Question: Need help with these Q's : to answer the following six questions Consider the following cash flows for two muually exclusive project. Yearl Project Project

Need help with these Q's :

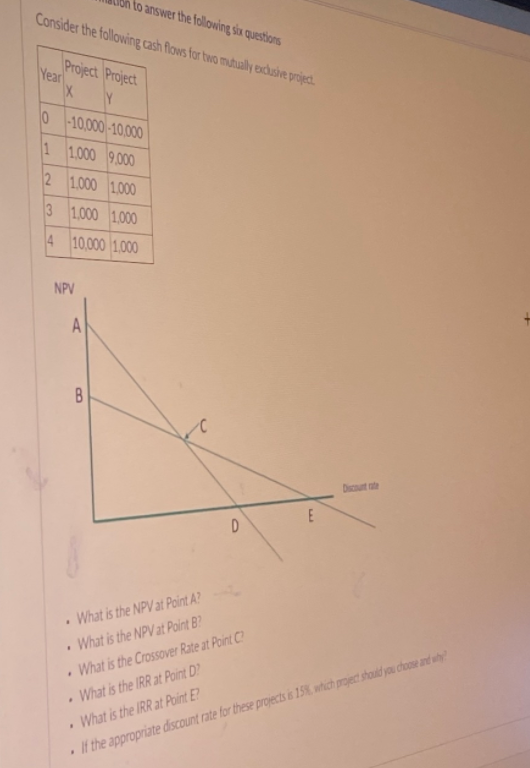

to answer the following six questions Consider the following cash flows for two muually exclusive project. Yearl Project Project Y 10 -10,000 -10,000 1 1.000 9.000 2 1.000 1.000 3 1.000 1.000 4 10.000 1.000 NPV A B E D . . . What is the NPV at Point A? What is the NPV at Point B? What is the Crossover Rate at Point What is the IRR at Point D? What is the IRR at Point ? If the appropriate discount rate for these projects is 15%, which project should you choose and ty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts