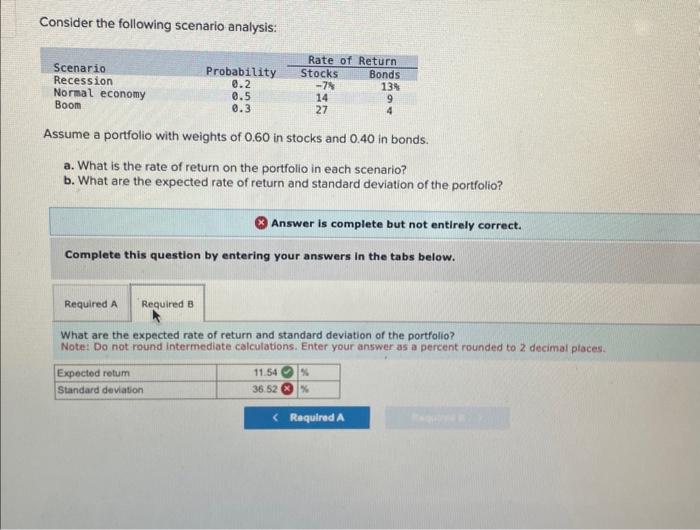

Question: Need help with the standard deviation Consider the following scenario analysis: Assume a portfolio with weights of 0.60 in stocks and 0.40 in bonds. a.

Consider the following scenario analysis: Assume a portfolio with weights of 0.60 in stocks and 0.40 in bonds. a. What is the rate of return on the portfollo in each scenario? b. What are the expected rate of return and standard deviation of the portfolio? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the expected rate of return and standard deviation of the portfolio? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts