Question: need help with these two questions Depreciation by Two Methods; Partial Years Knife Edge Company purchased tool sharpening equipment on July 1,20Y5, for $16,200. The

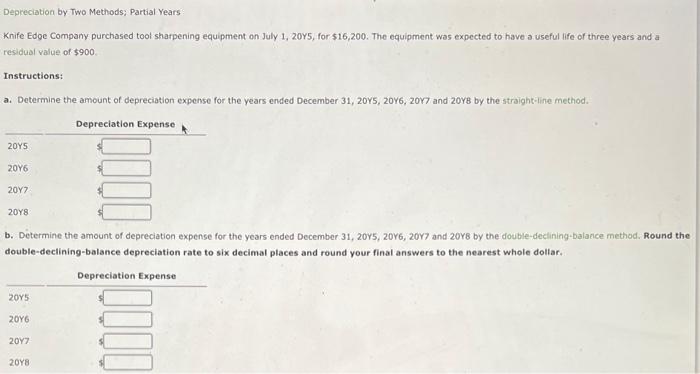

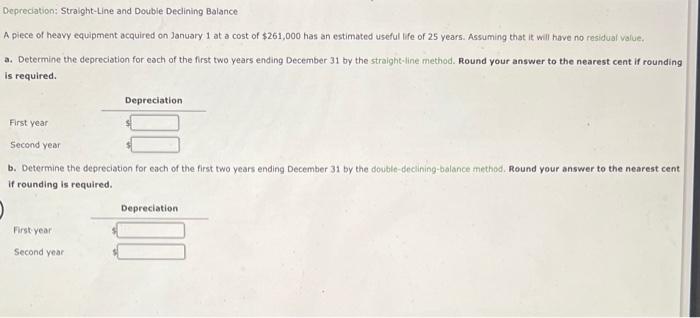

Depreciation by Two Methods; Partial Years Knife Edge Company purchased tool sharpening equipment on July 1,20Y5, for $16,200. The equipment was expected to have a useful life of three years and a residual value of $900 Instructions: a. Determine the amount of depreciation expense for the years ended December 31,20 y, 20 y 6,20 y 7 and 20 Y by the straight-line method. b. Determine the amount of depreciation expense for the years ended December 31,20Y5,20Y6,20Y7 and 20 y by the double-declining-balance method. Round the double-declining-balance depreciation rate to six decimal places and round your final answers to the nearest whole dollar, Depreciation: Straight-Line and Double Declining Balance A piece of heavy equipment acquired on January 1 at a cost of $261,000 has an estimated useful life of 25 years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years ending December 31 by the straight-line method. Round your answer to the nearest cent if rounding is required. b. Determine the depreciation for cach of the first two years ending December 31 by the double-declining-balance method. Round your answer to the nearest cent if rounding is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts