Question: need help with these homework questions. please show work. 5-How many years left in a 10-year bond outstanding with 10% annual coupon rate, 12% annual

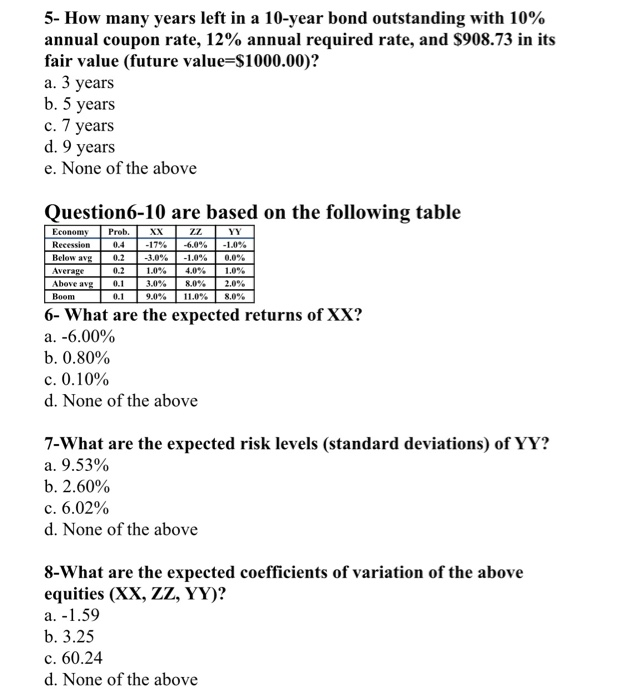

5-How many years left in a 10-year bond outstanding with 10% annual coupon rate, 12% annual required rate, and $908.73 in its fair value (future value-$1000.00)? a. 3 years b. 5 years c. 7 years d. 9 years e. None of the above Question6-10 are based on the following table Prob. 0.4 XX 17% 3.0% -6.0% -1.0% 4.0 8.0% 11.0% Recessiorn Below a -1.0% 0.0% Above av 3.0% 9.0% 2.0% 8.0% Boom 0.1 6- What are the expected returns of XX? a.-6.00% b. 0.80% c. 0.10% d. None of the above 7-What are the expected risk levels (standard deviations) of YY? a. 9.53% b, 2.60% C. 6.02% d. None of the above 8-What are the expected coefficients of variation of the above equities (XX, ZZ, YY)? a. 1.59 b. 3.25 c. 60.24 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts