Question: need help with the numbers!!! pls or if anything i have wrong 2. How much life insurance do you need? Calculating needs-Part1 Kate and Jon

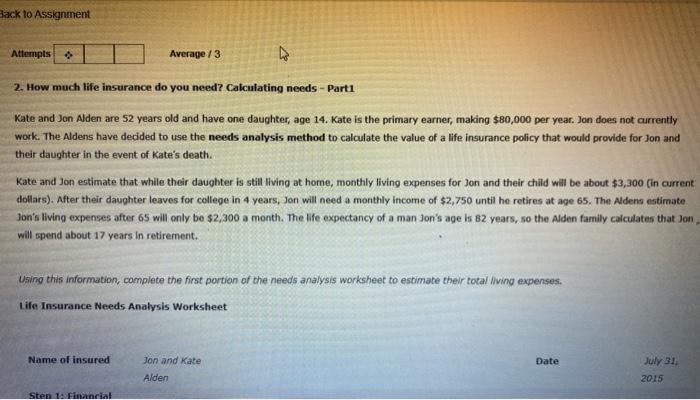

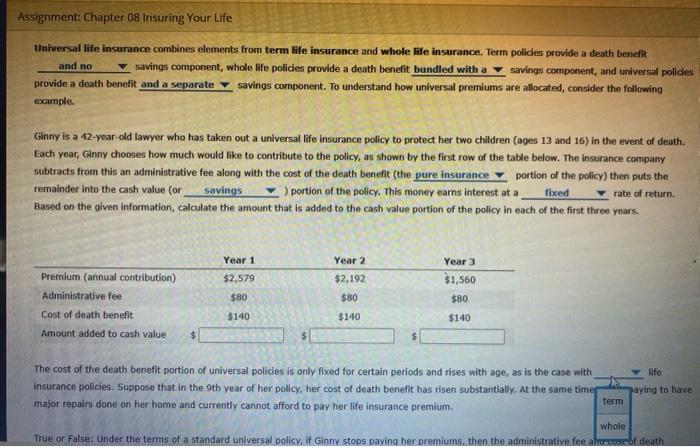

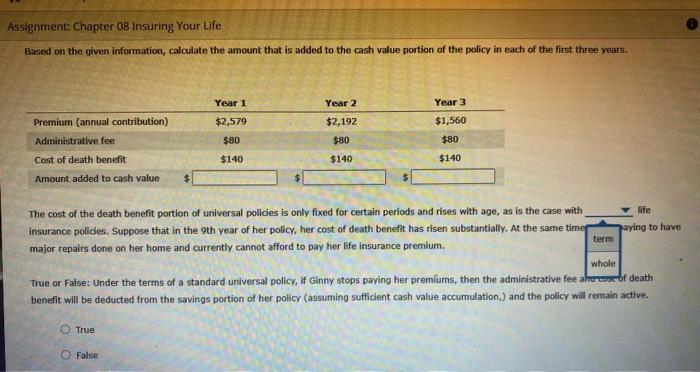

2. How much life insurance do you need? Calculating needs-Part1 Kate and Jon Alden are 52 years old and have one daughter, age 14. Kate is the primary earner, making $80,000 per year. Jon does not currently work. The Aldens have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Jon and their daughter in the event of Kate's death. Kate and Jon estimate that while their daughter is still living at home, monthly living expenses for Jon and their child will be about $3,300 (in current dollars). After their daughter leaves for college in 4 years, Jon will need a monthly income of $2,750 until he retires at age 65 . The Adens estimate Jon's living expenses after 65 will only be $2,300 a month. The life expectancy of a man Jon's age is 82 years, so the Aden family calculates that Jon will spend about 17 years in retirement. Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses, Life Insurance Needs Analysis Worksheet Jon and Kare Date Alden Universal life insurance combines elements from term life insurance and whole life insurance. Term policies provide a death benicfit and no savings component, whole life policies provide a denth benefit bundled with a savings component, and universal policies provide a death benefit and a separate savings component. To understand how universal premiums are allocated, consider the following exnmple. Ginny is a 42-year-old lawyer who has taken out a universal life insurance policy to protect her two children (ages 13 and 16 ) in the event of death. Each year, Ginny chooses how much would like to contribute to the policy, as shown by the first row of the table below. The insurance company subtracts from this an administrative fee along with the cost of the death benefit (the portion of the policy) then puts the remainder into the cash value (or portion of the policy. This money earns interest at a Based on the given information, calculate the amount that is added to the cash value portion of the policy in each of the first three years. The cost of the death benefit portion of universal policies is only fixed for certain periods and rises with age, as is the case with insurance policies. Suppose that in the 9 th year of her policy, her cost of death benefit has risen substantially, At the same time major repairs done on her home and currently carinot afford to pay her life insurance premium. True or False: Under the terms of a standard universal policy, if Ginny stops payina her aremiums, then the administrative fed a Based on the given information, calculate the amount that is added to the cash value portion of the policy in each of the first three years. The cost of the death benefit portion of universal policies is only fixed for certain periods and rises with age, as is the case with insurance policies. Suppose that in the 9 th year of her policy, her cost of death benefit has risen substantially. At the same time major repairs done on her home and currently cannot afford to pay her life insurance premium. True or False: Under the terms of a standard universal policy, if Ginny stops paying her premfums, then the administrative fee anu own meath benefit will be deducted from the savings portion of her policy (assuming sufficient cash value accumulation, ) and the policy wili remain active. True Faise 2. How much life insurance do you need? Calculating needs-Part1 Kate and Jon Alden are 52 years old and have one daughter, age 14. Kate is the primary earner, making $80,000 per year. Jon does not currently work. The Aldens have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Jon and their daughter in the event of Kate's death. Kate and Jon estimate that while their daughter is still living at home, monthly living expenses for Jon and their child will be about $3,300 (in current dollars). After their daughter leaves for college in 4 years, Jon will need a monthly income of $2,750 until he retires at age 65 . The Adens estimate Jon's living expenses after 65 will only be $2,300 a month. The life expectancy of a man Jon's age is 82 years, so the Aden family calculates that Jon will spend about 17 years in retirement. Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses, Life Insurance Needs Analysis Worksheet Jon and Kare Date Alden Universal life insurance combines elements from term life insurance and whole life insurance. Term policies provide a death benicfit and no savings component, whole life policies provide a denth benefit bundled with a savings component, and universal policies provide a death benefit and a separate savings component. To understand how universal premiums are allocated, consider the following exnmple. Ginny is a 42-year-old lawyer who has taken out a universal life insurance policy to protect her two children (ages 13 and 16 ) in the event of death. Each year, Ginny chooses how much would like to contribute to the policy, as shown by the first row of the table below. The insurance company subtracts from this an administrative fee along with the cost of the death benefit (the portion of the policy) then puts the remainder into the cash value (or portion of the policy. This money earns interest at a Based on the given information, calculate the amount that is added to the cash value portion of the policy in each of the first three years. The cost of the death benefit portion of universal policies is only fixed for certain periods and rises with age, as is the case with insurance policies. Suppose that in the 9 th year of her policy, her cost of death benefit has risen substantially, At the same time major repairs done on her home and currently carinot afford to pay her life insurance premium. True or False: Under the terms of a standard universal policy, if Ginny stops payina her aremiums, then the administrative fed a Based on the given information, calculate the amount that is added to the cash value portion of the policy in each of the first three years. The cost of the death benefit portion of universal policies is only fixed for certain periods and rises with age, as is the case with insurance policies. Suppose that in the 9 th year of her policy, her cost of death benefit has risen substantially. At the same time major repairs done on her home and currently cannot afford to pay her life insurance premium. True or False: Under the terms of a standard universal policy, if Ginny stops paying her premfums, then the administrative fee anu own meath benefit will be deducted from the savings portion of her policy (assuming sufficient cash value accumulation, ) and the policy wili remain active. True Faise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts