Question: Need help with this homework assignment! Mastery Problem: Accounting for Retail Businesses Merchandising Transactions You are working as a summer intern for AAA Auditing, Inc.

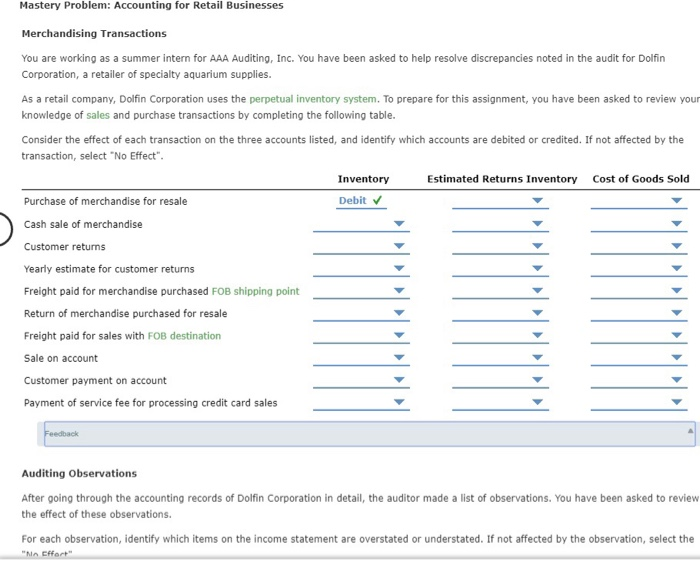

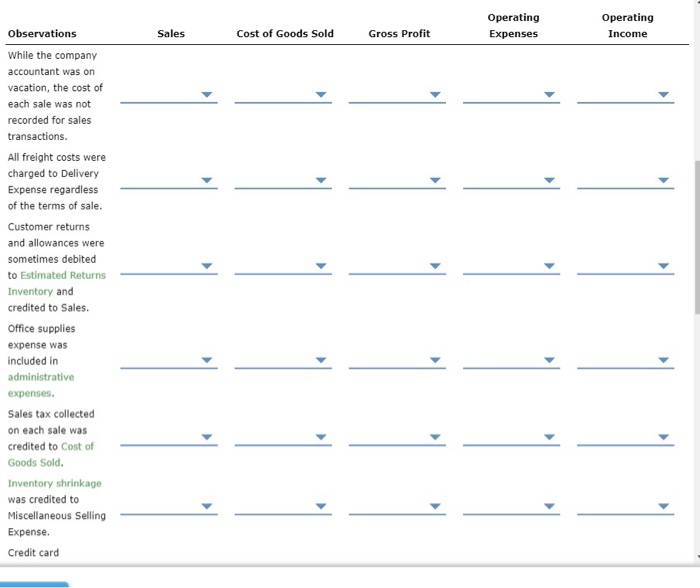

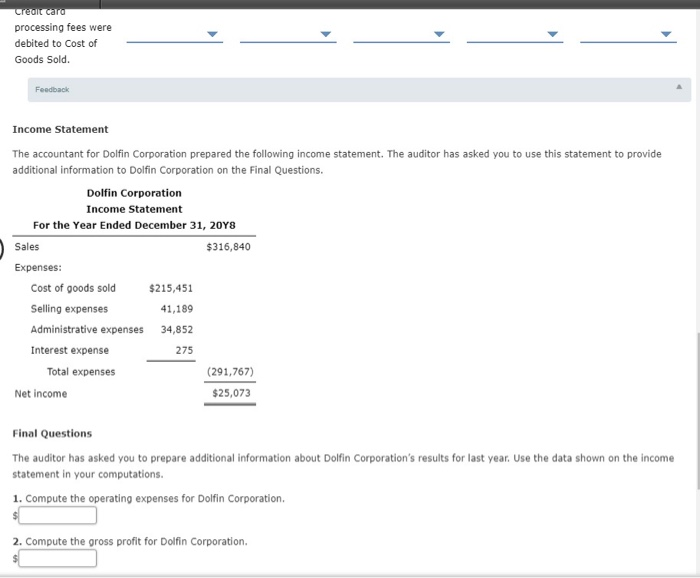

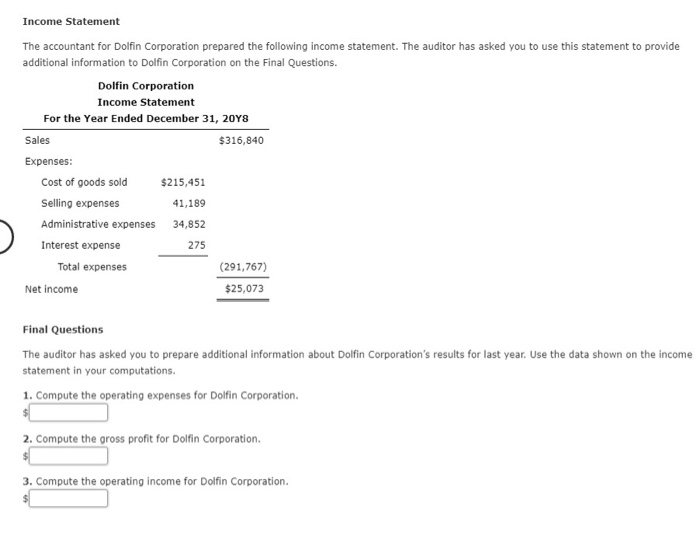

Mastery Problem: Accounting for Retail Businesses Merchandising Transactions You are working as a summer intern for AAA Auditing, Inc. You have been asked to help resolve discrepancies noted in the audit for Dolfin Corporation, a retailer of specialty aquarium supplies. As a retail company, Dolfin Corporation uses the perpetual inventory system. To prepare for this assignment, you have been asked to review your knowledge of sales and purchase transactions by completing the following table. Consider the effect of each transaction on the three accounts listed, and identify which accounts are debited or credited. If not affected by the transaction, select "No Effect". Inventory Estimated Returns Inventory Cost of Goods Sold Purchase of merchandise for resale Debit Cash sale of merchandise Customer returns Yearly estimate for customer returns Freight paid for merchandise purchased FOB shipping point Return of merchandise purchased for resale Freight paid for sales with FOB destination Sale on account Customer payment on account Payment of service fee for processing credit card sales Feedback Auditing Observations After going through the accounting records of Dolfin Corporation in detail, the auditor made a list of observations. You have been asked to review the effect of these observations. For each observation, identify which items on the income statement are overstated or understated. If not affected by the observation, select the "Na cffort Operating Expenses Operating Income Observations Sales Cost of Goods Sold Gross Profit While the company accountant was on vacation, the cost of each sale was not recorded for sales transactions. All freight costs were charged to Delivery Expense regardless of the terms of sale. Customer returns and allowances were sometimes debited to Estimated Returns Inventory and credited to Sales. Office supplies expense was included in administrative expenses. Sales tax collected on each sale was credited to Cost of Goods Sold Inventory shrinkage was credited to Miscellaneous Selling Expense. Credit card Credit card processing fees were debited to cost of Goods Sold. -- - - Feedback Income Statement The accountant for Dolfin Corporation prepared the following income statement. The auditor has asked you to use this statement to provide additional information to Dolfin Corporation on the Final Questions. Dolfin Corporation Income Statement For the Year Ended December 31, 2018 Sales $316,840 Expenses: Cost of goods sold Selling expenses Administrative expenses $215,451 41,189 34,852 Interest expense 275 Total expenses (291,767) Net income $25,073 Final Questions The auditor has asked you to prepare additional information about Dolfin Corporation's results for last year. Use the data shown on the income statement in your computations. 1. Compute the operating expenses for Dolfin Corporation. 2. Compute the gross profit for Dolfin Corporation. Income Statement The accountant for Dolfin Corporation prepared the following income statement. The auditor has asked you to use this statement to provide additional information to Dolfin Corporation on the Final Questions. Dolfin Corporation Income Statement For the Year Ended December 31, 2048 Sales $316,840 Expenses: Cost of goods sold $215,451 Selling expenses 41,189 Administrative expenses 34,852 Interest expense 275 Total expenses (291,767) Net income $25,073 Final Questions The auditor has asked you to prepare additional information about Dolfin Corporation's results for last year. Use the data shown on the income statement in your computations. 1. Compute the operating expenses for Dolfin Corporation. 2. Compute the gross profit for Dolfin Corporation. 3. Compute the operating income for Dolfin Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts