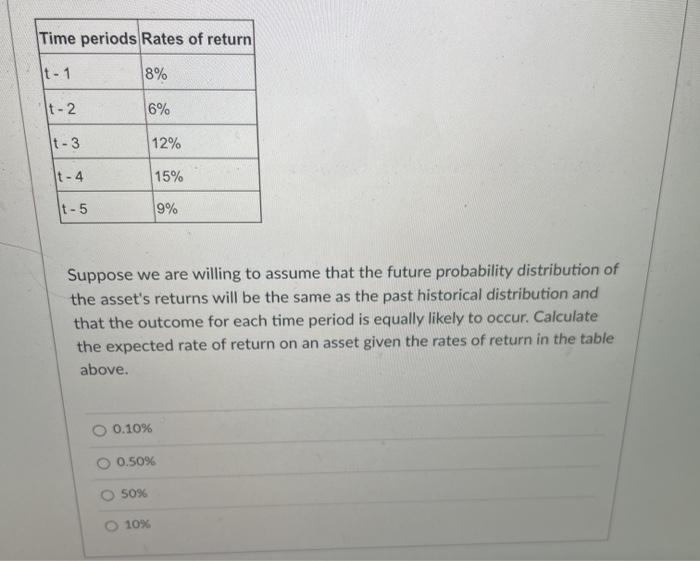

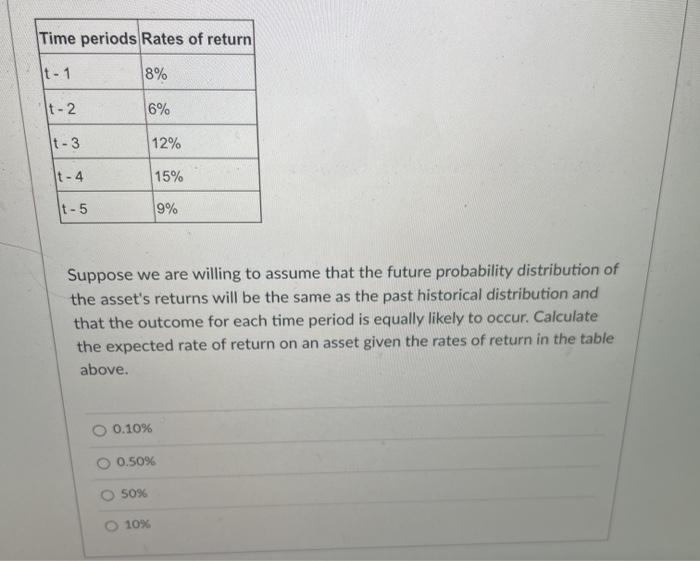

Question: need help with these 2, i dont understand them at all. Time periods Rates of return It-1 8% It-2 6% It-3 12% It - 4

need help with these 2, i dont understand them at all.

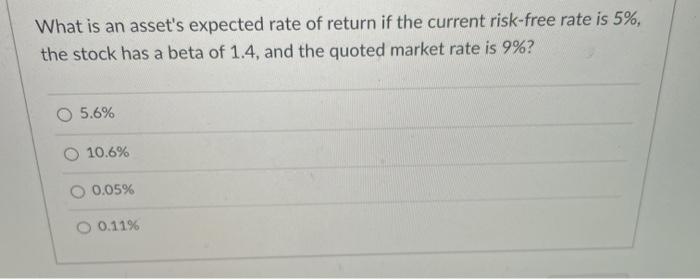

Time periods Rates of return It-1 8% It-2 6% It-3 12% It - 4 15% It - 5 9% Suppose we are willing to assume that the future probability distribution of the asset's returns will be the same as the past historical distribution and that the outcome for each time period is equally likely to occur. Calculate the expected rate of return on an asset given the rates of return in the table above. 0.10% 0.5096 50% 1090 What is an asset's expected rate of return if the current risk-free rate is 5%, the stock has a beta of 1.4, and the quoted market rate is 9%? 5.6% 10.6% O 0.05% 0.11%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock