Question: Need help with these 2 questions from below: Here is the excel template they used D Question 6 15 pts AAL Options.xlsx file has the

Need help with these 2 questions from below:

Here is the excel template they used

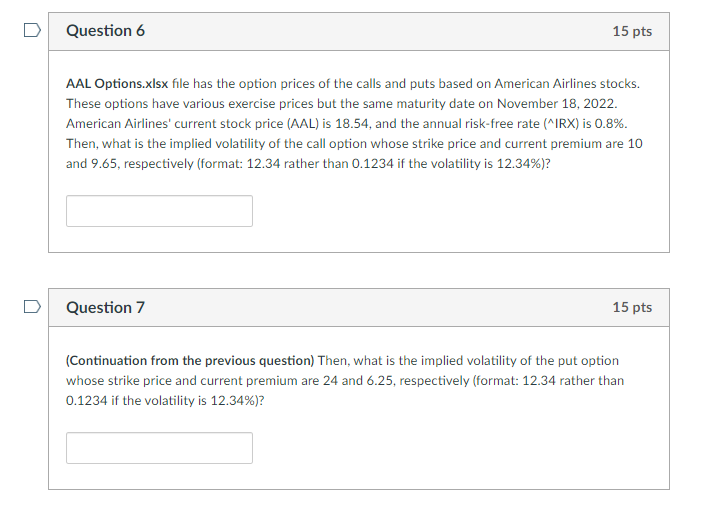

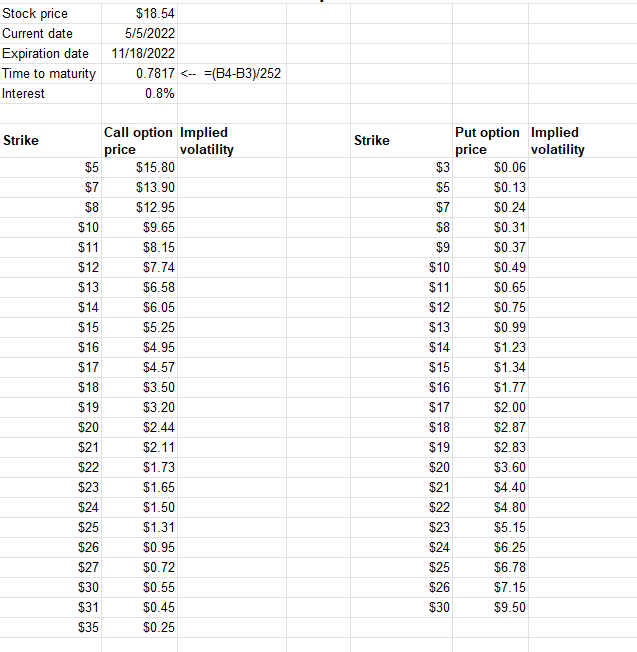

D Question 6 15 pts AAL Options.xlsx file has the option prices of the calls and puts based on American Airlines stocks. These options have various exercise prices but the same maturity date on November 18, 2022. American Airlines' current stock price (AAL) is 18.54, and the annual risk-free rate (MIRX) is 0.8%. Then, what is the implied volatility of the call option whose strike price and current premium are 10 and 9.65, respectively (format: 12.34 rather than 0.1234 if the volatility is 12.34%)? Question 7 15 pts (Continuation from the previous question) Then, what is the implied volatility of the put option whose strike price and current premium are 24 and 6.25, respectively (format: 12.34 rather than 0.1234 if the volatility is 12.34%)? Stock price Current date Expiration date Time to maturity Interest $18.54 5/5/2022 11/18/2022 0.7817

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts