Question: Need help with the steps 1 and 2 Purpose It is simply good business to continually know the cash value (corporate valuation) of your company.

Need help with the steps 1 and 2

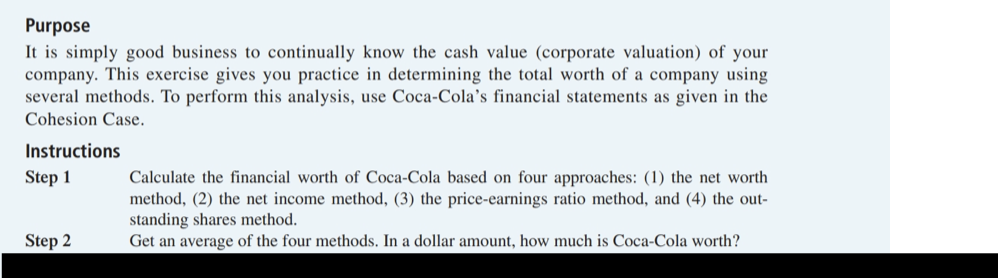

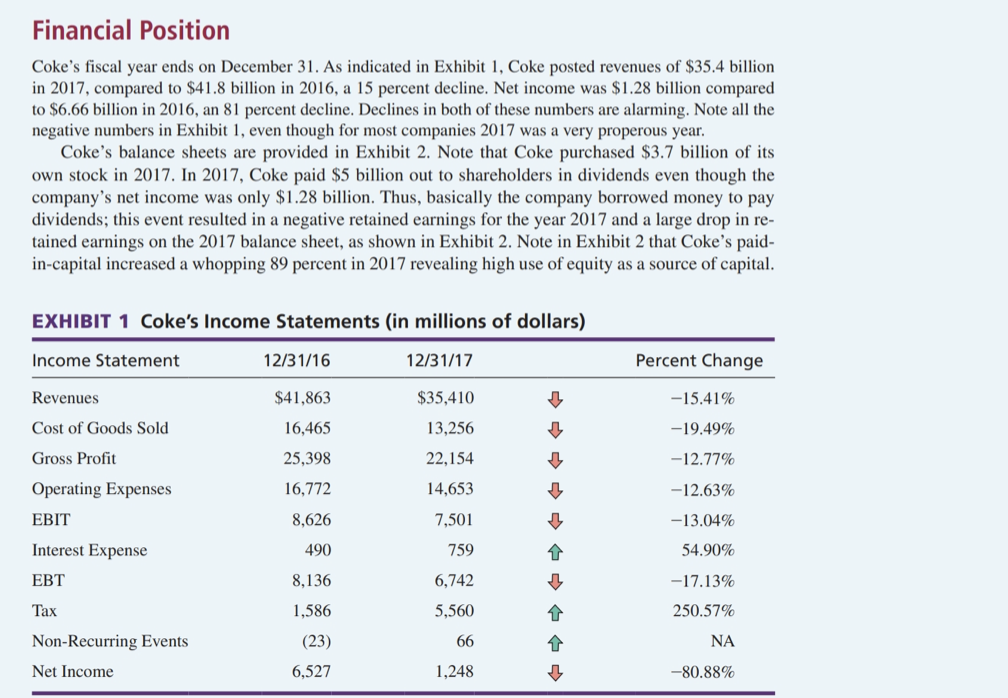

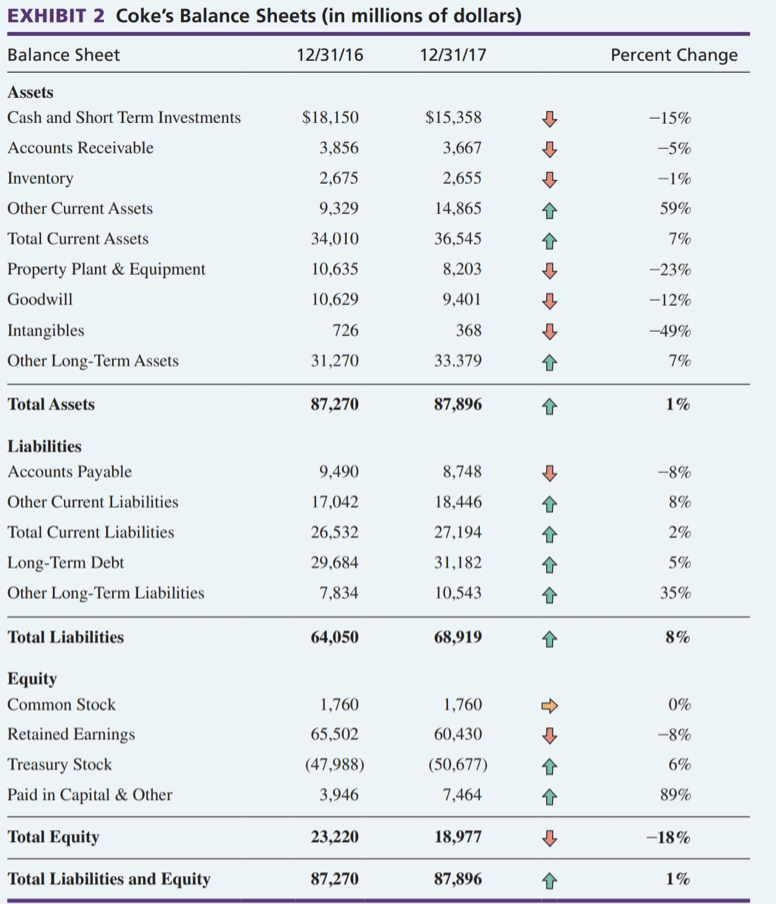

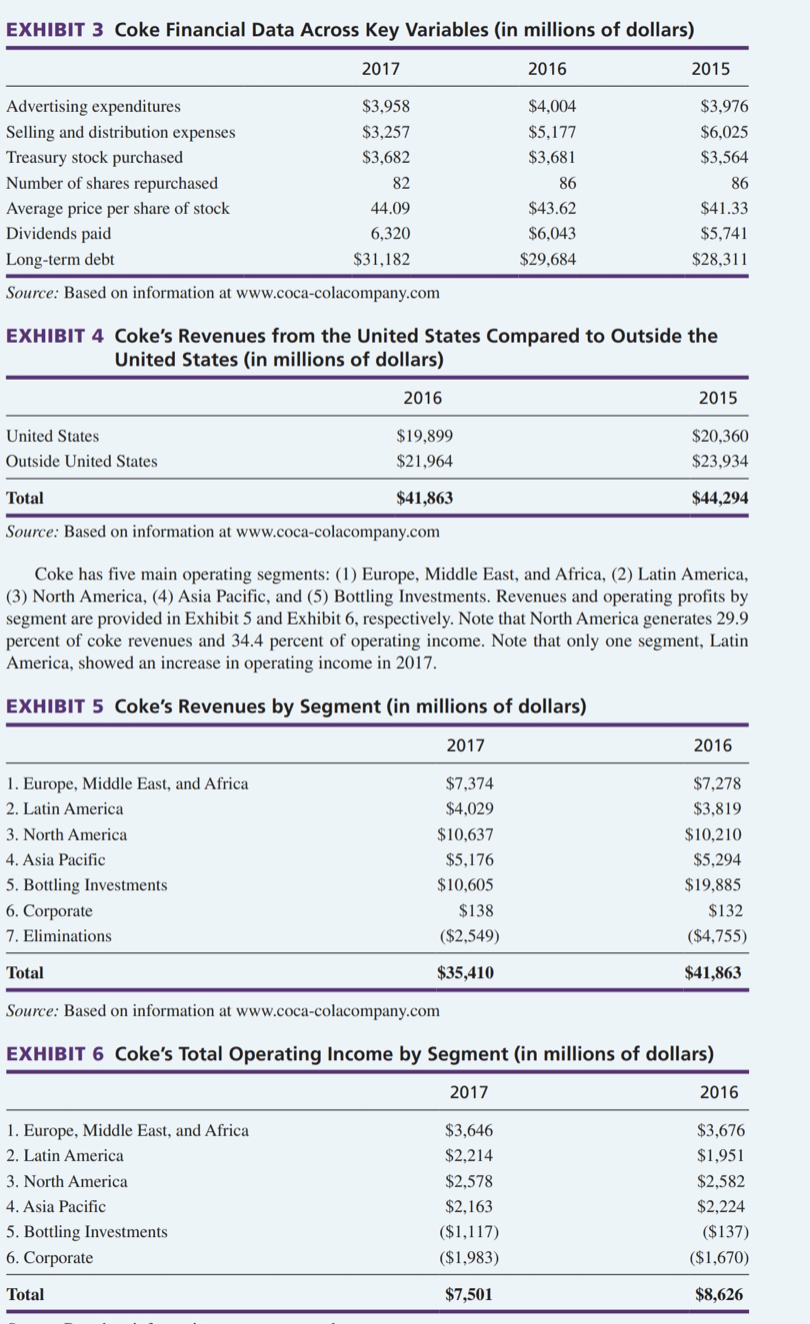

Purpose It is simply good business to continually know the cash value (corporate valuation) of your company. This exercise gives you practice in determining the total worth of a company using several methods. To perform this analysis, use Coca-Cola's financial statements as given in the Cohesion Case. Instructions Step 1 Calculate the financial worth of Coca-Cola based on four approaches: (1) the net worth method, (2) the net income method, (3) the price-earnings ratio method, and (4) the outstanding shares method. Step 2 Get an average of the four methods. In a dollar amount, how much is Coca-Cola worth? Headquartered in Atlanta, Georgia, Coca-Cola Company (Coke) is the world's largest producer and distributor of beverages, marketing over 500 nonalcoholic brands in more than 200 countries. Coke has 21 billion-dollar brands, 19 of which are available in lower- and no-sugar options. Four of the top five beverages sold globally are Coke products: 1) Coca-Cola, 2) Diet Coke, 3) Fanta, and 4) Sprite. Other Coke products include Dasani waters, Fanta, Gold Peak teas and coffees, Honest Tea, Powerade sports drinks, Simply juices, Glaceau Smartwater, Sprite, and Zico coconut water. However, company's revenues for 2017 declined 15 percent, so rumblings are spreading within the firm. Coke brands sold mostly outside the United States include Ayataka green tea in Japan, I LOHAS water in Japan, Ice Dew water in China, FUZE TEA outside the United States, Minute Maid Pulpy in Asia Pacific, Georgia coffee in Japan, and Del Valle in Latin America. Five large independent bottling companies supply Coke with 39 percent of their bottling needs, led by Coca-Cola FEMSA that supplies central Mexico and countries in Latin and South America. Coke revenues have declined every year for nearly a decade, usually accompanied by net income declines. Since 2005, sales of diet soda in general have dropped every year, a combined 34 percent. Although Diet Coke is the weakest link in the company's whole soda lineup, the brand is still the third best-selling carbonated drink in the United States. Environmentalists are complaining, saying Coke produces 110 million plastic bottles annually that end up in landfills and oceans. To combat this complaint, the company launched in 2018 its "World Without Waste" initiative. Coke needs a good strategic plan because its customer base is eroding and its shareholders want sustained 5 percent annual growth in revenues and profits-and not declines-every year. Copyright by Fred David Books LLC. History Founded in 1886, Coke's flagship product Coca-Cola was invented in 1886 by pharmacist John Pemberton in Columbus, Georgia. Coke has operated a franchised distribution system since 1889, whereby the company only produces syrup concentrate, which is then sold to various bottlers throughout the world, who hold exclusive territories. Interestingly, the big, jolly man in the red suit with a white beard (Santa Claus), did not always look that way. In 1931, Coke paid illustrator Haddon Sundblom to create advertising images depicting a jolly, plump, red (like Coke cans) dressed, warm, friendly Santa Claus delivering toys to children. To create the new Santa ads, Sundblom used Clement Clark Moore's 1822 poem "A Visit from St. Nicholas" (commonly called "'Twas the Night Before Christmas"). Coke's new Santa advertisements debuted in 1931 in magazines such as The Saturday Evening Post, National Geographic, The New Yorker, and others. Before 1931, Santa was depicted as everything from a tall gaunt man to a spooky-looking elf. He was often shown wearing a bishop's robe and a Norse huntsman's animal skin. From 1931 to 1934, Coke ads featuring the new Santa Claus changed the whole world's view of Santa; these original images of Santa are valuable works of art even today. In 2010, Coke became the first brand to exceed 1 billion euros in annual United Kingdom grocery sales. In January 2018, in the United States, Coke introduced its slimmer 12-ounce Diet Coke can, updating the logo and offering the 35-year-old drink four new flavors: mango, cherry, blood orange, and ginger lime. Diet Coke sales have declined as more people switch to other low-calorie drinks, such as flavored fizzy water. The company said the new flavors and lookwith a different color vertical stripe for each flavor and red for plain-are aimed at appealing to millennials (people ages 18 to 34 ). Coke tested more than 30 flavors before settling on the four new ones. Financial Position Coke's fiscal year ends on December 31. As indicated in Exhibit 1, Coke posted revenues of $35.4 billion in 2017 , compared to $41.8 billion in 2016, a 15 percent decline. Net income was $1.28 billion compared to $6.66 billion in 2016 , an 81 percent decline. Declines in both of these numbers are alarming. Note all the negative numbers in Exhibit 1, even though for most companies 2017 was a very properous year. Coke's balance sheets are provided in Exhibit 2. Note that Coke purchased $3.7 billion of its own stock in 2017. In 2017, Coke paid \$5 billion out to shareholders in dividends even though the company's net income was only $1.28 billion. Thus, basically the company borrowed money to pay dividends; this event resulted in a negative retained earnings for the year 2017 and a large drop in retained earnings on the 2017 balance sheet, as shown in Exhibit 2. Note in Exhibit 2 that Coke's paidin-capital increased a whopping 89 percent in 2017 revealing high use of equity as a source of capital. EXHIBIT 1 Coke's Income Statements (in millions of dollars) EXHIBIT 2 Coke's Balance Sheets (in millions of dollars) EXHIBIT 3 Coke Financial Data Across Key Variables (in millions of dollars) Source: Based on information at www.coca-colacompany.com EXHIBIT 4 Coke's Revenues from the United States Compared to Outside the United States (in millions of dollars) Source: Based on intormation at www.coca-colacompany.com Coke has five main operating segments: (1) Europe, Middle East, and Africa, (2) Latin America, (3) North America, (4) Asia Pacific, and (5) Bottling Investments. Revenues and operating profits by segment are provided in Exhibit 5 and Exhibit 6, respectively. Note that North America generates 29.9 percent of coke revenues and 34.4 percent of operating income. Note that only one segment, Latin America, showed an increase in operating income in 2017. EXHIBIT 5 Coke's Revenues by Segment (in millions of dollars) Source: Based on information at www.coca-colacompany.com EXHIBIT 6 Coke's Total Operating Income by Segment (in millions of dollars) Purpose It is simply good business to continually know the cash value (corporate valuation) of your company. This exercise gives you practice in determining the total worth of a company using several methods. To perform this analysis, use Coca-Cola's financial statements as given in the Cohesion Case. Instructions Step 1 Calculate the financial worth of Coca-Cola based on four approaches: (1) the net worth method, (2) the net income method, (3) the price-earnings ratio method, and (4) the outstanding shares method. Step 2 Get an average of the four methods. In a dollar amount, how much is Coca-Cola worth? Headquartered in Atlanta, Georgia, Coca-Cola Company (Coke) is the world's largest producer and distributor of beverages, marketing over 500 nonalcoholic brands in more than 200 countries. Coke has 21 billion-dollar brands, 19 of which are available in lower- and no-sugar options. Four of the top five beverages sold globally are Coke products: 1) Coca-Cola, 2) Diet Coke, 3) Fanta, and 4) Sprite. Other Coke products include Dasani waters, Fanta, Gold Peak teas and coffees, Honest Tea, Powerade sports drinks, Simply juices, Glaceau Smartwater, Sprite, and Zico coconut water. However, company's revenues for 2017 declined 15 percent, so rumblings are spreading within the firm. Coke brands sold mostly outside the United States include Ayataka green tea in Japan, I LOHAS water in Japan, Ice Dew water in China, FUZE TEA outside the United States, Minute Maid Pulpy in Asia Pacific, Georgia coffee in Japan, and Del Valle in Latin America. Five large independent bottling companies supply Coke with 39 percent of their bottling needs, led by Coca-Cola FEMSA that supplies central Mexico and countries in Latin and South America. Coke revenues have declined every year for nearly a decade, usually accompanied by net income declines. Since 2005, sales of diet soda in general have dropped every year, a combined 34 percent. Although Diet Coke is the weakest link in the company's whole soda lineup, the brand is still the third best-selling carbonated drink in the United States. Environmentalists are complaining, saying Coke produces 110 million plastic bottles annually that end up in landfills and oceans. To combat this complaint, the company launched in 2018 its "World Without Waste" initiative. Coke needs a good strategic plan because its customer base is eroding and its shareholders want sustained 5 percent annual growth in revenues and profits-and not declines-every year. Copyright by Fred David Books LLC. History Founded in 1886, Coke's flagship product Coca-Cola was invented in 1886 by pharmacist John Pemberton in Columbus, Georgia. Coke has operated a franchised distribution system since 1889, whereby the company only produces syrup concentrate, which is then sold to various bottlers throughout the world, who hold exclusive territories. Interestingly, the big, jolly man in the red suit with a white beard (Santa Claus), did not always look that way. In 1931, Coke paid illustrator Haddon Sundblom to create advertising images depicting a jolly, plump, red (like Coke cans) dressed, warm, friendly Santa Claus delivering toys to children. To create the new Santa ads, Sundblom used Clement Clark Moore's 1822 poem "A Visit from St. Nicholas" (commonly called "'Twas the Night Before Christmas"). Coke's new Santa advertisements debuted in 1931 in magazines such as The Saturday Evening Post, National Geographic, The New Yorker, and others. Before 1931, Santa was depicted as everything from a tall gaunt man to a spooky-looking elf. He was often shown wearing a bishop's robe and a Norse huntsman's animal skin. From 1931 to 1934, Coke ads featuring the new Santa Claus changed the whole world's view of Santa; these original images of Santa are valuable works of art even today. In 2010, Coke became the first brand to exceed 1 billion euros in annual United Kingdom grocery sales. In January 2018, in the United States, Coke introduced its slimmer 12-ounce Diet Coke can, updating the logo and offering the 35-year-old drink four new flavors: mango, cherry, blood orange, and ginger lime. Diet Coke sales have declined as more people switch to other low-calorie drinks, such as flavored fizzy water. The company said the new flavors and lookwith a different color vertical stripe for each flavor and red for plain-are aimed at appealing to millennials (people ages 18 to 34 ). Coke tested more than 30 flavors before settling on the four new ones. Financial Position Coke's fiscal year ends on December 31. As indicated in Exhibit 1, Coke posted revenues of $35.4 billion in 2017 , compared to $41.8 billion in 2016, a 15 percent decline. Net income was $1.28 billion compared to $6.66 billion in 2016 , an 81 percent decline. Declines in both of these numbers are alarming. Note all the negative numbers in Exhibit 1, even though for most companies 2017 was a very properous year. Coke's balance sheets are provided in Exhibit 2. Note that Coke purchased $3.7 billion of its own stock in 2017. In 2017, Coke paid \$5 billion out to shareholders in dividends even though the company's net income was only $1.28 billion. Thus, basically the company borrowed money to pay dividends; this event resulted in a negative retained earnings for the year 2017 and a large drop in retained earnings on the 2017 balance sheet, as shown in Exhibit 2. Note in Exhibit 2 that Coke's paidin-capital increased a whopping 89 percent in 2017 revealing high use of equity as a source of capital. EXHIBIT 1 Coke's Income Statements (in millions of dollars) EXHIBIT 2 Coke's Balance Sheets (in millions of dollars) EXHIBIT 3 Coke Financial Data Across Key Variables (in millions of dollars) Source: Based on information at www.coca-colacompany.com EXHIBIT 4 Coke's Revenues from the United States Compared to Outside the United States (in millions of dollars) Source: Based on intormation at www.coca-colacompany.com Coke has five main operating segments: (1) Europe, Middle East, and Africa, (2) Latin America, (3) North America, (4) Asia Pacific, and (5) Bottling Investments. Revenues and operating profits by segment are provided in Exhibit 5 and Exhibit 6, respectively. Note that North America generates 29.9 percent of coke revenues and 34.4 percent of operating income. Note that only one segment, Latin America, showed an increase in operating income in 2017. EXHIBIT 5 Coke's Revenues by Segment (in millions of dollars) Source: Based on information at www.coca-colacompany.com EXHIBIT 6 Coke's Total Operating Income by Segment (in millions of dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts