Question: Need help with this accounting question as soon as possible please. Thanks people of Chegg. Molly's Meal Delivery Service Molly's Meal Delivery service has been

Need help with this accounting question as soon as possible please. Thanks people of Chegg.

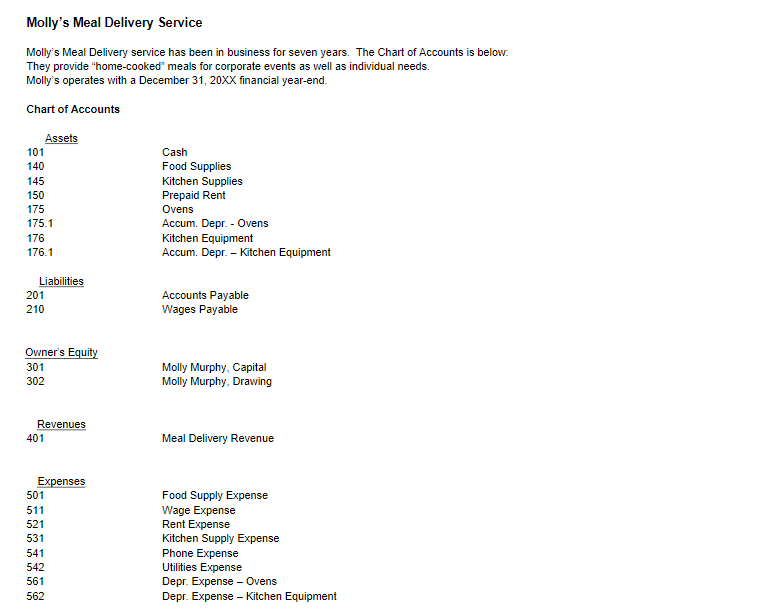

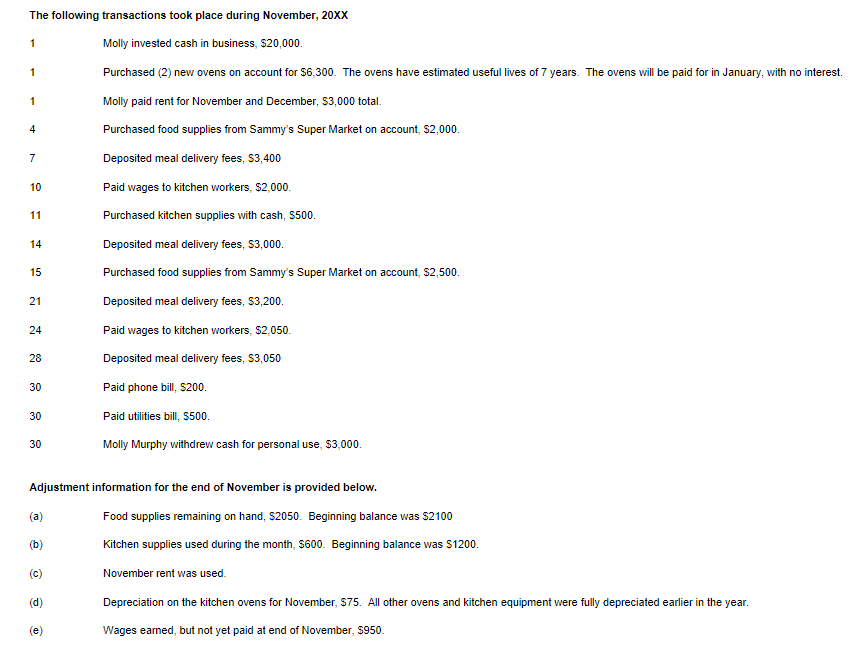

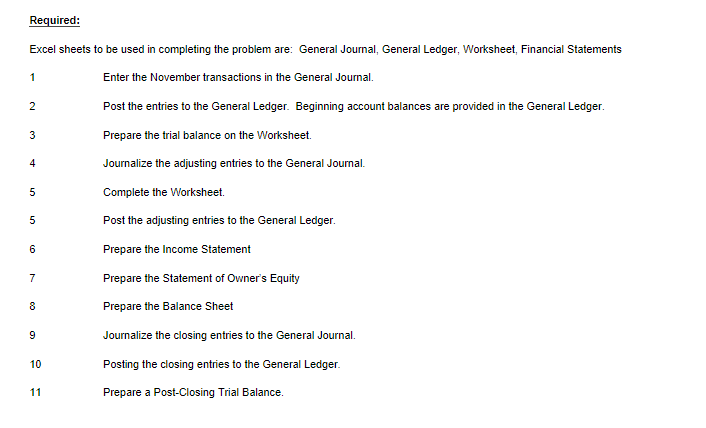

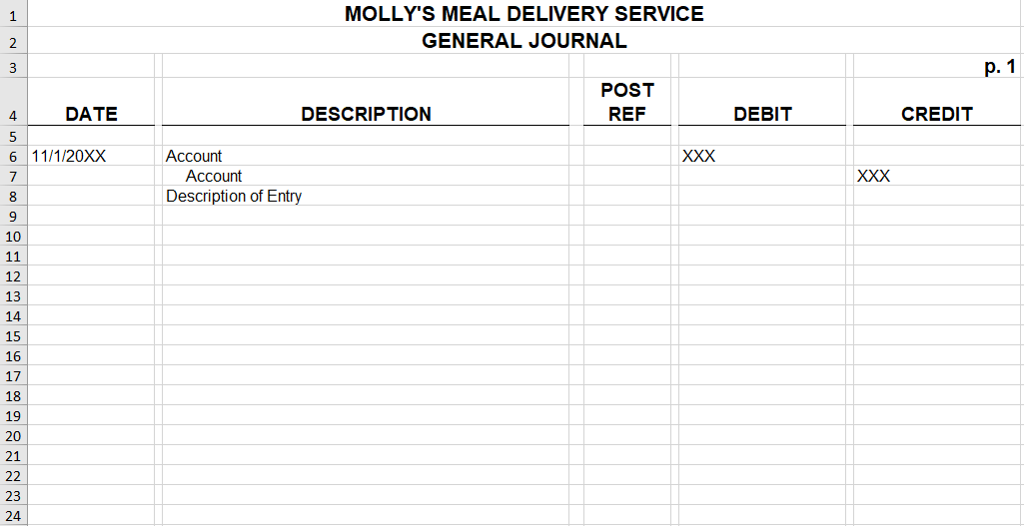

Molly's Meal Delivery Service Molly's Meal Delivery service has been in business for seven years. The Chart of Accounts is below They provide "home-cooked" meals for corporate events as well as individual needs Molly's operates with a December 31, 20XX financial year-end. Chart of Accounts Assets 101 140 145 150 175 175.1 176 176.1 Cash Food Supplies Kitchen Supplies Prepaid Rent Ovens Accum. Depr. - Ovens Kitchen Equipment Accum. Depr. - Kitchen Equipment Liabilities 201 210 Accounts Payable Wages Payable Owner's Equity 301 302 Molly Murphy, Capital Molly Murphy, Drawing Revenues 401 Meal Delivery Revenue Expenses 501 511 521 531 541 542 561 562 Food Supply Expense Wage Expense Rent Expense Kitchen Supply Expense Phone Expense Utilities Expense Depr. Expense Oven:s Depr. Expense Kitchen Equipment The following transactions took place during November, 20xX Molly invested cash in business, $20,000 Purchased (2) new ovens on account for $6,300. The ovens have estimated useful lives of 7 years. The ovens will be paid for in January, with no interest. Molly paid rent for November and December, S3,000 total Purchased food supplies from Sammy's Super Market on account, $2,000 Deposited meal delivery fees, S3,400 Paid wages to kitchen workers, $2,000 Purchased kitchen supplies with cash, S500 Deposited meal delivery fees, S3,000 Purchased food supplies from Sammy's Super Market on account, $2,500 Deposited meal delivery fees, S3,200 Paid wages to kitchen workers, $2,050 Deposited meal delivery fees, S3,050 Paid phone bill, S200 Paid utilities bill, S500 Molly Murphy withdrew cash for personal use, $3,000 10 21 30 30 30 Adjustment information for the end of November is provided below Food supplies remaining on hand, $2050. Beginning balance was $2100 Kitchen supplies used during the month, $600. Beginning balance was $1200 November rent was used Depreciation on the kitchen ovens for November, S75. All other ovens and kitchen equipment were fully depreciated earlier in the year. Wages earned, but not yet paid at end of November, $950 Required: Excel sheets to be used in completing the problem are: General Journal, General Ledger, Worksheet, Financial Statements Enter the November transactions in the General Journal. Post the entries to the General Ledger. Beginning account balances are provided in the General Ledger. Prepare the trial balance on the Worksheet. Journalize the adjusting entries to the General Journal. Complete the Worksheet. Post the adjusting entries to the General Ledger. Prepare the Income Statement Prepare the Statement of Owner's Equity Prepare the Balance Sheet Journalize the closing entries to the General Journal. Posting the closing entries to the General Ledger. Prepare a Post-Closing Trial Balance. 4 10 MOLLY'S MEAL DELIVERY SERVICE GENERAL JOURNAL 1 POST REF DEBIT CREDIT DATE DESCRIPTION 4 6 11/1/20XX Account Account Description of Entry 10 12 13 14 15 16 17 18 19 20 21 23 24 ADJUSTING ENTRIES 2 67 68 69 70 71 72 73 74 75 76 78 79 80 81 82 83 84 85 86 87 CLOSING ENTRIES 89 90 91 92 93 94 95 96 97 98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts