Question: Need help with this mortgage case report Need a instroduction and house criteria and house recommendations done and need help with a purchase budget FINANCE

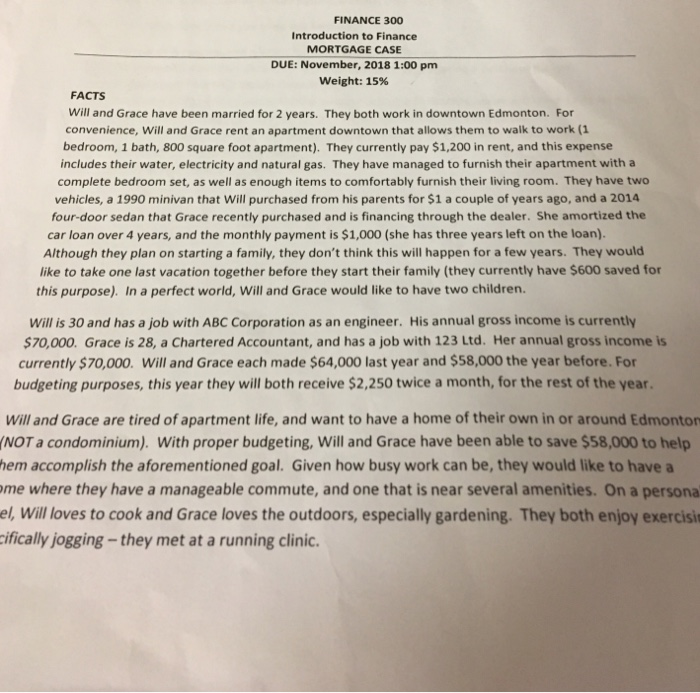

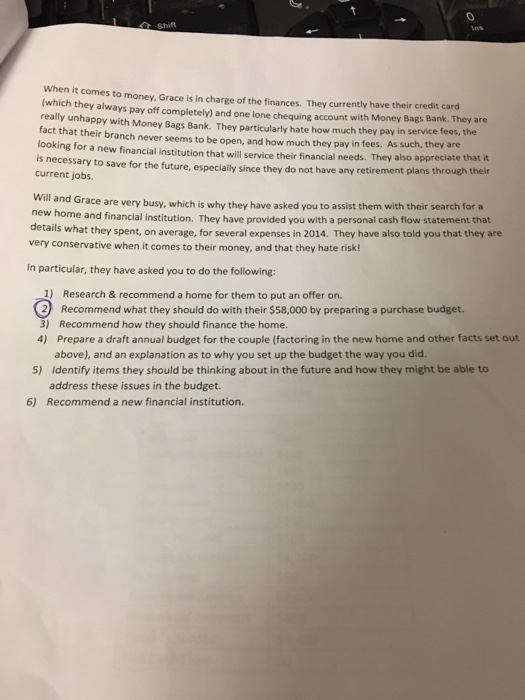

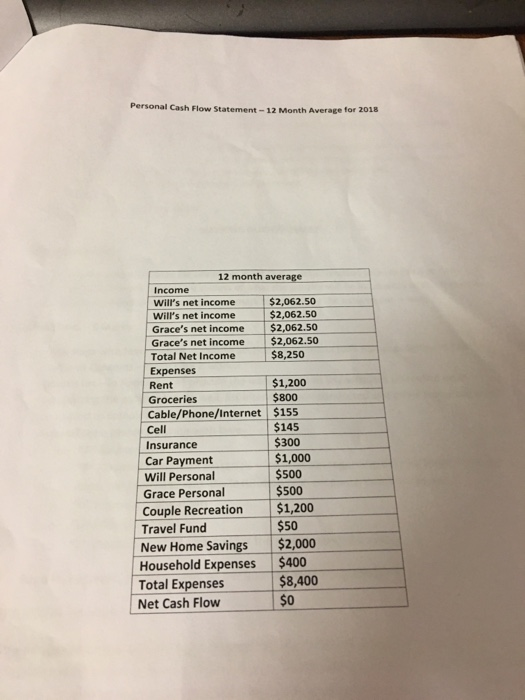

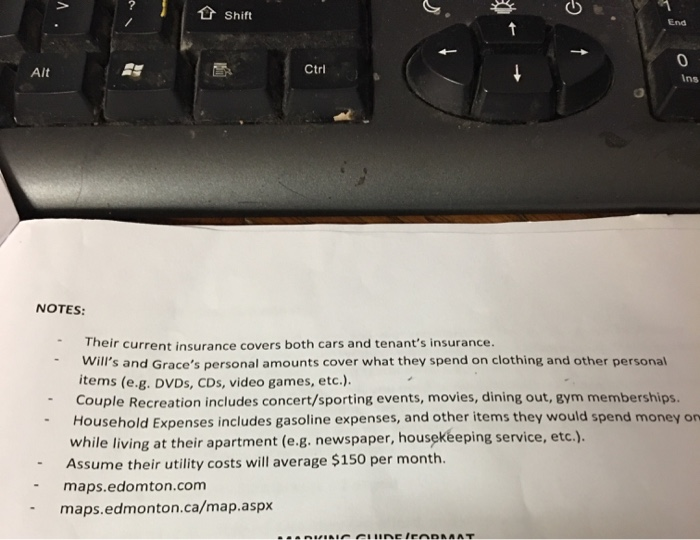

FINANCE 300 Introduction to Finance MORTGAGE CASE DUE: November, 2018 1:00 pm weight: 15% FACTS Will and Grace have been married for 2 years. They both work in downtown Edmonton. For convenience, Will and Grace rent an apartment downtown that allows them to walk to work (1 bedroom, 1 bath, 800 square foot apartment). They currently pay $1,200 in rent, and this expense includes their water, electricity and natural gas. They have managed to furnish their apartment with a complete bedroom set, as well as enough items to comfortably furnish their living room. They have two vehicles, a 1990 minivan that Will purchased from his parents for $1 a couple of years ago, and a 2014 four-door sedan that Grace recently purchased and is financing through the dealer. She amortized the car loan over 4 years, and the monthly payment is $1,000 (she has three years left on the loan). Although they plan on starting a family, they don't think this will happen for a few years. They would like to take one last vacation together before they start their family (they currently have $600 saved for this purpose). In a perfect world, Will and Grace would like to have two children. Will is 30 and has a job with ABC Corporation as an engineer. His annual gross income is currently 70,000. Grace is 28, a Chartered Accountant, and has a job with 123 Ltd. Her annual gross income is currently $70,000. Will and Grace each made $64,000 last year and $58,000 the year before. For budgeting purposes, this year they will both receive $2,250 twice a month, for the rest of the year Will and Grace are tired of apartment life, and want to have a home of their own in or around Edmonton NOT a condominium). With proper budgeting, Will and Grace have been able to save $58,000 to help hem accomplish the aforementioned goal. Given how busy work can be, they would like to have a me where they have a manageable commute, and one that is near several amenities. On a persona el, Will loves to cook and Grace loves the outdoors, especially gardening. They both enjoy exercisi ifically jogging-they met at a running clinic. FINANCE 300 Introduction to Finance MORTGAGE CASE DUE: November, 2018 1:00 pm weight: 15% FACTS Will and Grace have been married for 2 years. They both work in downtown Edmonton. For convenience, Will and Grace rent an apartment downtown that allows them to walk to work (1 bedroom, 1 bath, 800 square foot apartment). They currently pay $1,200 in rent, and this expense includes their water, electricity and natural gas. They have managed to furnish their apartment with a complete bedroom set, as well as enough items to comfortably furnish their living room. They have two vehicles, a 1990 minivan that Will purchased from his parents for $1 a couple of years ago, and a 2014 four-door sedan that Grace recently purchased and is financing through the dealer. She amortized the car loan over 4 years, and the monthly payment is $1,000 (she has three years left on the loan). Although they plan on starting a family, they don't think this will happen for a few years. They would like to take one last vacation together before they start their family (they currently have $600 saved for this purpose). In a perfect world, Will and Grace would like to have two children. Will is 30 and has a job with ABC Corporation as an engineer. His annual gross income is currently 70,000. Grace is 28, a Chartered Accountant, and has a job with 123 Ltd. Her annual gross income is currently $70,000. Will and Grace each made $64,000 last year and $58,000 the year before. For budgeting purposes, this year they will both receive $2,250 twice a month, for the rest of the year Will and Grace are tired of apartment life, and want to have a home of their own in or around Edmonton NOT a condominium). With proper budgeting, Will and Grace have been able to save $58,000 to help hem accomplish the aforementioned goal. Given how busy work can be, they would like to have a me where they have a manageable commute, and one that is near several amenities. On a persona el, Will loves to cook and Grace loves the outdoors, especially gardening. They both enjoy exercisi ifically jogging-they met at a running clinic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts