Question: Need help with these 4 questions Question 1 2.5 pts Sooner Motors Inc. has a 11% required rate of return. The firm does not expect

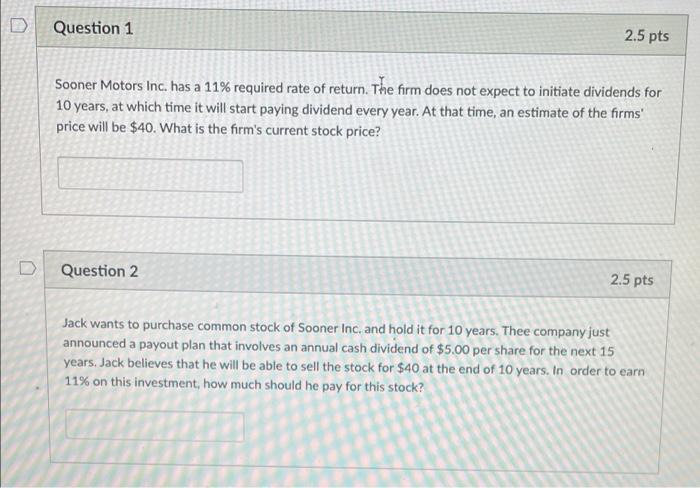

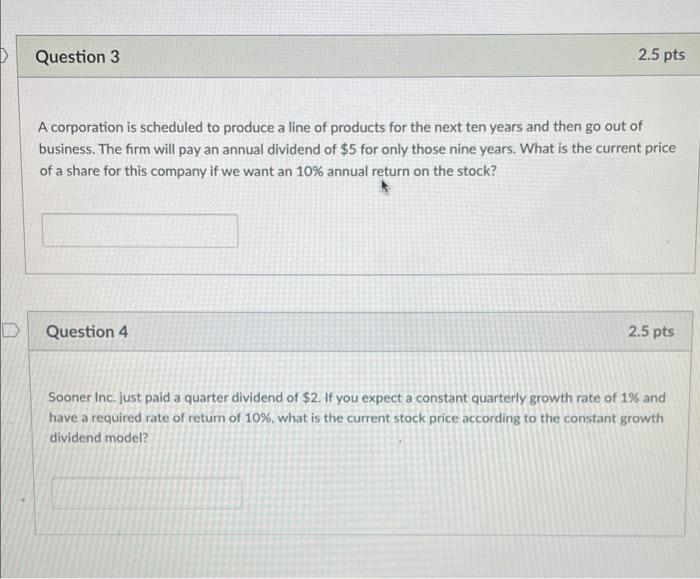

Question 1 2.5 pts Sooner Motors Inc. has a 11% required rate of return. The firm does not expect to initiate dividends for 10 years, at which time it will start paying dividend every year. At that time, an estimate of the firms' price will be $40. What is the firm's current stock price? D Question 2 2.5 pts Jack wants to purchase common stock of Sooner Inc. and hold it for 10 years. Thee company just announced a payout plan that involves an annual cash dividend of $5.00 per share for the next 15 years. Jack believes that he will be able to sell the stock for $40 at the end of 10 years. In order to earn 11% on this investment, how much should he pay for this stock? Question 3 2.5 pts A corporation is scheduled to produce a line of products for the next ten years and then go out of business. The firm will pay an annual dividend of $5 for only those nine years. What is the current price of a share for this company if we want an 10% annual return on the stock? D Question 4 2.5 pts Sooner Inc. just paid a quarter dividend of $2. If you expect a constant quarterly growth rate of 1% and have a required rate of return of 10%, what is the current stock price according to the constant growth dividend model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts