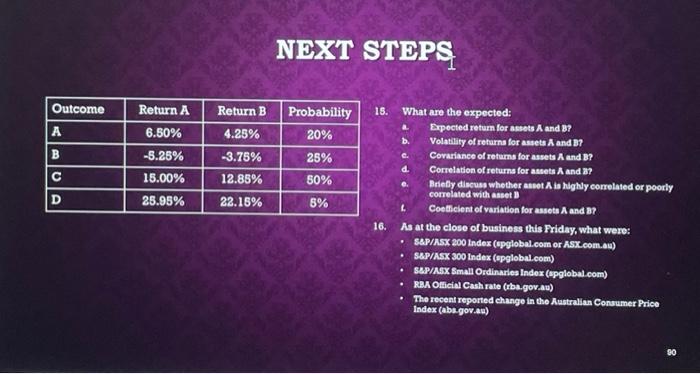

Question: need help with these questions NEXT STEPS Outcome Return A Return B Probability 15. A 6.50% 4.25% 20% B -5.25% -3.75% 12.85% 25% 50% C

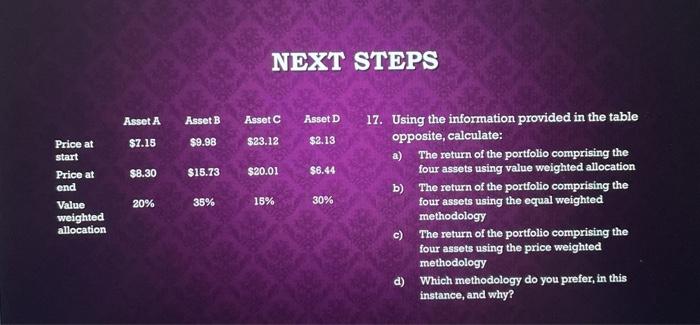

NEXT STEPS Outcome Return A Return B Probability 15. A 6.50% 4.25% 20% B -5.25% -3.75% 12.85% 25% 50% C 15.00% D 25.95% 22.15% 5% What are the expected: Expected return for assets A and B? b. Volatility of returns for assets A and B? Covariance of returns for assets A and B? d. Correlation of returns for assets A and B? Briefly discuss whether asset is highly correlated or poorly correlated with asset Coeficient of variation for assets A and B? As at the close of business this Friday, what were: S&P/ASX 200 Index (spglobal.com or ASX.com.au) S&P/ASX 300 Index (upglobal.com) S&P/ASX Small Ordinaries Index (spglobal.com) RBA Official Cash rate (rba.gov.au) The recent reported change in the Australian Consumer Price Index (abs.gov.au) 16. 80 NEXT STEPS Asset A Asset B Asset C Asset D $7.15 $9.98 $23.12 $2.13 $8.30 $15.73 $20.01 $6.44 Price at start Price at end Value weighted allocation 20% 35% 15% 30% 17. Using the information provided in the table opposite, calculate: a) The return of the portfolio comprising the four assets using value weighted allocation b) The return of the portfolio comprising the four assets using the equal weighted methodology ) The return of the portfolio comprising the four assets using the price weighted methodology d) Which methodology do you prefer, in this instance, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts