Question: need help with these two questions please. need solutions for both and will upvote for your time. thank you An investor bought a stock for

need help with these two questions please. need solutions for both and will upvote for your time. thank you

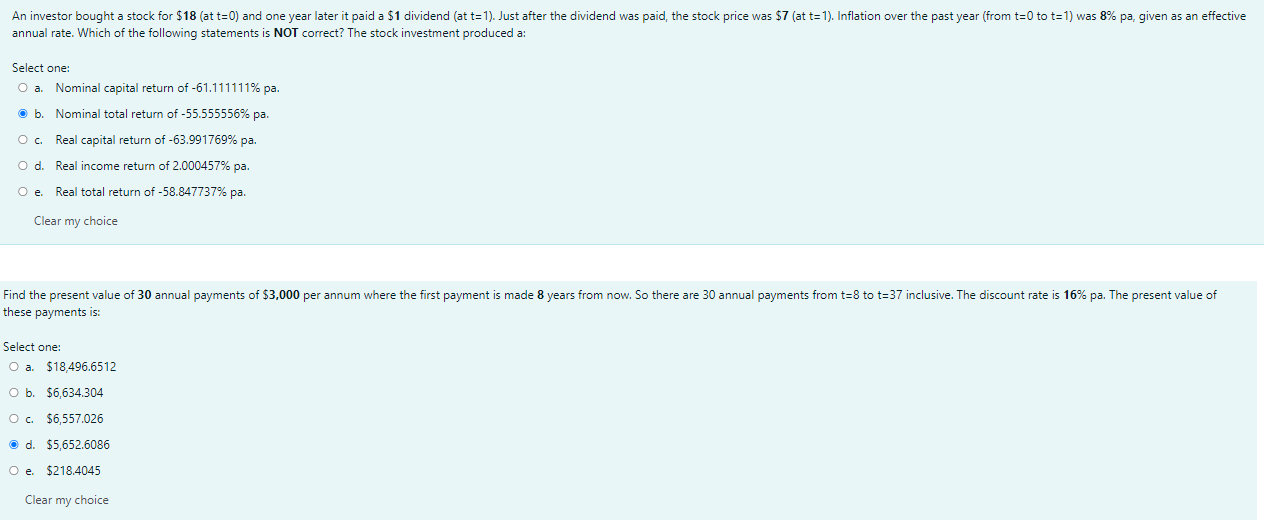

An investor bought a stock for $18 (at t=0) and one year later it paid a $1 dividend (at t= 1). Just after the dividend was paid, the stock price was $7 (at t= 1). Inflation over the past year (from t=0 to t=1) was 8% pa given as an effective annual rate. Which of the following statements is NOT correct? The stock investment produced a: Select one: O a. Nominal capital return of -61.111111% pa. b. Nominal total return of -55.555556% pa. O c. Real capital return of -63.991769% pa. O d. Real income return of 2.000457% pa. Oe. Real total return of -58.847737% pa. Clear my choice Find the present value of 30 annual payments of $3,000 per annum where the first payment is made 8 years from now. So there are 30 annual payments from t=8 to t=37 inclusive. The discount rate is 16% pa. The present value of these payments is: Select one: O a. $18,496.6512 O b. $6,634.304 Oc. $6,557.026 d. $5,652.6086 O e. $218.4045 Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts