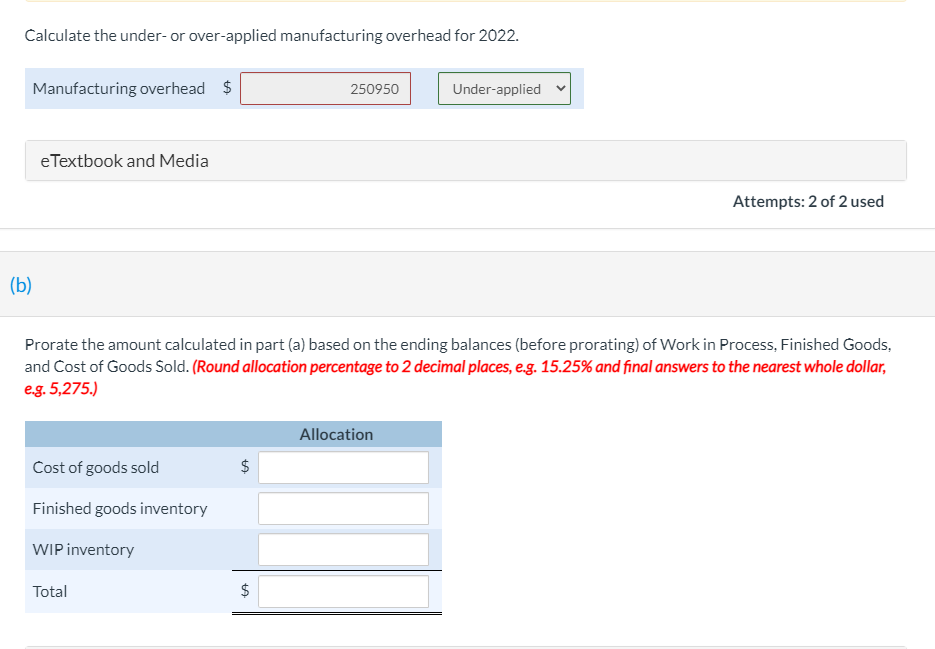

Question: Need help with this assignment question, confused about the ending balances and the actual amount of under applied overhead Pharoah Limited is a company that

Need help with this assignment question, confused about the ending balances and the actual amount of under applied overhead

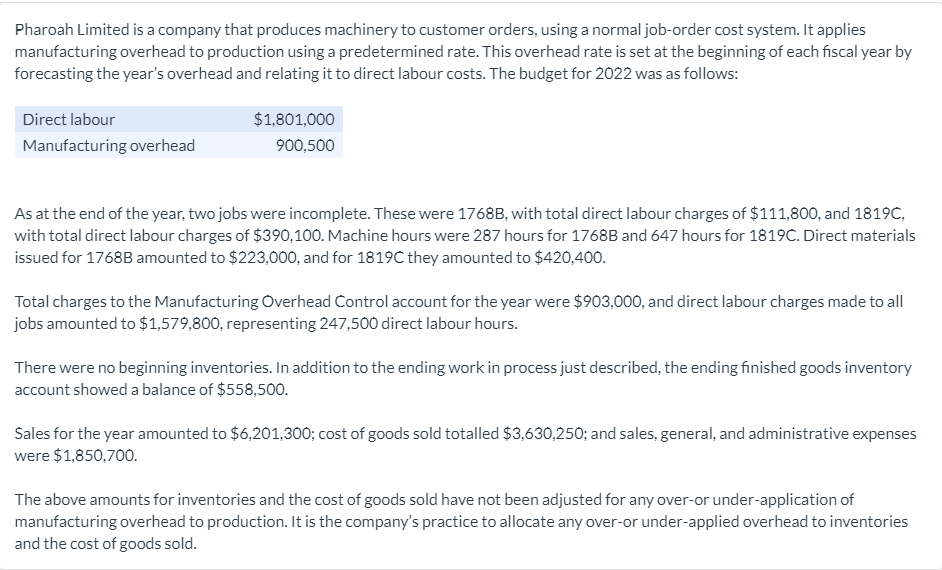

Pharoah Limited is a company that produces machinery to customer orders, usinga normal joborder cost system. It applies manufactu ring overhead to production using a predetermined rate. This overhead rate is set at the beginning of each scal year by forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour $L801,000 Manufacturing overhead 900,500 As at the end of the year, two jobs were incomplete. These were 17633, with total direct labour charges of $111,800, and 1819C, with total direct labour charges of $390,100. Machine hours were 237 hours for 17683 and 647 hours for 1819-2. Direct materials issued for 17688 amounted to $223,000, and for 1319C they amounted to $420,400. Total charges to the Manufacturing Overhead Control account for the year were $903,000, and direct labour charges made to all jobs amou nted to $1,572,800, representing 247,500 direct labour hours. There were no beginning inventories. In addition to the ending work in process just described, the ending nished goods inventory account showed a balance of $553,500. Sales for the year amounted to $6,201,300; cost of goods sold totalled $3,630,250; and sales, general, and administrative expenses were $1,850,700. The above amounts for inventories and the cost of goods sold have not been adjusted for any over-or under-application of manufactu ring overhead to production. It is the company's practice to allocate any overor underapplied overhead to inventories and the cost of goods sold. \f