Question: need help with these asap pls CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially

need help with these asap pls

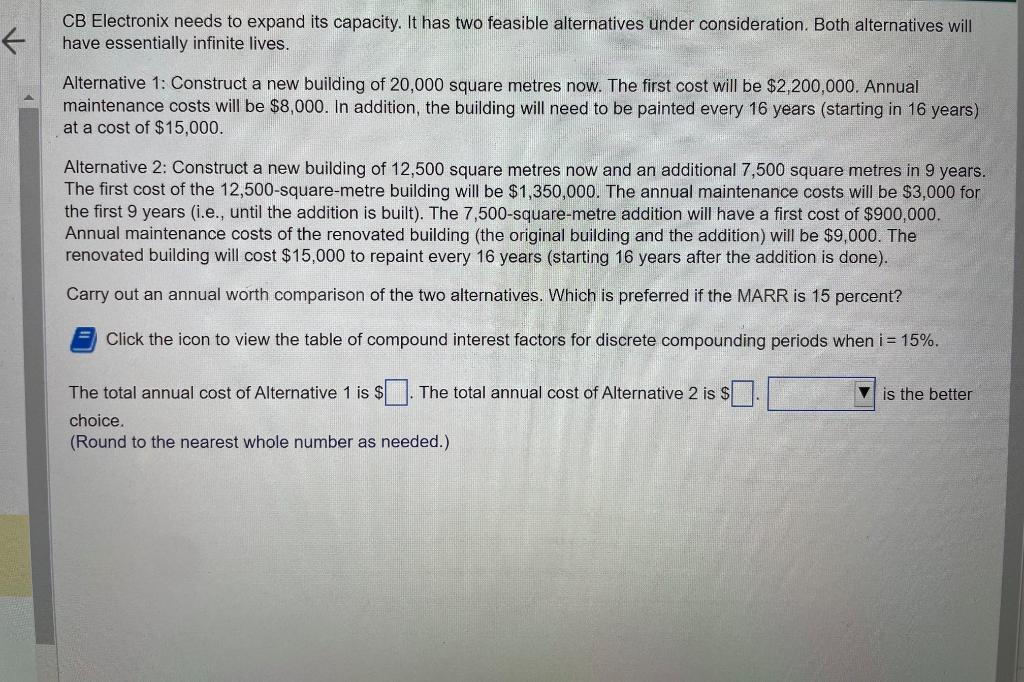

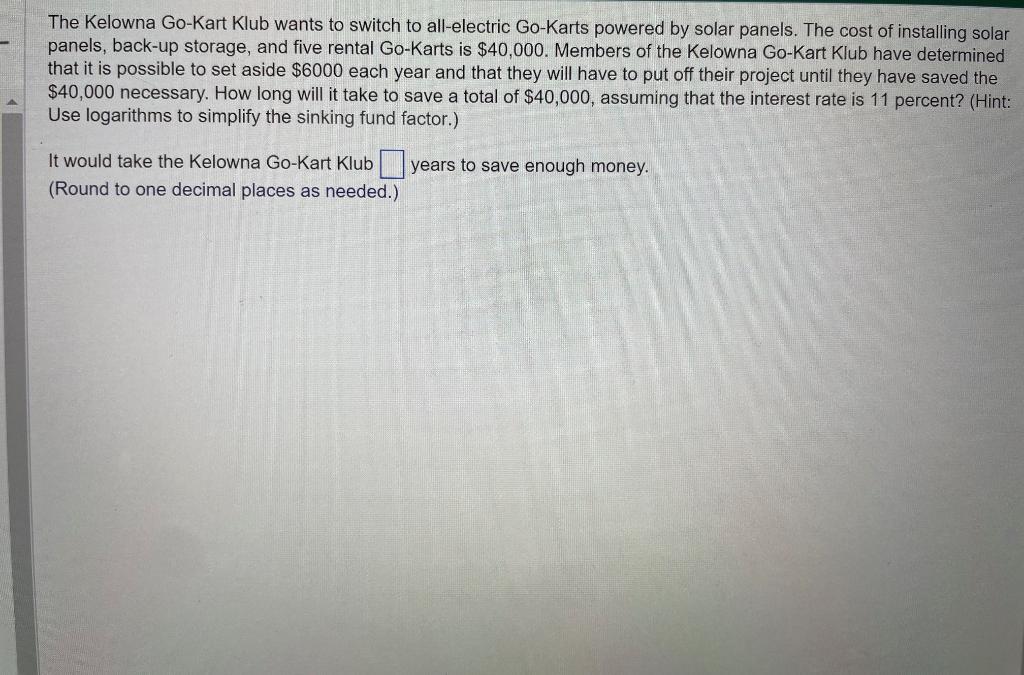

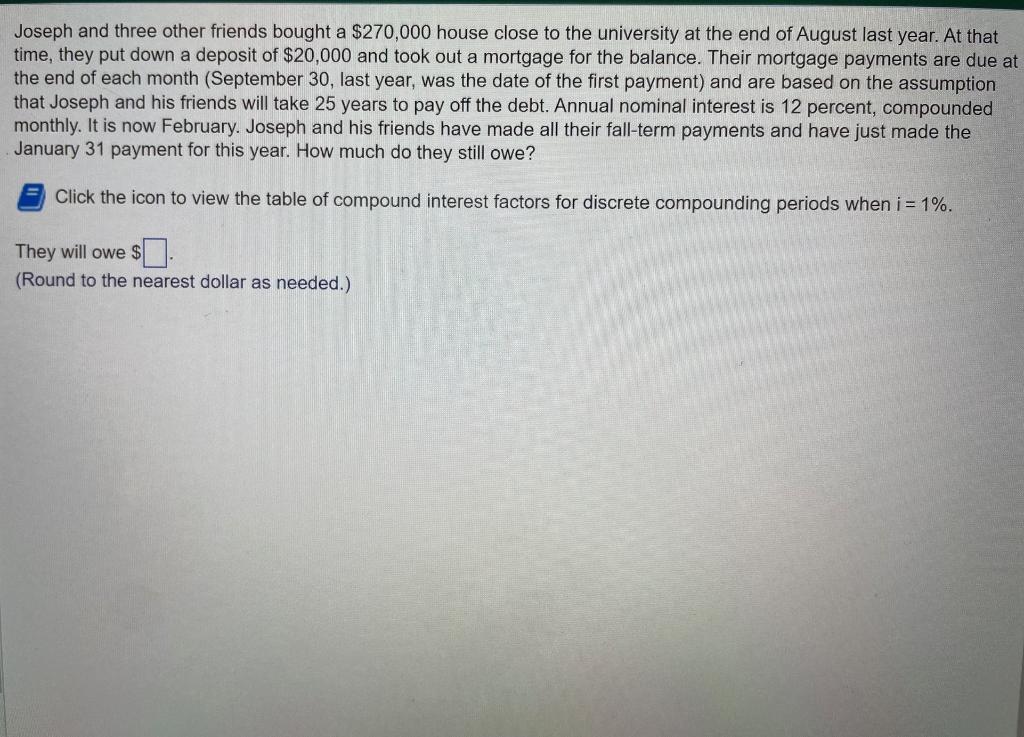

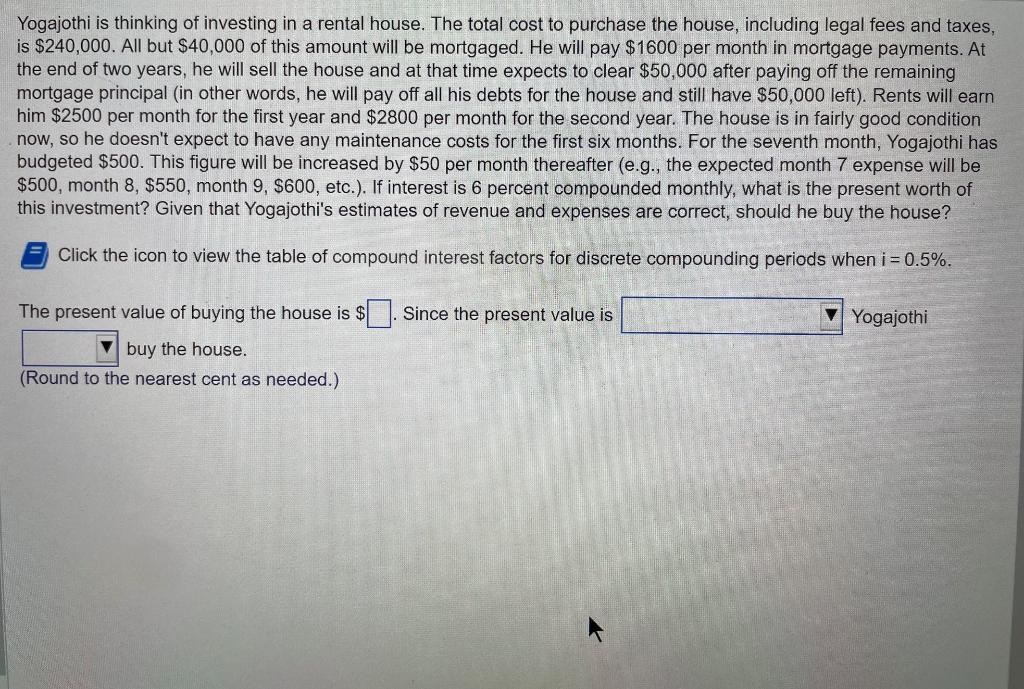

CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a new building of 20,000 square metres now. The first cost will be $2,200,000. Annual maintenance costs will be $8,000. In addition, the building will need to be painted every 16 years (starting in 16 years) at a cost of $15,000 Alternative 2: Construct a new building of 12,500 square metres now and an additional 7,500 square metres in 9 years. The first cost of the 12,500 -square-metre building will be $1,350,000. The annual maintenance costs will be $3,000 for the first 9 years (i.e., until the addition is built). The 7,500-square-metre addition will have a first cost of $900,000. Annual maintenance costs of the renovated building (the original building and the addition) will be $9,000. The renovated building will cost $15,000 to repaint every 16 years (starting 16 years after the addition is done). Carry out an annual worth comparison of the two alternatives. Which is preferred if the MARR is 15 percent? Click the icon to view the table of compound interest factors for discrete compounding periods when i=15%. The total annual cost of Alternative 1 is $. The total annual cost of Alternative 2 is $ is the better choice. (Round to the nearest whole number as needed.) The Kelowna Go-Kart Klub wants to switch to all-electric Go-Karts powered by solar panels. The cost of installing solar panels, back-up storage, and five rental Go-Karts is $40,000. Members of the Kelowna Go-Kart Klub have determined that it is possible to set aside $6000 each year and that they will have to put off their project until they have saved the $40,000 necessary. How long will it take to save a total of $40,000, assuming that the interest rate is 11 percent? (Hint: Use logarithms to simplify the sinking fund factor.) It would take the Kelowna Go-Kart Klub years to save enough money. (Round to one decimal places as needed.) Joseph and three other friends bought a $270,000 house close to the university at the end of August last year. At that time, they put down a deposit of $20,000 and took out a mortgage for the balance. Their mortgage payments are due at the end of each month (September 30, last year, was the date of the first payment) and are based on the assumption that Joseph and his friends will take 25 years to pay off the debt. Annual nominal interest is 12 percent, compounded monthly. It is now February. Joseph and his friends have made all their fall-term payments and have just made the January 31 payment for this year. How much do they still owe? Click the icon to view the table of compound interest factors for discrete compounding periods when i=1%. They will owe $ (Round to the nearest dollar as needed.) Yogajothi is thinking of investing in a rental house. The total cost to purchase the house, including legal fees and taxes, is $240,000. All but $40,000 of this amount will be mortgaged. He will pay $1600 per month in mortgage payments. At the end of two years, he will sell the house and at that time expects to clear $50,000 after paying off the remaining mortgage principal (in other words, he will pay off all his debts for the house and still have $50,000 left). Rents will earn him $2500 per month for the first year and $2800 per month for the second year. The house is in fairly good condition now, so he doesn't expect to have any maintenance costs for the first six months. For the seventh month, Yogajothi has budgeted $500. This figure will be increased by $50 per month thereafter (e.g., the expected month 7 expense will be $500, month 8,$550, month 9,$600, etc.). If interest is 6 percent compounded monthly, what is the present worth of this investment? Given that Yogajothi's estimates of revenue and expenses are correct, should he buy the house? Click the icon to view the table of compound interest factors for discrete compounding periods when i=0.5%. The present value of buying the house is $. Since the present value is Yogajothi buy the house. (Round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts