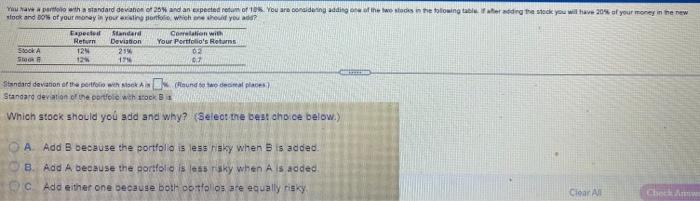

Question: need help with the three questions in the problem. The last two are pasted in due to screen issues but they are visible. You apartfolio

You apartfolio with a standard deviahes of 20 and an expected retum of 10. You are considering adding the westors in the following altered the stock you will have 20% of your money in the new look and 80% of your money in your de Boli Wich one who you? Expected Standard Correlation with Return Devision Your Portfolio's Returns SOKA 12N 25 02 She 12 17 07 Standard deviation of the portfolio with lock (und te to complex Standard deviation of the portfole with stock Which stook should you add and why? (Select the best choice below.) DA Add B because the portfolio is less risky when B is added B. Add A because the portfolio is less risky when A is added c Ado either one because both cotillos are equally risky Clear All You apartfolio with a standard deviahes of 20 and an expected retum of 10. You are considering adding the westors in the following altered the stock you will have 20% of your money in the new look and 80% of your money in your de Boli Wich one who you? Expected Standard Correlation with Return Devision Your Portfolio's Returns SOKA 12N 25 02 She 12 17 07 Standard deviation of the portfolio with lock (und te to complex Standard deviation of the portfole with stock Which stook should you add and why? (Select the best choice below.) DA Add B because the portfolio is less risky when B is added B. Add A because the portfolio is less risky when A is added c Ado either one because both cotillos are equally risky Clear All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts