Question: need help with them all BI U ab X, XIA Paragraph Styles Dietate Sensitivity 1. Calculate the compounded annual return of the following investment: Year

need help with them all

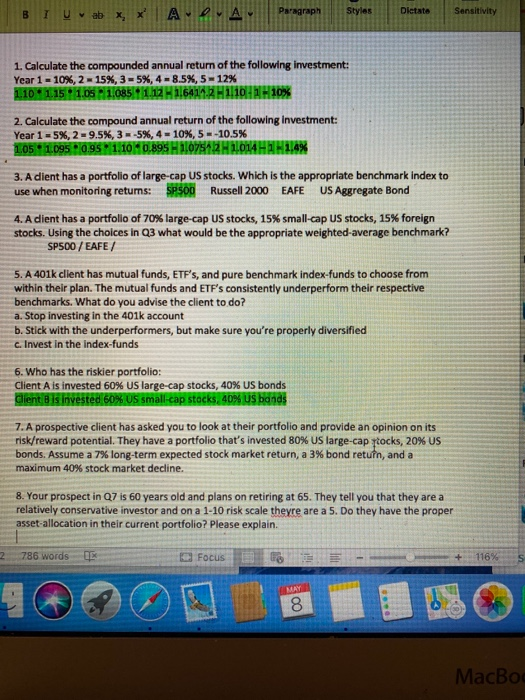

need help with them allBI U ab X, XIA Paragraph Styles Dietate Sensitivity 1. Calculate the compounded annual return of the following investment: Year 1 - 10%,2 -15%, 3-5%, 4-8.5%, 5-12% 1.10 1.15 1.1.085111216411H11101 - 10% 2. Calculate the compound annual return of the following Investment: Year 1-5%, 2-9.5%, 3 -5%, 4 - 10%, 5=-10.5% 105 1095 096 M1:100.895 H110751B2014H1.4% 3. A dient has a portfolio of large-cap US stocks. Which is the appropriate benchmark index to use when monitoring retums: SP500 Russell 2000 EAFE US Aggregate Bond 4. A dient has a portfolio of 70% large-cap US stocks, 15% small-cap US stocks, 15% foreign stocks. Using the choices in Q3 what would be the appropriate weighted average benchmark? SP500 / EAFE/ 5. A 401k client has mutual funds, ETF's, and pure benchmark index-funds to choose from within their plan. The mutual funds and ETF's consistently underperform their respective benchmarks. What do you advise the client to do? a. Stop investing in the 401k account b. Stick with the underperformers, but make sure you're properly diversified c. Invest in the index-funds 6. Who has the riskier portfolio: Client A is invested 60% US large-cap stocks, 40% US bonds Client is invested 60% US small-cap stocks, 40% US band 7. A prospective client has asked you to look at their portfolio and provide an opinion on its risk/reward potential. They have a portfolio that's invested 80% US large-cap stocks, 20% US bonds. Assume a 7% long-term expected stock market return, a 3% bond return, and a maximum 40% stock market decline. 8. Your prospect in Q7 is 60 years old and plans on retiring at 65. They tell you that they are a relatively conservative investor and on a 1-10 risk scale theyre are a 5. Do they have the proper asset-allocation in their current portfolio? Please explain. 786 words Focus + 116% S MacBod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts