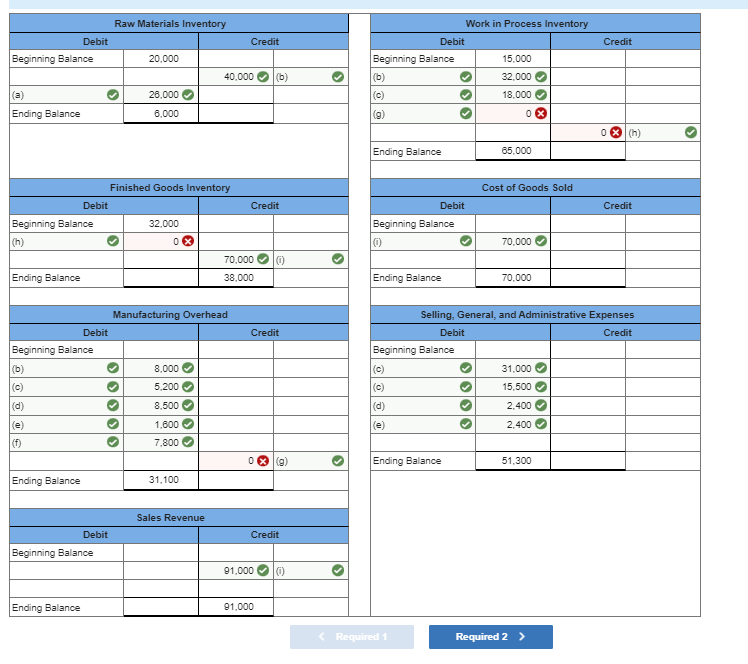

need help with the ones I got wrong Christophers Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balances at the beginning of the current year follow:

Raw Materials Inventory $

Work in Process Inventory

Finished Goods Inventory

The following transactions occurred during January:

a Purchased materials on account for $

b Issued materials to production totaling $ percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c Payroll costs totaling $ were recorded as follows:

$ for assembly workers

$ for factory supervision

$ for administrative personnel

$ for sales commissions

d Recorded depreciation: $ for factory machines, $ for the copier used in the administrative office.

d Recorded $ of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

Paid $ in other factory costs in cash.

g Applied manufacturing overhead at a rate of percent of direct labor cost.

h Completed all jobs but one; the job cost sheet for the uncompleted job shows $ for direct materials, $ for direct labor, and $ for applied overhead.

i Sold jobs costing $ The revenue earned on these jobs was $

Required:

Set up Taccounts, record the beginning balances, post the January transactions, and compute the final balance for the following accounts:

a Raw Materials Inventory.

b Work in Process Inventory.

cFinished Goods Inventory.

d Cost of Goods Sold.

eManufacturing Overhead.

f Selling, General, and Administrative Expenses.

g Sales Revenue.

Determine how much gross profit the company would report during the month of January before any adjustment is made for the overhead balance. Answer $

Determine the amount of over or underapplied overhead.

Compute adjusted gross profit assuming that any over or underapplied overhead balance is adjusted directly to Cost of Goods Sold.