Question: need help with the top part Draw Design Layout References Mailings Review View Tell me Share Verdana v 10 Aav v A vel X X

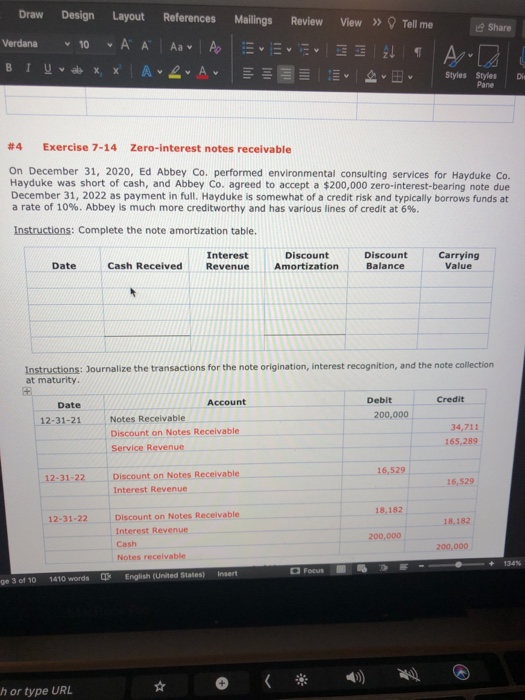

Draw Design Layout References Mailings Review View Tell me Share Verdana v 10 Aav v A vel X X A2 Styles Styles Pane Die #4 Exercise 7-14 Zero-interest notes receivable On December 31, 2020, Ed Abbey Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Abbey Co. agreed to accept a $200,000 zero-interest-bearing note due December 31, 2022 as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 10%. Abbey is much more creditworthy and has various lines of credit at 6%. Instructions: Complete the note amortization table. Interest Discount Discount Carrying Date Cash Received Revenue Amortization Value Balance Instructions: Journalize the transactions for the note origination, interest recognition, and the note collection at maturity. Credit Date Debit 200,000 12-31-21 Account Notes Receivable Discount on Notes Receivable Service Revenue 34,711 165,289 16,529 12-31-22 Discount on Notes Receivable Interest Revenue 16,529 18,182 12-31-22 18,182 Discount on Notes Receivable Interest Revenue Cash Notes receivable 200,000 200,000 1349 C Focus Insert 1410 words English (United States) ge 3 of 10 h or type URL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts