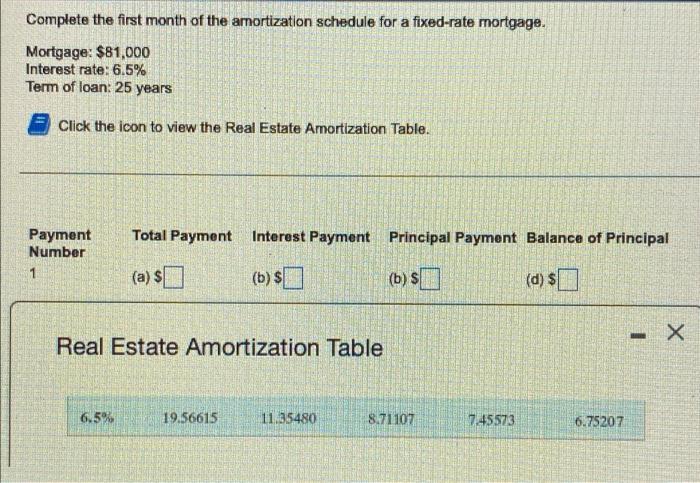

Question: need help with these questions this is the only information it shows and i got it as close up as i could. Complete the first

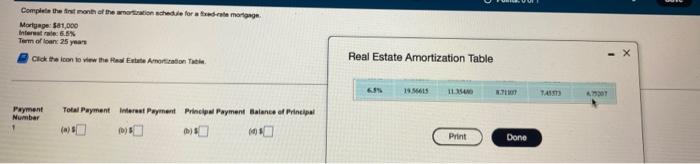

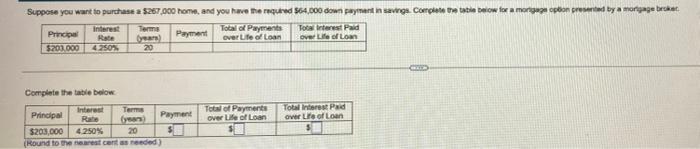

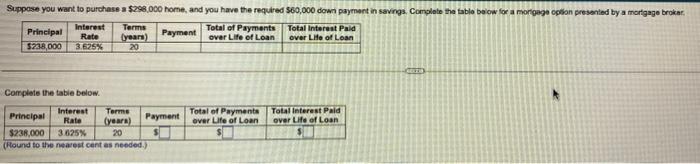

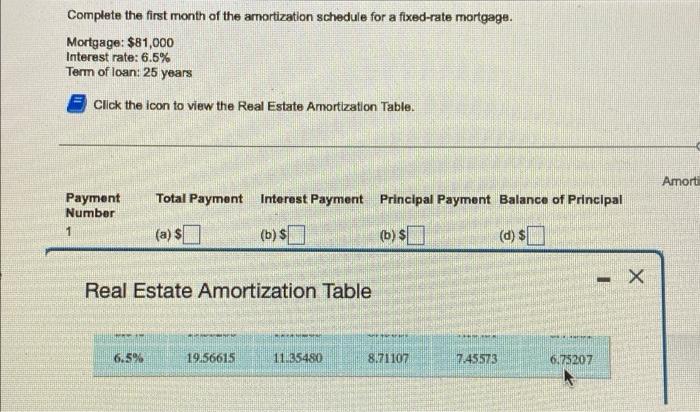

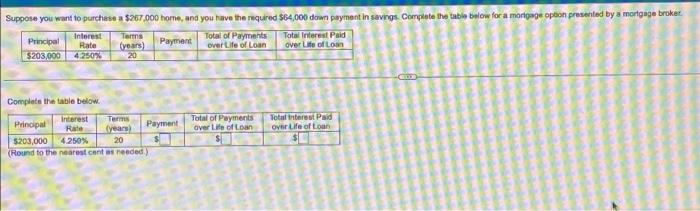

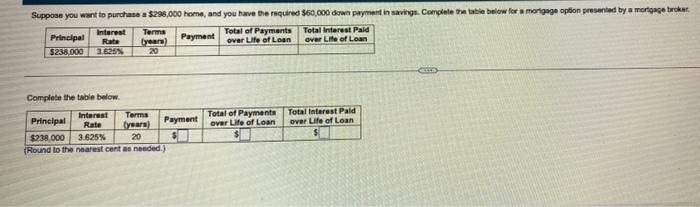

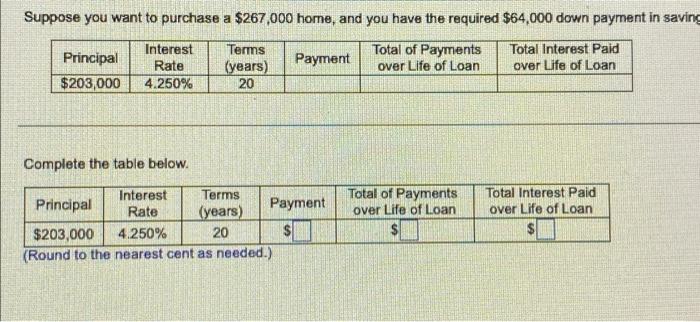

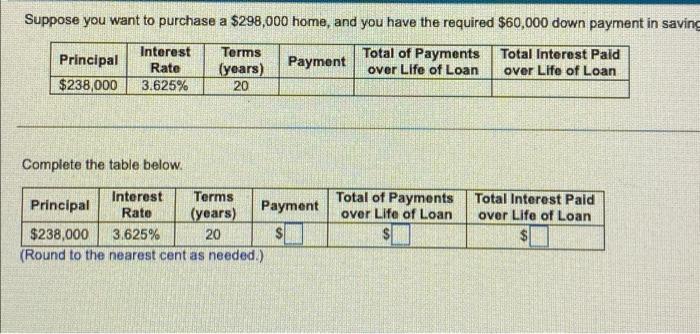

Complete the first month of the norton chedule for the elemento Mortype: $81,000 Interest rate: 6.5% Term of loan 25 years Click to tow the Had Estate Amortization Real Estate Amortization Table 68 19.05 1 TAIST A01 Payment Number Total Payment Interest Payment Principal Payment Balance of Principal Print Done Suppose you want to purchase a $287.000 home, and you have the required 564,000 down payment in avro Complete the table below for a more upton presented by a mortgage broken Principal Tocal of Payments Payment Total Interest Paid years) over Lito Loan ove/Life of loan 5203.000 4250 20 Terms interest Rate Complete the table below Interest Terms Principal Payment Rate Gyer $200,000 4.250% 20 Hound to the nearest centre ded) Total of Payments over Life of loan Total interest Pad over Lire of Loan Suppose you want to purchase a $288,000 home, and you have the required $60,000 down payment in savings. Complete the table below for a morguse option presented by a mortgage broker Principal Total Interest Paid Total of Payments Lyears) Payment over Life of Loan Terms Interest Rate 3.625% over Life of Loan $238,000 20 Complete the table below Total of Payments over Life of Loan Total Interest Paid over Life of Loan Interest Terme Principal Rate (years) Payment $238.000 3.625% 20 (Round to the nearest cent as needed.) Complete the first month of the amortization schedule for a fixed-rate mortgage. Mortgage: $81,000 Interest rate: 6.5% Term of loan: 25 years Click the icon to view the Real Estate Amortization Table. Amorti Total Payment Interest Payment Principal Payment Balance of Principal Payment Number 1 (a) $ () (b) $1 (b) $ (d) $ ) 10 - X Real Estate Amortization Table SH 6.5% 19.56615 11.35480 8171107 7.45573 6075207 Suppose you want to purchase a $267.000 home, and you have the requred $64,000 down payment in savings. Complete the table below for a morloge option presented by a mortgage broker Interest Terms Principal Total Interest Paid Total of Payments Rate Payment (years) over Life of Loan over Life of loan $203,000 4.250% 20 Complete the table below. Total of Payments aver Life of loan Interest Terms Principal Rate Payment (years) $200,000 4.250% 20 (Round to the nearest cant as needed) Total interest Paid over Life of loan $ Suppose you want to purchase a $298.000 home, and you have the quired $60,000 down payment in savings Complete the table below for a mortgage option presented by a mortgage broker Interest Terms Total of Payments Principal Total Interest Paid Rate years) Payment over Life of Loan over Life of Loan 5238.000 3.625% 20 Complete the table below. Total of Payments over Life of Loan Total Interest Paid over Life of Loan Interest Principal Terms Rate tyears) Payment $239,000 3.625% 20 (Round to the nearest cent as needed) Suppose you want to purchase a $267,000 home, and you have the required $64.000 down payment in saving Principal $203,000 Payment Interest Rate 4.250% Terms (years) 20 Total of Payments over Life of Loan Total Interest Paid over Life of Loan Complete the table below. Interest Terms Principal Rate (years) Payment $203,000 4.250% 20 $ (Round to the nearest cent as needed.) Total of Payments over Life of Loan $ Total Interest Paid over Life of Loan $ Suppose you want to purchase a $298,000 home, and you have the required $60,000 down payment in saving Interest Rate 3.625% Principal $238,000 Terms (years) 20 Payment Total of Payments over Life of Loan Total Interest Pald over Life of Loan Complete the table below. Interest Terms Principal Rate (years) Payment $238,000 3.625% 20 $ (Round to the nearest cent as needed.) Total of Payments over Life of Loan $ Total Interest Paid over Life of Loan Complete the first month of the amortization schedule for a fixed-rate mortgage. Mortgage: $81,000 Interest rate: 6.5% Term of loan: 25 years Click the icon to view the Real Estate Amortization Table. Total Payment Interest Payment Principal Payment Balance of Principal Payment Number 1 (a) $ (b) $| $ (b) b (d) $ d0 - X Real Estate Amortization Table 6.5% 19.56615 11,35480 8.71107 7 45573 6.75207

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts