Question: Need help with the problem being done in Excel 2. In finance, as in accounting, the two sides of the balance sheet must be equal.

Need help with the problem being done in Excel

Need help with the problem being done in Excel

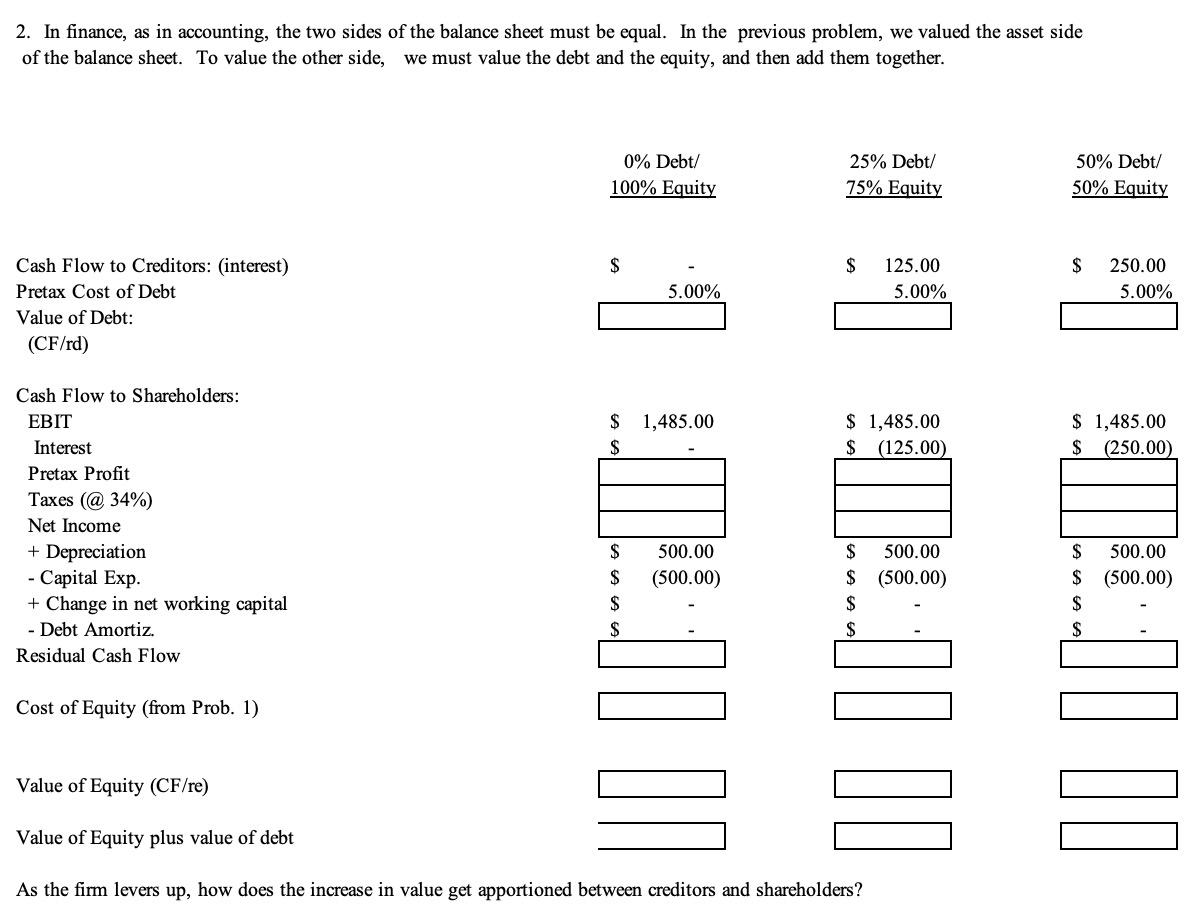

2. In finance, as in accounting, the two sides of the balance sheet must be equal. In the previous problem, we valued the asset side of the balance sheet. To value the other side, we must value the debt and the equity, and then add them together. 0% Debt/ 100% Equity 25% Debt/ 75% Equity 50% Debt/ 50% Equity $ $ 125.00 5.00% 250.00 5.00% 5.00% Cash Flow to Creditors: (interest) Pretax Cost of Debt Value of Debt: (CF/rd) 1,485.00 $ $ $ 1,485.00 $ (125.00) $ 1,485.00 $ (250.00) Cash Flow to Shareholders: EBIT Interest Pretax Profit Taxes (@ 34%) Net Income + Depreciation - Capital Exp. + Change in net working capital - Debt Amortiz. Residual Cash Flow $ $ $ 500.00 (500.00) 500.00 (500.00) 500.00 (500.00) Cost of Equity (from Prob. 1) Value of Equity (CF/re) Value of Equity plus value of debt As the firm levers up, how does the increase in value get apportioned between creditors and shareholders? 2. In finance, as in accounting, the two sides of the balance sheet must be equal. In the previous problem, we valued the asset side of the balance sheet. To value the other side, we must value the debt and the equity, and then add them together. 0% Debt/ 100% Equity 25% Debt/ 75% Equity 50% Debt/ 50% Equity $ $ 125.00 5.00% 250.00 5.00% 5.00% Cash Flow to Creditors: (interest) Pretax Cost of Debt Value of Debt: (CF/rd) 1,485.00 $ $ $ 1,485.00 $ (125.00) $ 1,485.00 $ (250.00) Cash Flow to Shareholders: EBIT Interest Pretax Profit Taxes (@ 34%) Net Income + Depreciation - Capital Exp. + Change in net working capital - Debt Amortiz. Residual Cash Flow $ $ $ 500.00 (500.00) 500.00 (500.00) 500.00 (500.00) Cost of Equity (from Prob. 1) Value of Equity (CF/re) Value of Equity plus value of debt As the firm levers up, how does the increase in value get apportioned between creditors and shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts