Question: need help with this entry! QS 7-14 (Algo) Note receivable interest and maturity LO P4 On December 1, Daw Company accepts a $24,000,45-day, 7% note

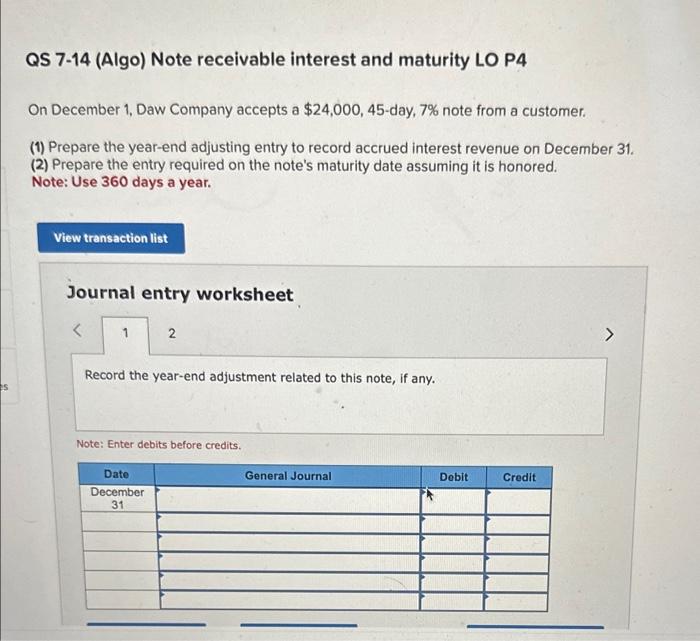

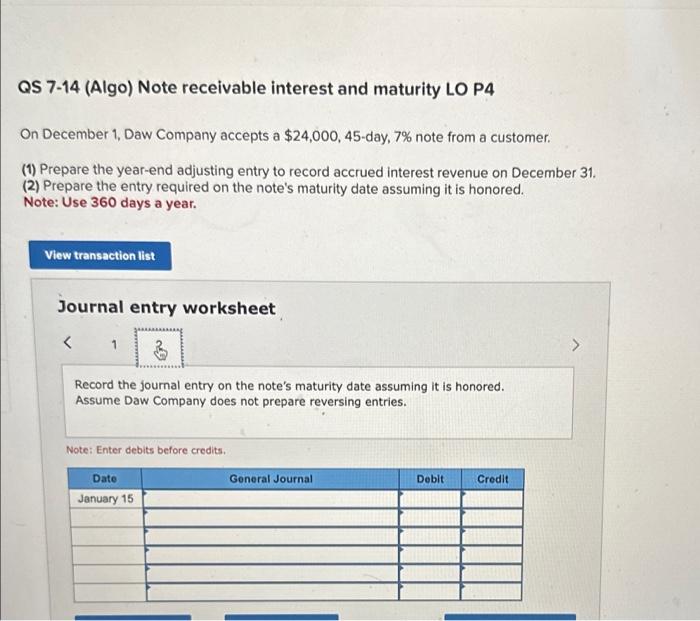

QS 7-14 (Algo) Note receivable interest and maturity LO P4 On December 1, Daw Company accepts a $24,000,45-day, 7% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31 . (2) Prepare the entry required on the note's maturity date assuming it is honored. Note: Use 360 days a year. Journal entry worksheet Record the year-end adjustment related to this note, if any. Note: Enter debits before credits. QS 7-14 (Algo) Note receivable interest and maturity LO P4 On December 1, Daw Company accepts a $24,000,45-day, 7% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31 . (2) Prepare the entry required on the note's maturity date assuming it is honored. Note: Use 360 days a year. Journal entry worksheet Record the journal entry on the note's maturity date assuming it is honored. Assume Daw Company does not prepare reversing entries. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts