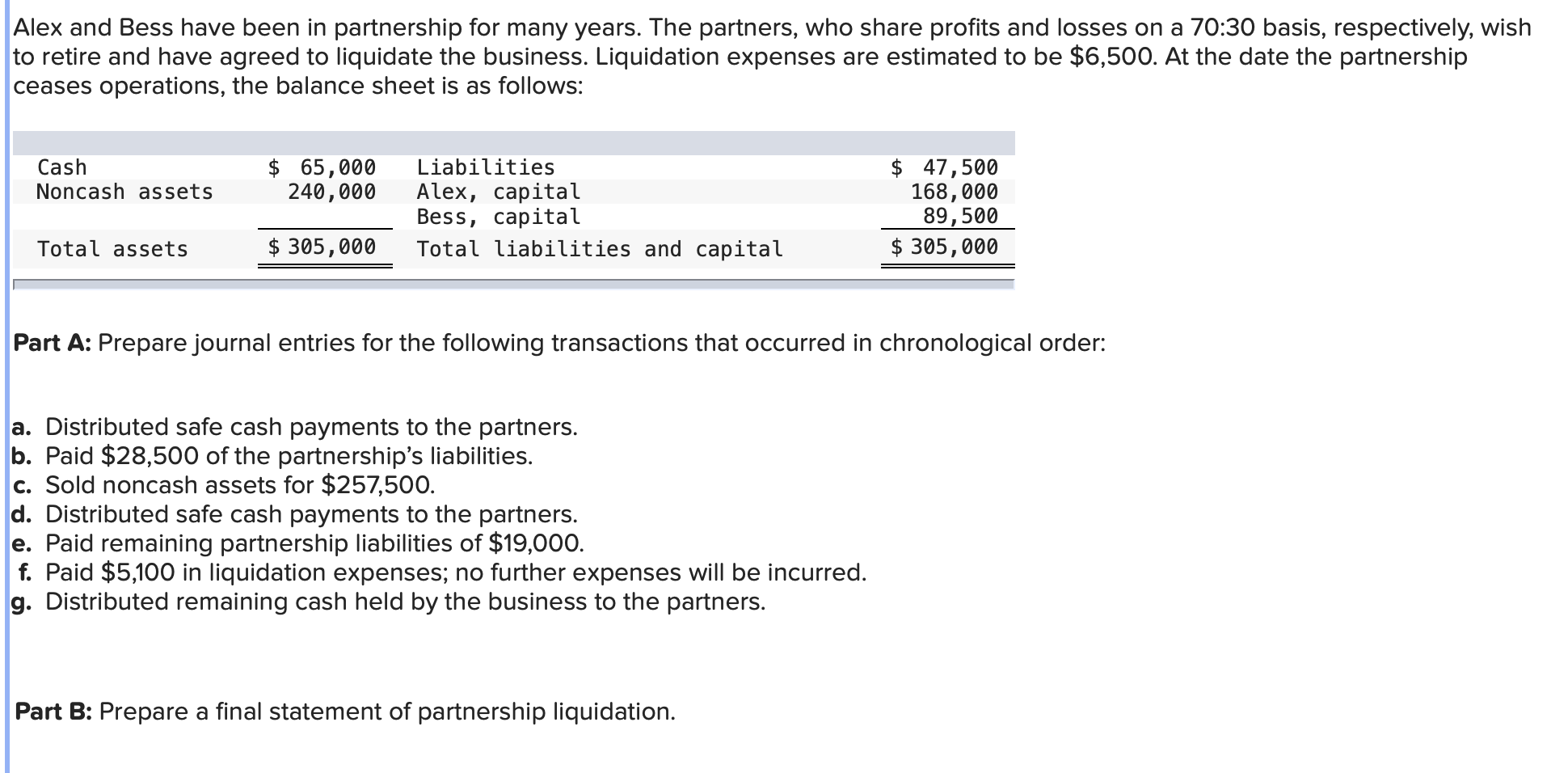

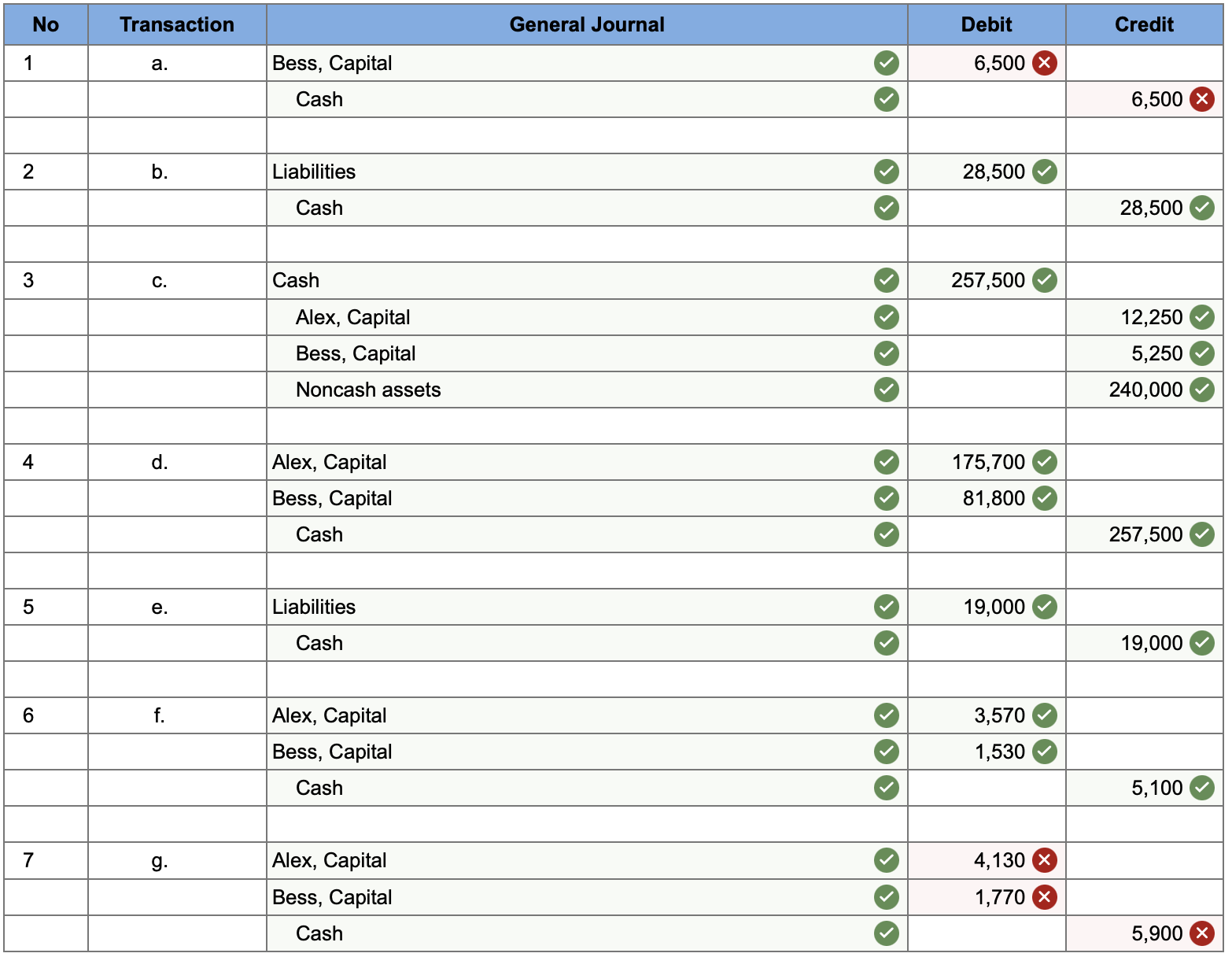

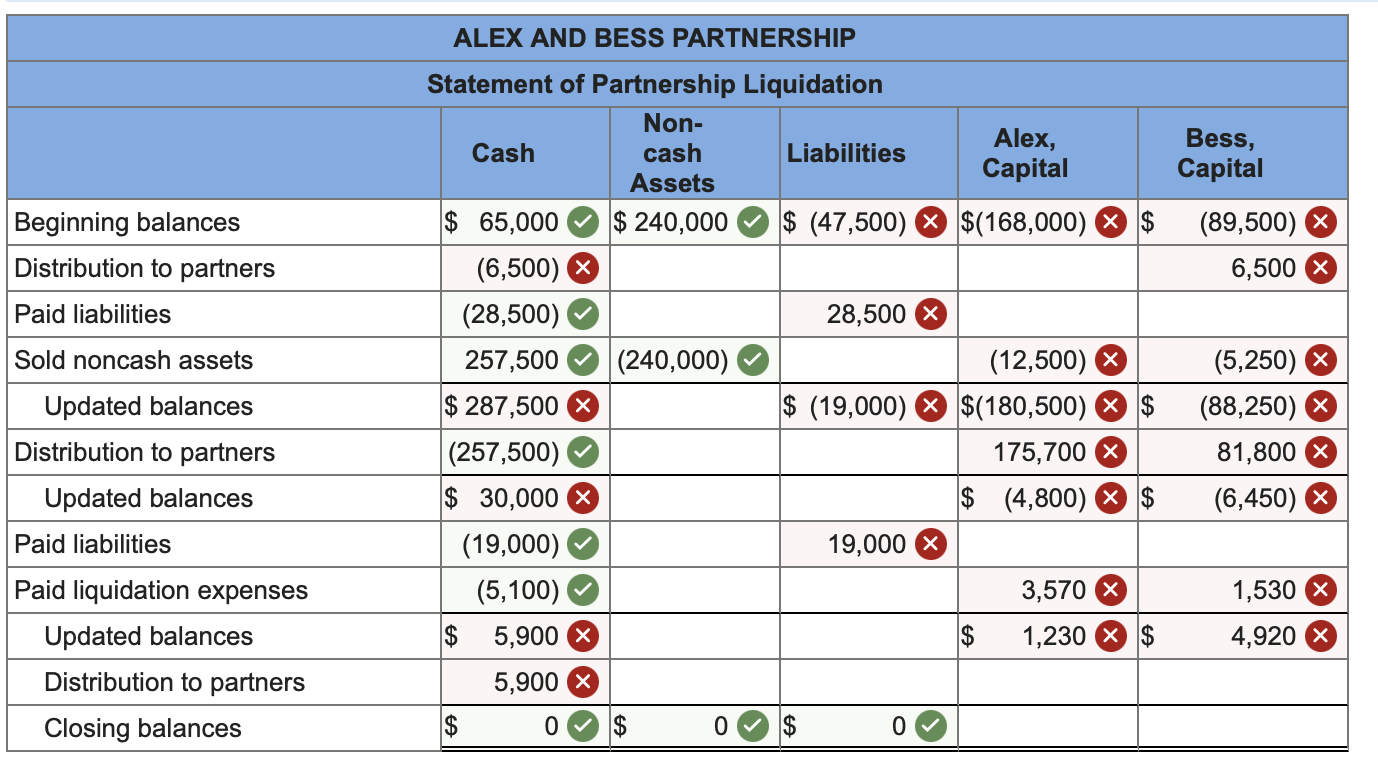

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation. ALEX AND BESS PARTNERSHIP Statement of Partnership Liquidation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts