Question: Need help with these 3 questions please M 6 4:30 pm Problem 01: A Tbill that is 225 days from maturity is selling for $95,850.

Need help with these 3 questions please

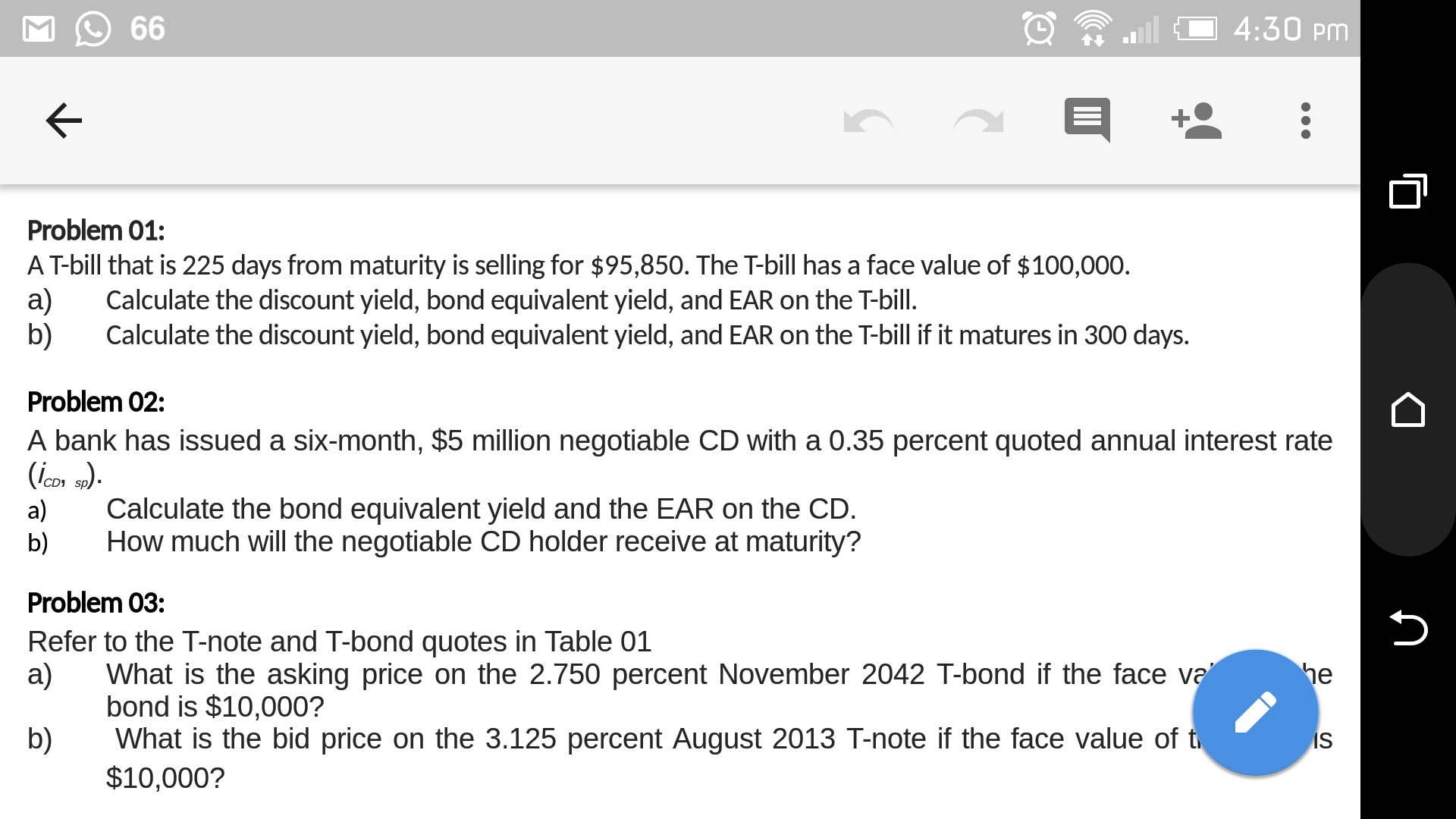

M 6 4:30 pm Problem 01: A Tbill that is 225 days from maturity is selling for $95,850. The T-bill has a face value of $100,000 a) Calculate the discount yield, bond equivalent yield, and EAR on the Tbill b) Calculate the discount yield, bond equivalent yield, and EAR on the Tbill if it matures in 300 days. Problem 02: A bank has issued a six-month, $5 million negotiable CD with a 0.35 percent quoted annual interest rate CD3 spl a) Calculate the bond equivalent yield and the EAR on the CD b) How much will the negotiable CD holder receive at maturity? Problem 03: Refer to the T-note and T-bond quotes in Table 01 a) What is the asking price on the 2.750 percent November 2042 T-bond if the face va he bond is $10,000? b) What is the bid price on the 3.125 percent August 2013 T-note if the face value of t $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts