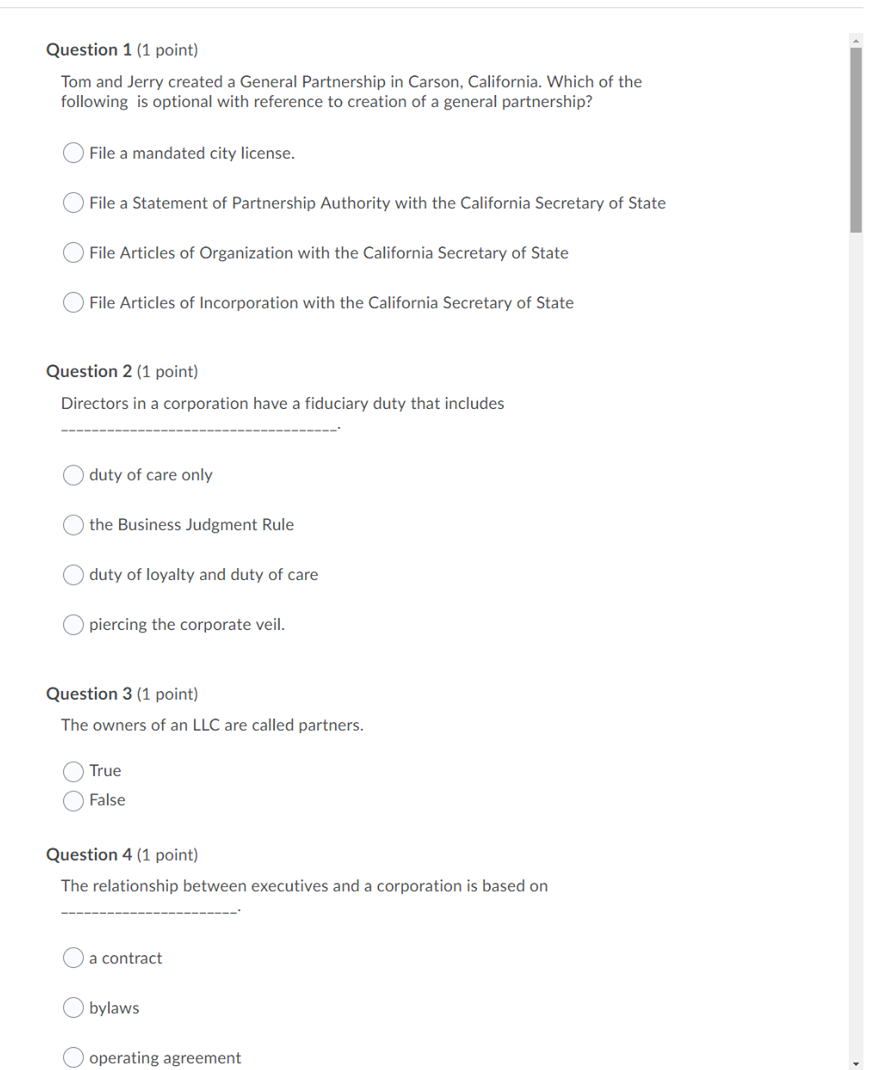

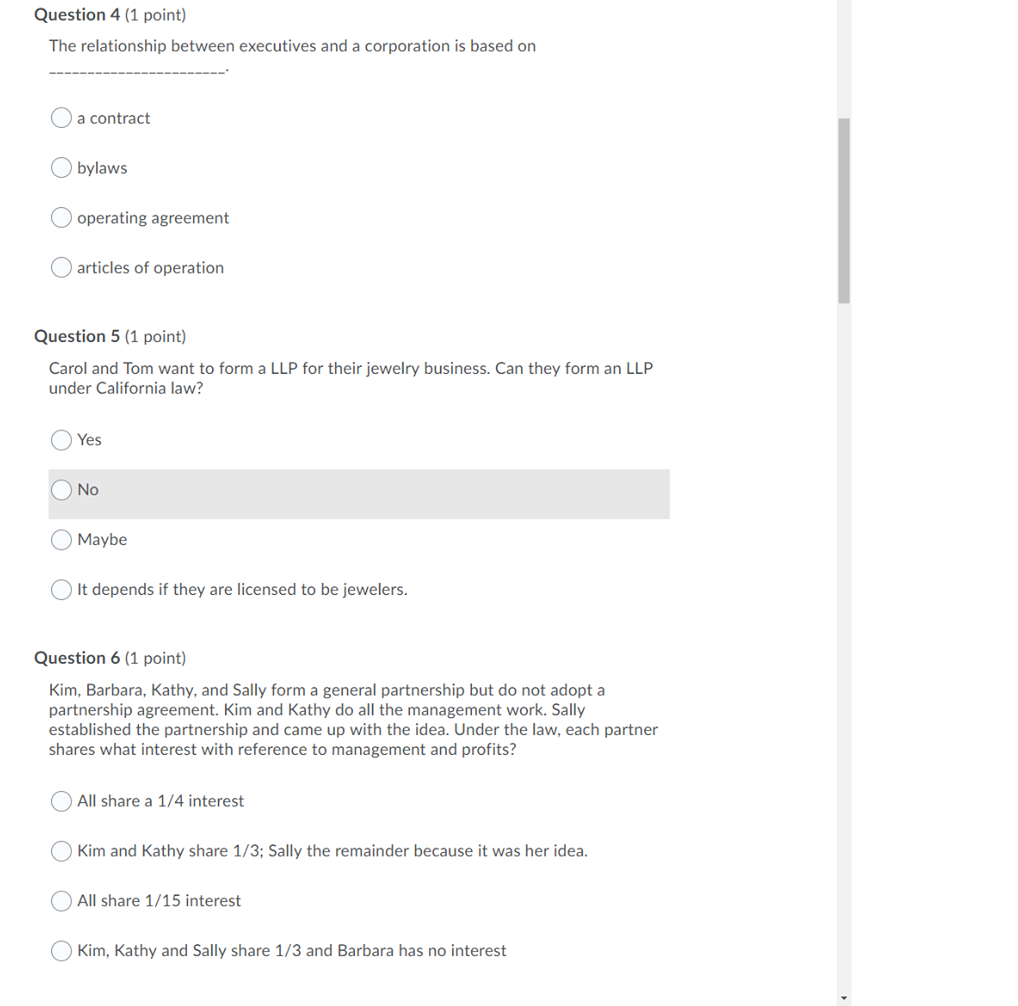

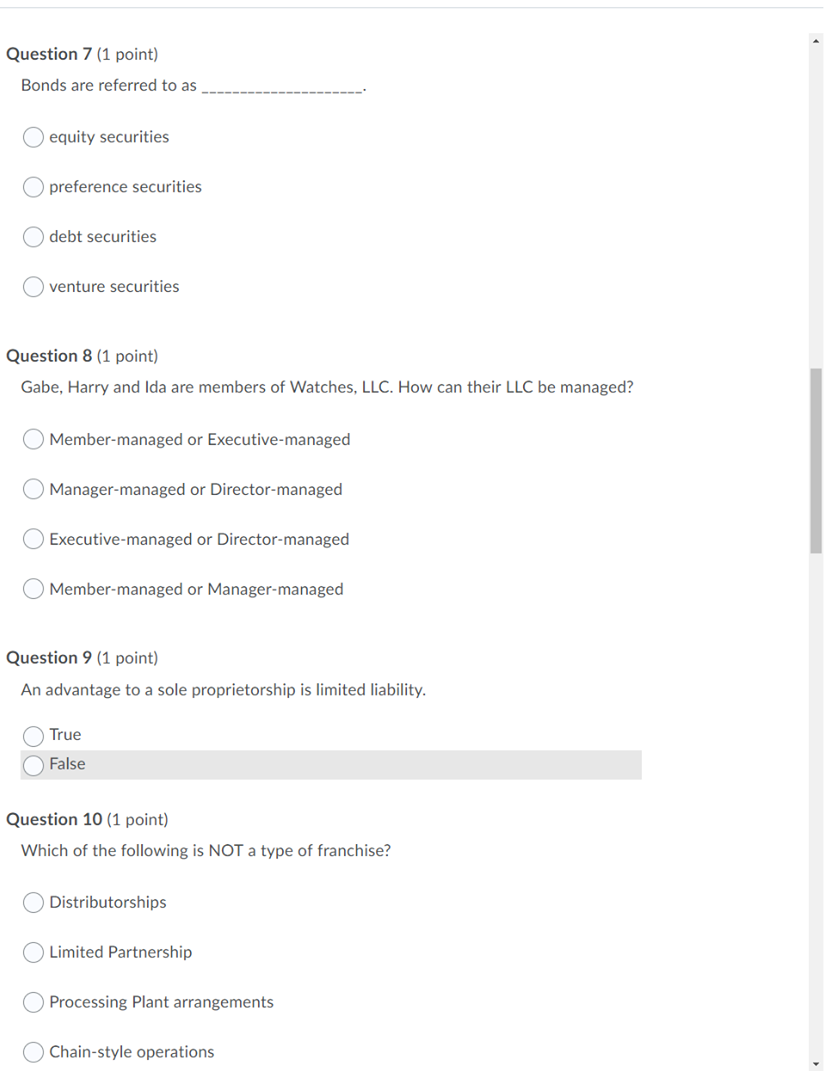

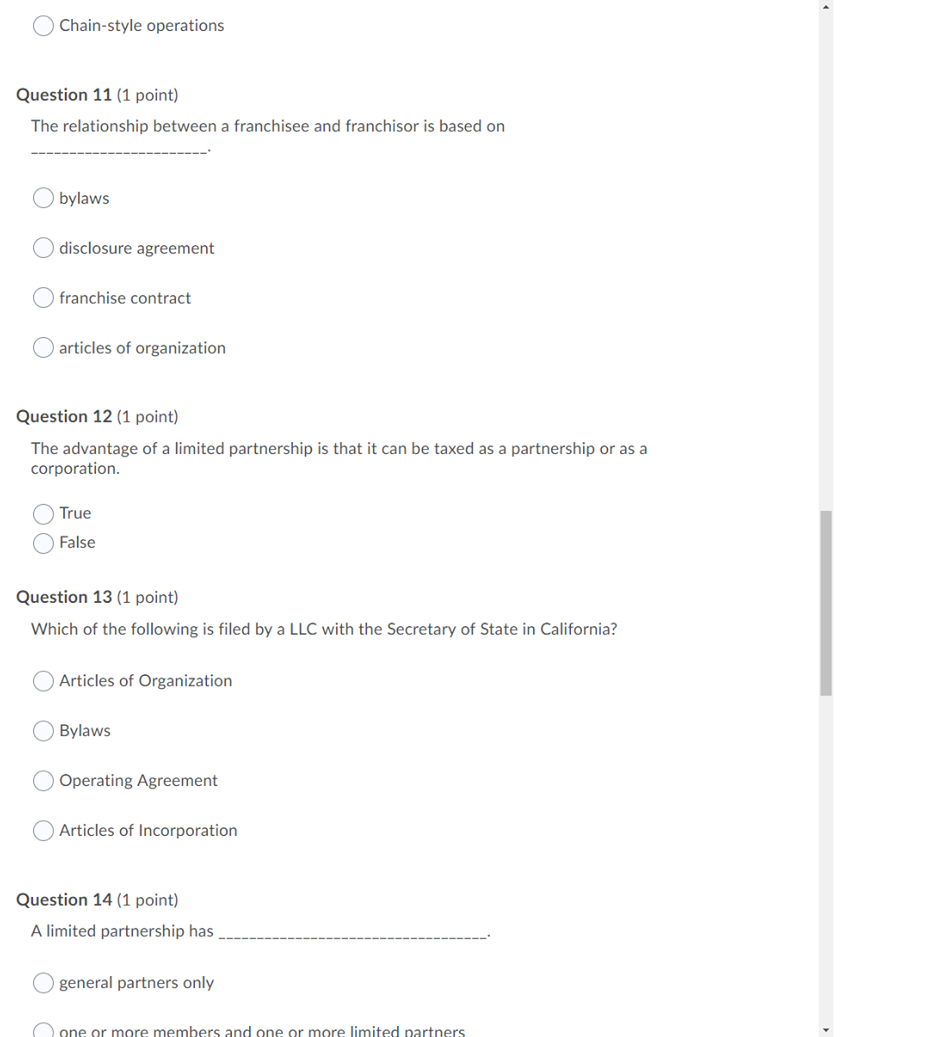

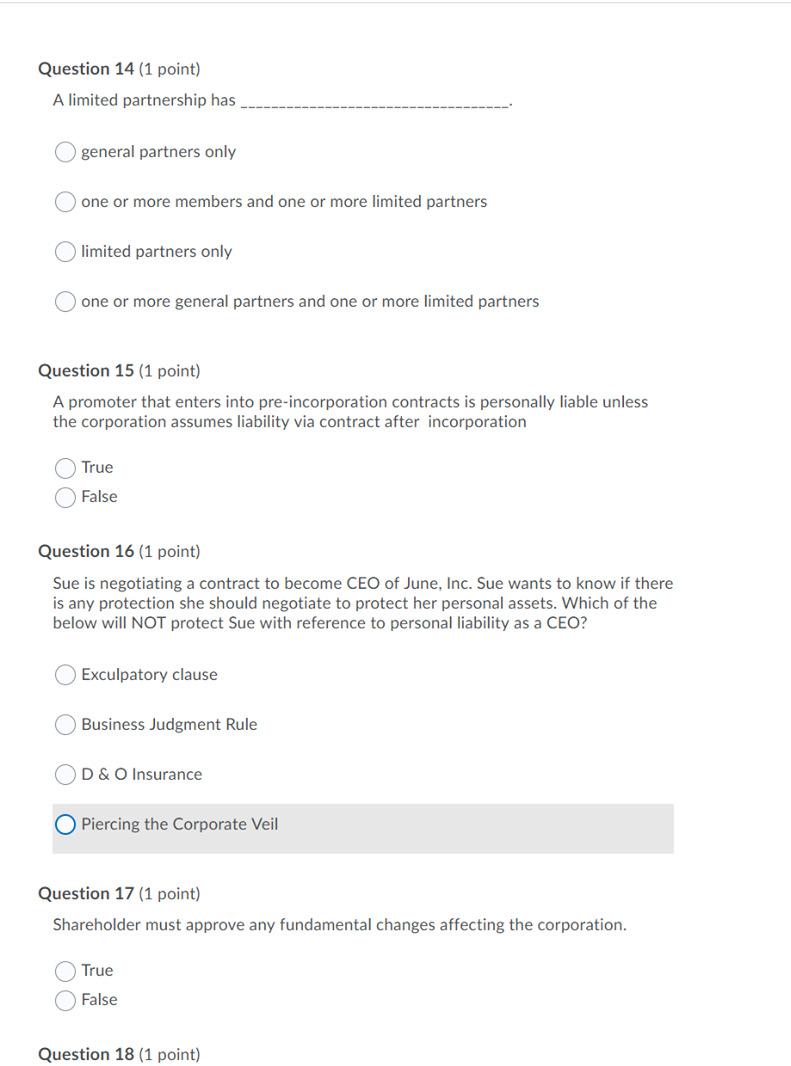

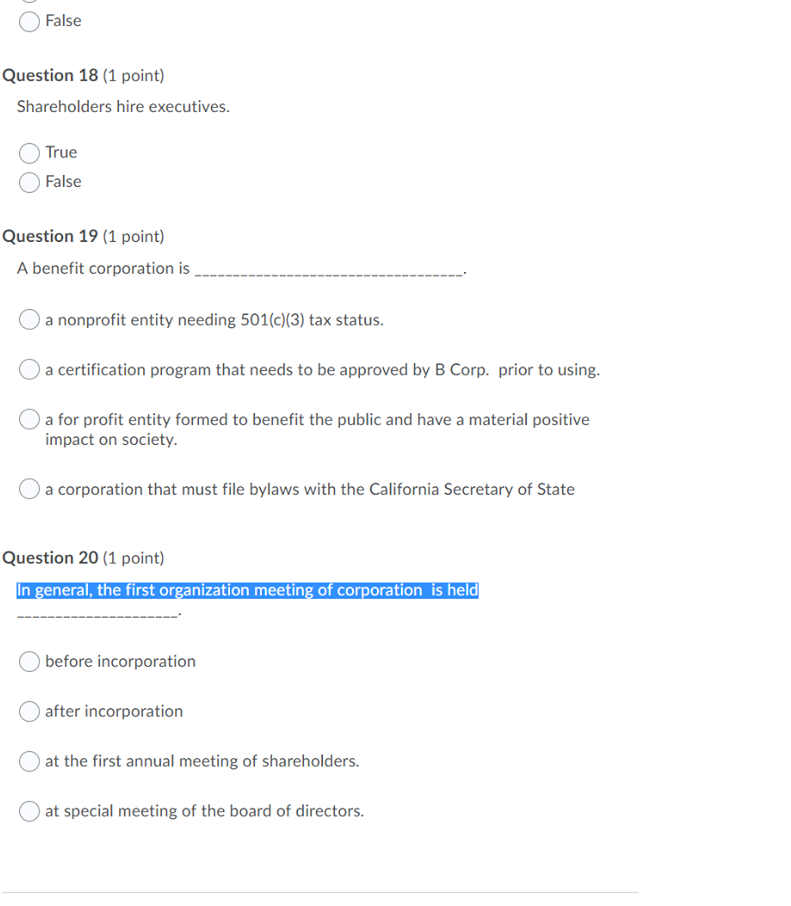

Question: Need help with these problems Question 1 (1 point) Tom and Jerry created a General Partnership in Carson, California. Which of the following is optional

Need help with these problems

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock