Question: Need help with the remaining parts please 8/11 - X Requirements 1. Compute the number of cartons of calendars that Vast Spirit Calendars must sell

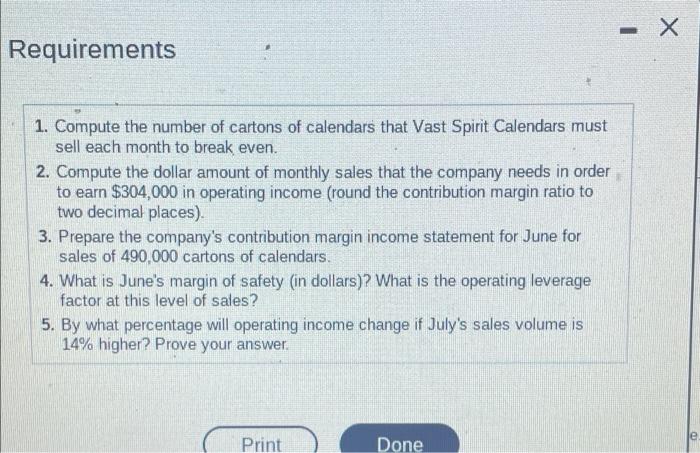

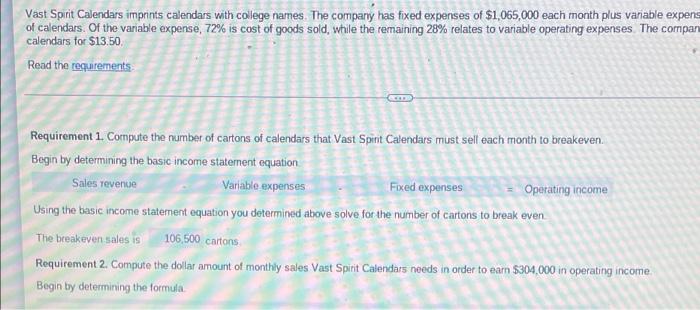

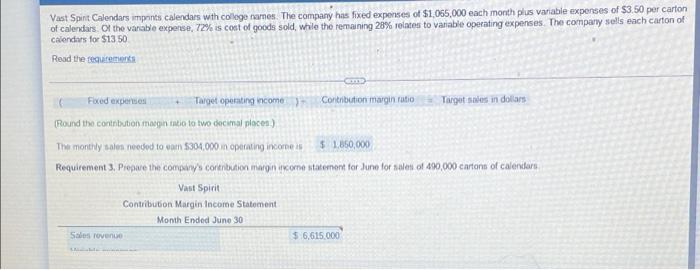

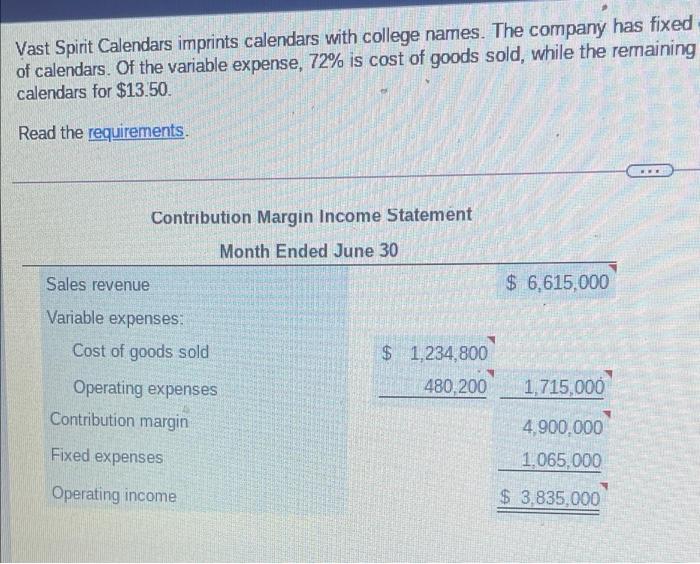

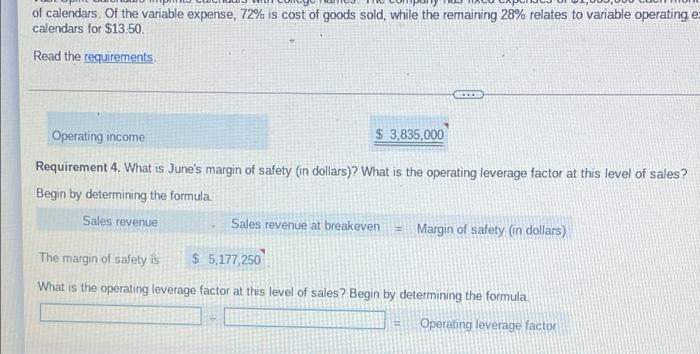

- X Requirements 1. Compute the number of cartons of calendars that Vast Spirit Calendars must sell each month to break even. 2. Compute the dollar amount of monthly sales that the company needs in order to earn $304,000 in operating income (round the contribution margin ratio to two decimal places). 3. Prepare the company's contribution margin income statement for June for sales of 490,000 cartons of calendars. 4. What is June's margin of safety (in dollars)? What is the operating leverage factor at this level of sales? 5. By what percentage will operating income change if July's sales volume is 14% higher? Prove your answer. Print Done Vast Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,065,000 each month plus variable expens of calendars. Of the variable expense, 72% is cost of goods sold, while the remaining 28% relates to variable operating expenses. The compan calendars for $13.50 Read the requirements Requirement 1. Compute the number of cartons of calendars that Vast Spinit Calendars must sell each month to breakeven. Begin by determining the basic income statement equation Sales revenue Variable expenses Fixed expenses Operating income Using the basic income statement equation you determined above solve for the number of cartons to break even The breakeven sales is 106.500 cartons Requirement 2. Compute the dollar amount of monthly sales Vast Spirit Calendars needs in order to earn 5304,000 in operating income Begin by determining the formula Vast Spint Calendars imprints calendars with collage names. The company has fixed expenses of $1,065,000 each month plus variable expenses of $3.50 per carton of calendars of the variable expense, 72% is cost of goods sold, while the remaining 28% relates to variabile operating expenses. The company sells each carton of Calendars for $13 50 Read the requirements Fixed expenses Target operating income) Contribution margin ratio Targets in dollars (Round the contribution maginatio to two decimal places) The monthly sal needed to cam 5304,000 in operating income $ 1850,000 Requirement 3. Pipwe the company's contribution margin come statement for June for sale of 490,000 cartons of calendars Vast Spirit Contribution Margin Income Statement Month Ended June 30 $.6.615.000 Salon rovence Vast Spirit Calendars imprints calendars with college names. The company has fixed of calendars. Of the variable expense, 72% is cost of goods sold, while the remaining calendars for $13.50. Read the requirements. Contribution Margin Income Statement Month Ended June 30 Sales revenue $ 6,615,000 Variable expenses Cost of goods sold $ 1,234,800 480,200 1,715,000 Operating expenses Contribution margin 4.900.000 Fixed expenses 1.065.000 Operating income $ 3.835.000 of calendars. Of the variable expense, 72% is cost of goods sold, while the remaining 28% relates to variable operating e calendars for $13.50 Read the requirements Operating income $ 3,835,000 Requirement 4. What is June's margin of safety (in dollars)? What is the operating leverage factor at this level of sales? Begin by determining the formula Sales revenue Sales revenue at breakeven = Margin of safety (in dollars) The margin of safety is $ 5,177,250 What is the operating leverage factor at this level of sales ? Begin by determining the formula Operating leverage factor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts