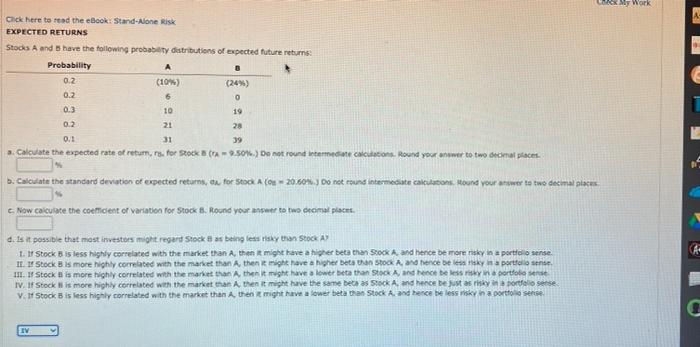

Question: need help with these questions as soon as possible please. My Work Chick here to read the eBook: Stand Alone Risk EXPECTED RETURNS Stocks A

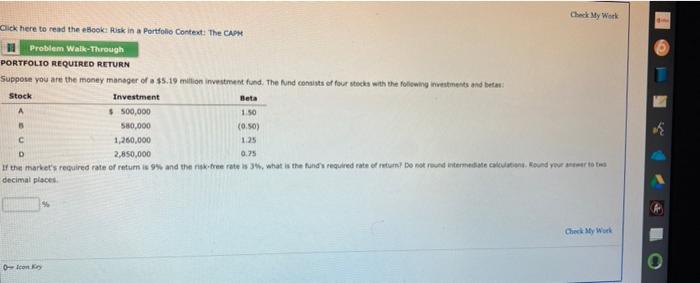

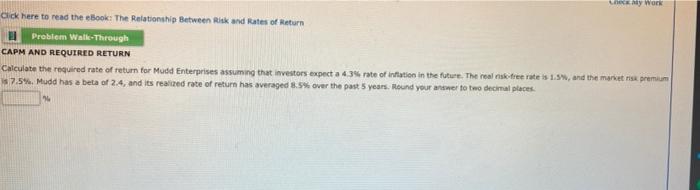

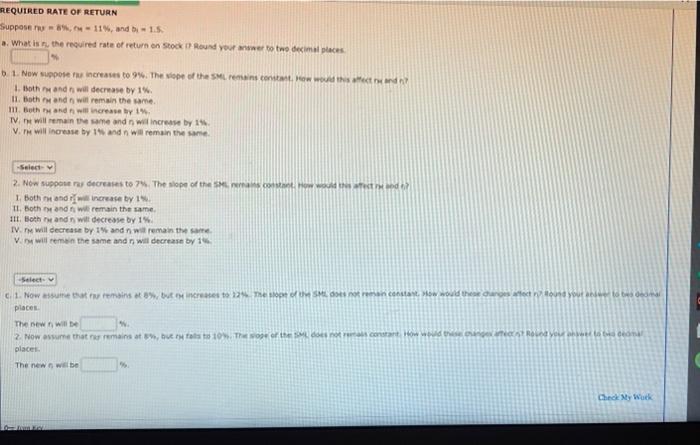

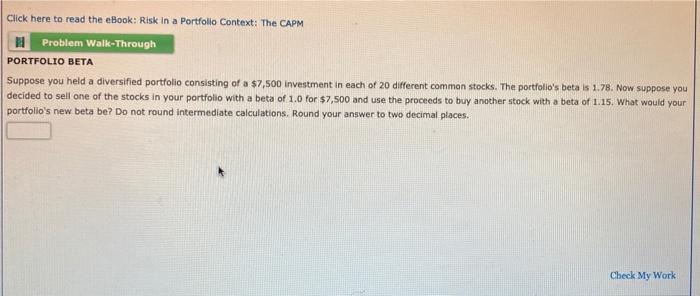

My Work Chick here to read the eBook: Stand Alone Risk EXPECTED RETURNS Stocks A and have the following probability distributions of expected future returns Probability B 0.2 (109) (24%) 0.2 6 0 0.3 10 19 02 21 28 0.1 31 39 a. Calculate the expected rate of returns for stock 9.508) Dentround imate Calcions. Round your answer to two decal places b. Calculate the standard deviation of expected returns, or for Stock A (u - 20.60%) Do not found intermediate cakton Hound your answer to two decimal places Now calculate the coefficient or variation for Stock 8. Round your answer to two decimal placet. d. Is it possible that most investors might regard Stock as being less risky than Stock 1. If Stock B is less highly correlated with the market than then might have a higher beta than Stock A, and hence de marenisky to a portfolio sense. IE. I Stock is more highly correlated with the market than then it might have a higher beta than stok A hence be less a portfolio sen. III. I Stock is more highly correlated with the market than then it might have a lower beathan Stock A, and hence be less risky na portfolio sense IV. If Stock is more highly correlated with the market than A then it might have the same be as Stock and hence be just as risky portfolio sense V. I Stock is less highly correlated with the market than Athen might have a lower beathan Stock A and hence be less risky in a portfolio TV Check My Work Click here to read the book Risk in a Portfolio Context: The CAP H Problem Walk-Through PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $5.19 million investment fund. The und consists of four stocks with the following investments and be Stock Investment Beta A $ 500,000 1.50 580,000 (0:50) 1,260,000 1.25 D 0.75 2,850,000 If the market's required rate of retum is 9% and the streets, what is the funds required rate of return? Do not und intermediate action. Round you to the decimal places Check My Work Olon My Wors Click here to read the eBook: The Relationship Between Risk and Rates of Return Problem Walk Through CAPM AND REQUIRED RETURN Calculate the required rate of return for Mudd Enterprises assuming that investors expect a 4.35 rate of inflation in the future. The real risk free rates 1.9, and the market risk premium 7.54. Mudd has a beta of 2.4, and its realised rate of return has averaged 8,5% over the past 5 years. Round your answer to two decimal places REQUIRED RATE OF RETURN Suppose nu 8.11%, and 1.5 . What is the required rate of return on Stock I Round your to two decimal places 1. Now suppose to increases to 9%. The vope of the SML remains cont. How would this ca 1. Both and will decrease by 1% 11. Both and will remain the same II Both and will increase by 1 TV will remain the same and will increase by 15 V. T will increase by and will remain the same -Select 2. Now super decreases to The slope of the St. How to 1. Both and increase by 10 II. Both and will remain the same 11. Both and will decrease by 1% IV. I will decrease by 1% and will remain the same V will remain the same and will decrease by 16 Select 6 1. Now assume that to remains to be increases to 224. The top of Om Shots no eman constant. How would there are the one you want to places The new will 2. Now assume that remains to be ny fals to 10 The other does not constant How went intenden place The news will be Check My Wuck Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO BETA Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 1.78. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 1.15. What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer to two decimal places. Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts