Question: need help with these 2 please A firm is considering two projects A, and B with the given cash flows; thel firm's cost of capital

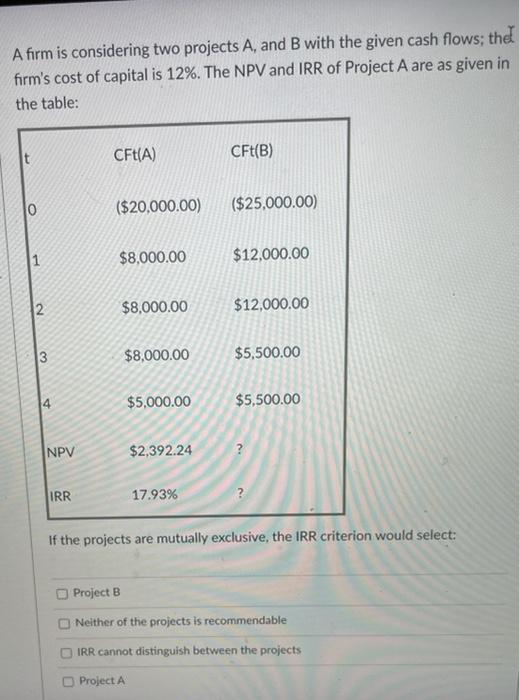

A firm is considering two projects A, and B with the given cash flows; thel firm's cost of capital is 12%. The NPV and IRR of Project A are as given in the table: CFL(A) CFt(B) 0 ($20,000.00) ($25,000.00) 1 1 $8,000.00 $12,000.00 N $8,000.00 $12,000.00 3 $8,000.00 $5,500.00 4 $5,000.00 $5,500.00 NPV $2,392.24 IRR 17.93% If the projects are mutually exclusive, the IRR criterion would select: Project B Neither of the projects is recommendable IRR cannot distinguish between the projects Project A If a firm has a 65.87% debt to asset ratio, what is its debt to equity ratio? (Answer should be a %)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts