Question: A B D E The following information is available for Remmers Corporation for 2017. F G H 1. Depreciation reported on the tax return

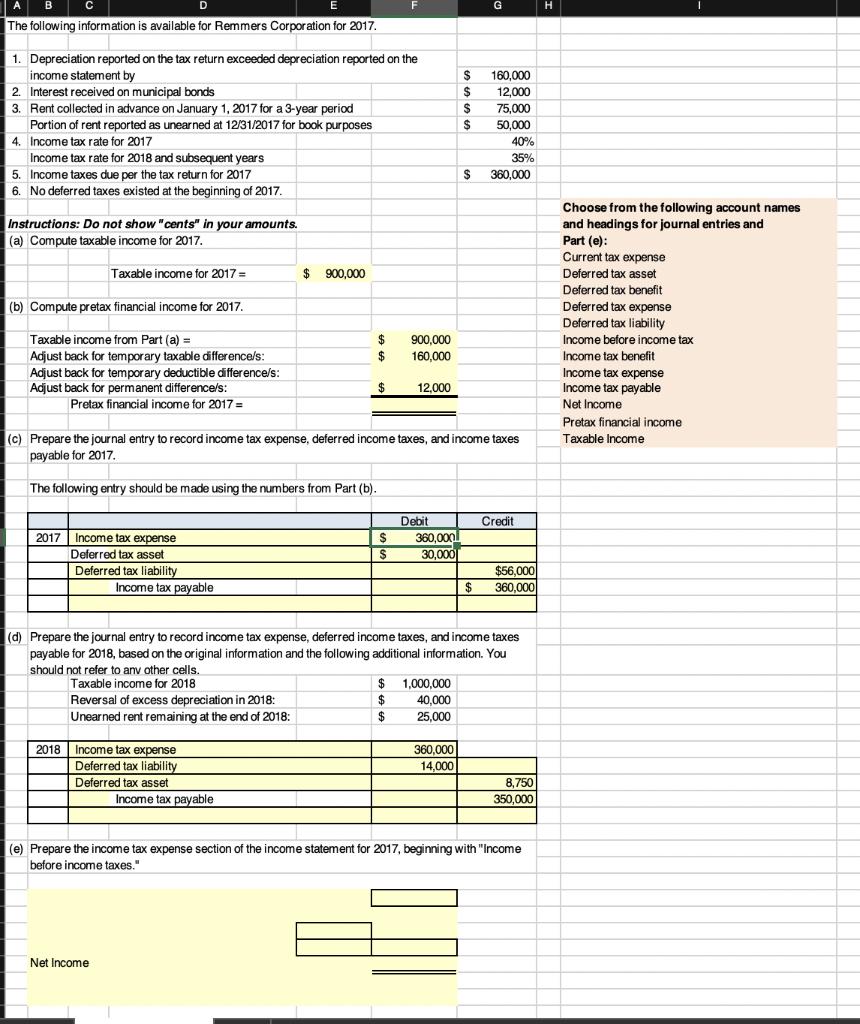

A B D E The following information is available for Remmers Corporation for 2017. F G H 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $ 160,000 2. Interest received on municipal bonds $ 12,000 3. Rent collected in advance on January 1, 2017 for a 3-year period $ 75,000 Portion of rent reported as unearned at 12/31/2017 for book purposes $ 50,000 4. Income tax rate for 2017 40% Income tax rate for 2018 and subsequent years 35% $ 360,000 5. Income taxes due per the tax return for 2017 6. No deferred taxes existed at the beginning of 2017. Instructions: Do not show "cents" in your amounts. (a) Compute taxable income for 2017. Choose from the following account names and headings for journal entries and Part (e): Current tax expense Deferred tax asset Deferred tax benefit Taxable income for 2017 = $ 900,000 (b) Compute pretax financial income for 2017. Deferred tax expense Deferred tax liability Taxable income from Part (a) = $ Adjust back for temporary taxable difference/s: $ 900,000 160,000 Income before income tax Income tax benefit Adjust back for temporary deductible difference/s: Income tax expense Adjust back for permanent difference/s: $ 12,000 Pretax financial income for 2017= (c) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017. The following entry should be made using the numbers from Part (b). Income tax payable Net Income Pretax financial income Taxable Income 2017 Income tax expense Deferred tax asset Deferred tax liability Income tax payable Debit Credit $ 360,000 $ 30,000 $56,000 $ 360,000 (d) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2018, based on the original information and the following additional information. You should not refer to any other cells. Taxable income for 2018 $ 1,000,000 Reversal of excess depreciation in 2018: $ 40,000 Unearned rent remaining at the end of 2018: $ 25,000 2018 Income tax expense 360,000 Deferred tax liability 14,000 Deferred tax asset 8,750 Income tax payable 350,000 (e) Prepare the income tax expense section of the income statement for 2017, beginning with "Income before income taxes." Net Income

Step by Step Solution

There are 3 Steps involved in it

Case Assignment 4 Solutions Deferred Taxes DT3 a Taxable Income Calculation for 2012 Item Amount Accounting Income Before Taxes 900000 Less TaxExempt Interest Municipal Bonds 80000 Add Rental Income T... View full answer

Get step-by-step solutions from verified subject matter experts