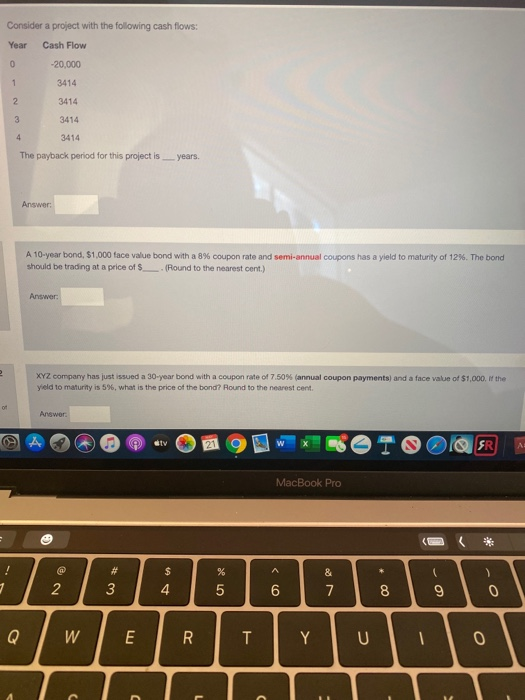

Question: need help with these 3 questions Consider a project with the following cash flows: Year Cash Flow 0 -20,000 1 3414 2 3414 3 3414

Consider a project with the following cash flows: Year Cash Flow 0 -20,000 1 3414 2 3414 3 3414 4 3414 The payback period for this project is years. Answer: A 10-year bond, $1,000 face value bond with a 8% coupon rate and semi-annual coupons has a yield to maturity of 12%. The bond should be trading at a price of $__(Round to the nearest cent.) Answer: 10 XYZ company has just issued a 30-year bond with a coupon rate of 7.50% (annual coupon payments) and a face value of $1,000. If the yield to maturity is 5%, what is the price of the bona? Round to the nearest cent. Answer: tv SR Al MacBook Pro @ # $ 2 % 5 3 & 7 4 6 8 9 0 Q W E R T Y U 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts