Question: Stol Pues es = 30) Assume that Mary Brown Inc. hired you as a consultant to help it estimate the cost of capital. You

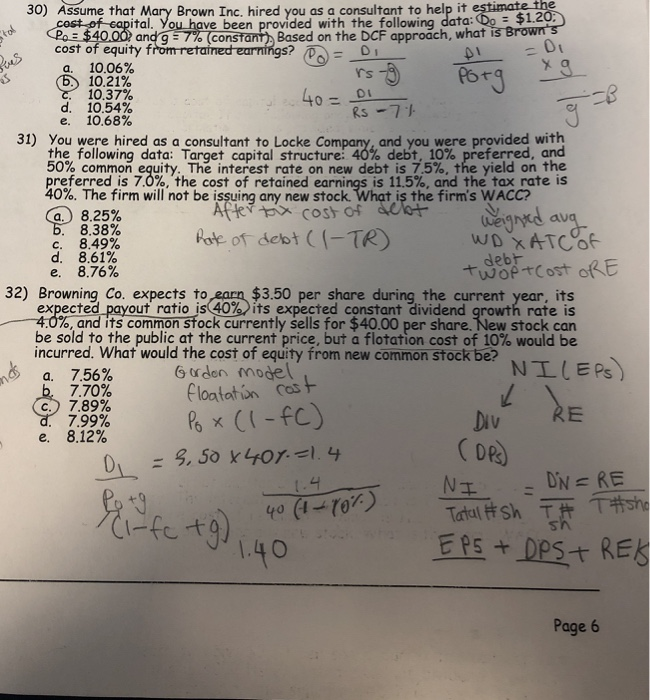

Stol Pues es = 30) Assume that Mary Brown Inc. hired you as a consultant to help it estimate the cost of capital. You have been provided with the following data: Do $1.20; Po $40.00) and g = 7% (constant) Based on the DCF approach, what is Brown's cost of equity from retained earnings? = DI DI = 0 x g Porg a. 10.06% (5. 10.21% c. 10.37% d. 10.54% e. 10.68% nds 31) You were hired as a consultant to Locke Company, and you were provided with the following data: Target capital structure: 40% debt, 10% preferred, and 50% common equity. The interest rate on new debt is 7.5%, the yield on the preferred is 7.0%, the cost of retained earnings is 11.5%, and the tax rate is 40%. The firm will not be issuing any new stock. What is the firm's WACC? After tax cost of debt Rate of debt (1-TR) weighted avg WD XATC OF debt TwoP+Cost ORE a. 8.25% 5. 8.38% C. 8.49% d. 8.61% e. 8.76% 32) Browning Co. expects to earn $3.50 per share during the current year, its expected payout ratio is 40% its expected constant dividend growth rate is 4.0%, and its common stock currently sells for $40.00 per share. New stock can be sold to the public at the current price, but a flotation cost of 10% would be incurred. What would the cost of equity from new common stock be? Gorden model floatation cost Pox (1-fc) a. 7.56% b. 7.70% C. 7.89% d. 7.99% e. 8.12% rs-3 40 = D -71 DI Rs D = 3,50 x 407.-1.4 (-fc +9) -1.4 40 (1-70%) 1.40 g=B NI(EPS) RE DIV (DPs) NI DN = RE = Tatal #sh T#T#sho EPS+ DPS+ REK sh Page 6

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

30 The cost of equity can be calculated as Re D1 Po g D1 D0 1 ... View full answer

Get step-by-step solutions from verified subject matter experts