Question: need help with these 2 please An aggressive (highly risk tolerant) investor seeks two aggressive growth stocks that will potentially give her the largest possible

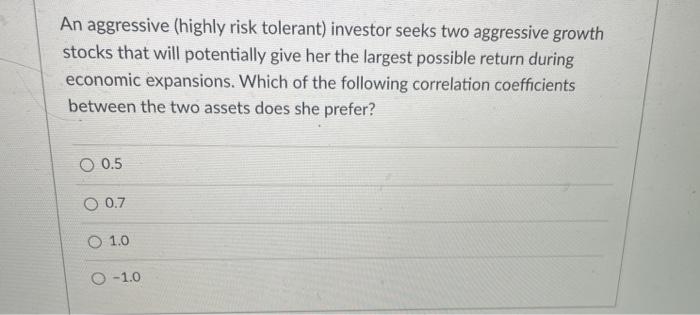

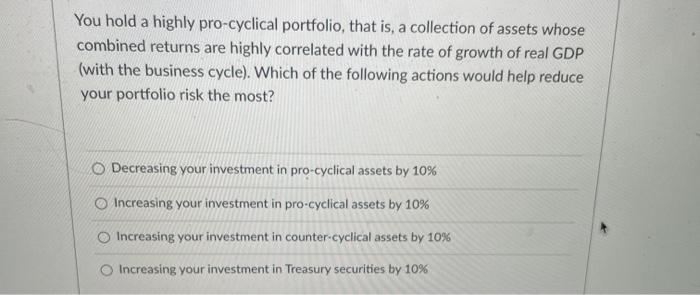

An aggressive (highly risk tolerant) investor seeks two aggressive growth stocks that will potentially give her the largest possible return during economic expansions. Which of the following correlation coefficients between the two assets does she prefer? O 0.5 O 0.7 O 1.0 O -1.0 You hold a highly pro-cyclical portfolio, that is, a collection of assets whose combined returns are highly correlated with the rate of growth of real GDP (with the business cycle). Which of the following actions would help reduce your portfolio risk the most? Decreasing your investment in pro-cyclical assets by 10% Increasing your investment in pro-cyclical assets by 10% Increasing your investment in counter-cyclical assets by 10% Increasing your investment in Treasury securities by 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts