Question: Need help with these three MC questions! Use the information below to answer Question 21. The following table reports the results of a Fama-French-Carhart four-factor

Need help with these three MC questions!

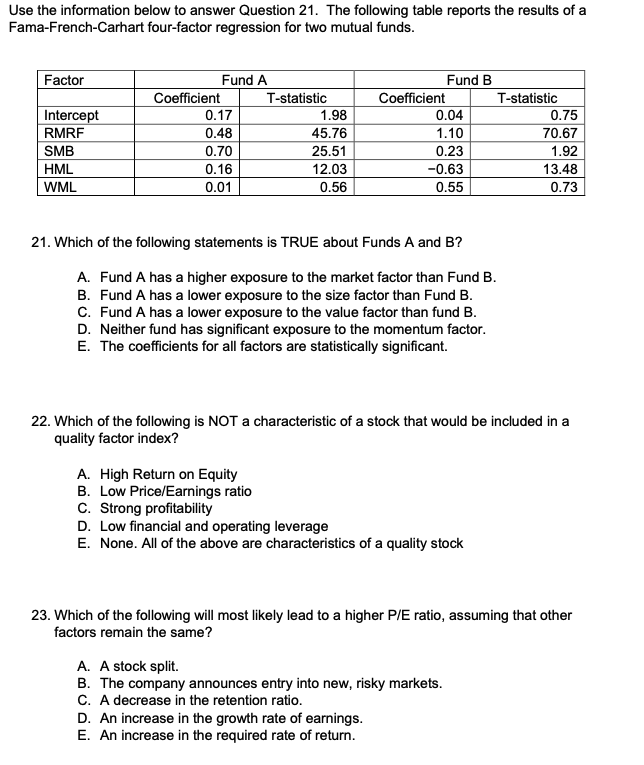

Use the information below to answer Question 21. The following table reports the results of a Fama-French-Carhart four-factor regression for two mutual funds. Factor Intercept RMRF SMB HML WML Fund A Coefficient T-statistic 0.17 1.98 0.48 45.76 0.70 25.51 0.16 12.03 0.01 0.56 Fund B Coefficient 0.04 1.10 0.23 -0.63 0.55 T-statistic 0.75 70.67 1.92 13.48 0.73 21. Which of the following statements is TRUE about Funds A and B? A. Fund A has a higher exposure to the market factor than Fund B. B. Fund A has a lower exposure to the size factor than Fund B. C. Fund A has a lower exposure to the value factor than fund B. D. Neither fund has significant exposure to the momentum factor. E. The coefficients for all factors are statistically significant. 22. Which of the following is NOT a characteristic of a stock that would be included in a quality factor index? A. High Return on Equity B. Low Price/Earnings ratio C. Strong profitability D. Low financial and operating leverage E. None. All of the above are characteristics of a quality stock 23. Which of the following will most likely lead to a higher P/E ratio, assuming that other factors remain the same? A. A stock split. B. The company announces entry into new, risky markets. C. A decrease in the retention ratio. D. An increase in the growth rate of earnings. E. An increase in the required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts