Question: Need help with the partially correct problems in the last photo. Fleming Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience

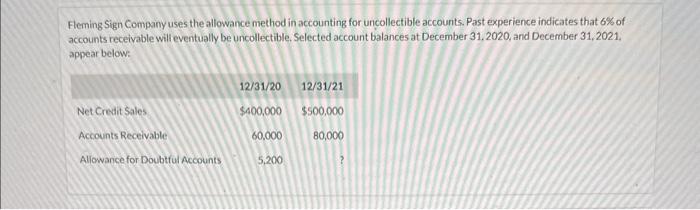

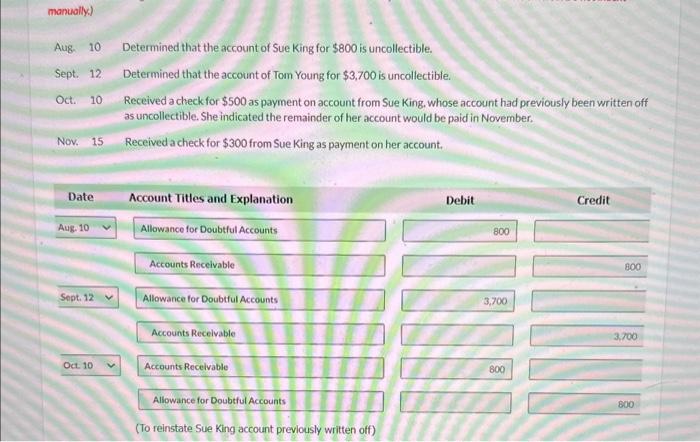

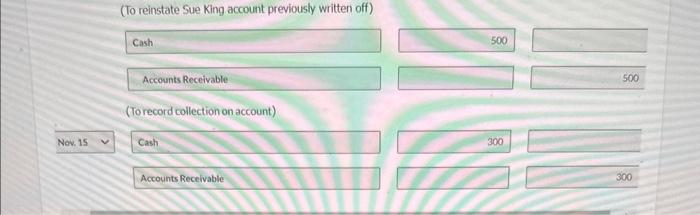

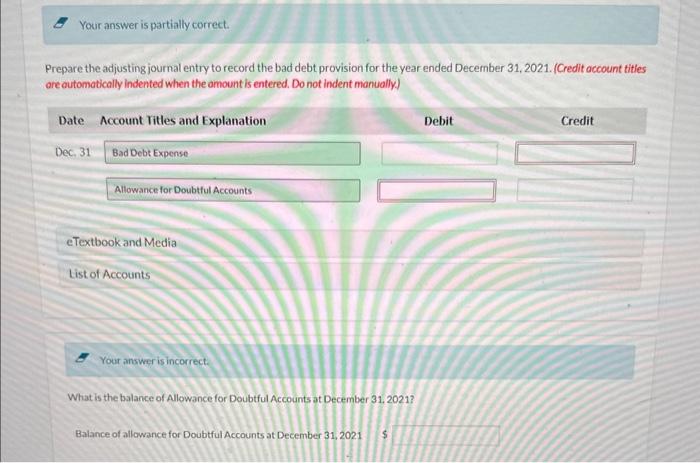

Fleming Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 6% of accounts receivable will eventually be uncollectible. Selected account balances at December 31, 2020, and December 31,2021. appear below: Aug. 10 Determined that the account of Sue King for $800 is uncollectible. Sept. 12. Determined that the account of Tom Young for $3,700 is uncollectible. Oct. 10 Received a check for $500 as payment on account from Sue King. whose account had previously been written off as uncollectible. She indicated the remainder of her account would be paid in November. Nov. 15 Received a check for $300 from Sue King as payment on her account. (To reinstate Sue King account previously written off) Cash 500 Accounts Receivable 500 (Torecord collection on account) Nov. 15 Cash 300 Accounts Receivable 300 Your answer is partially correct. Prepare the adjusting journal entry to record the bad debt provision for the year ended December 31, 2021. (Credit account tities are outomatically indented when the amount is entered. Do not indent manually.) eTextbook and Media Your answer is incorrect. What is the balance of Allowance for Doubtful Accounts at December 31, 2021? Balance of allowance for Doubtful Accounts at December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts