Question: Need help with this multi step accounting question. Need missing answers in the boxes. If unable to solve please credit my question back. Thank you!

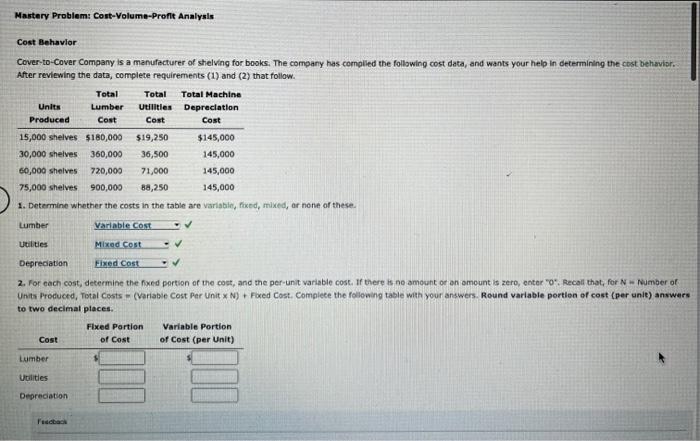

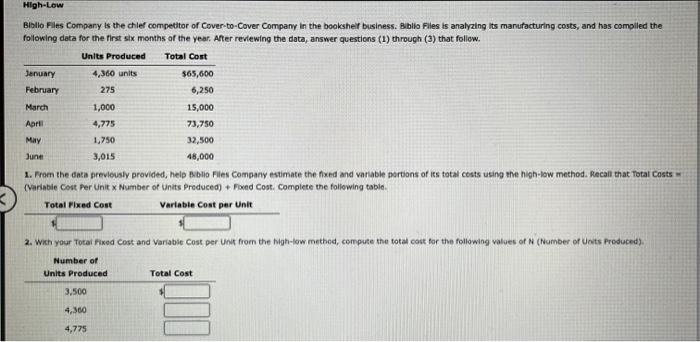

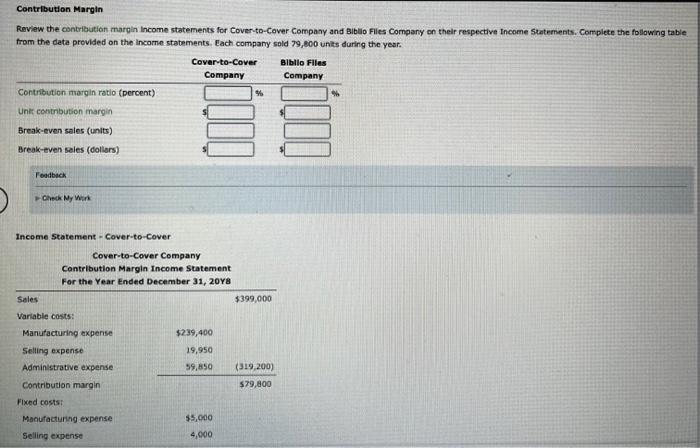

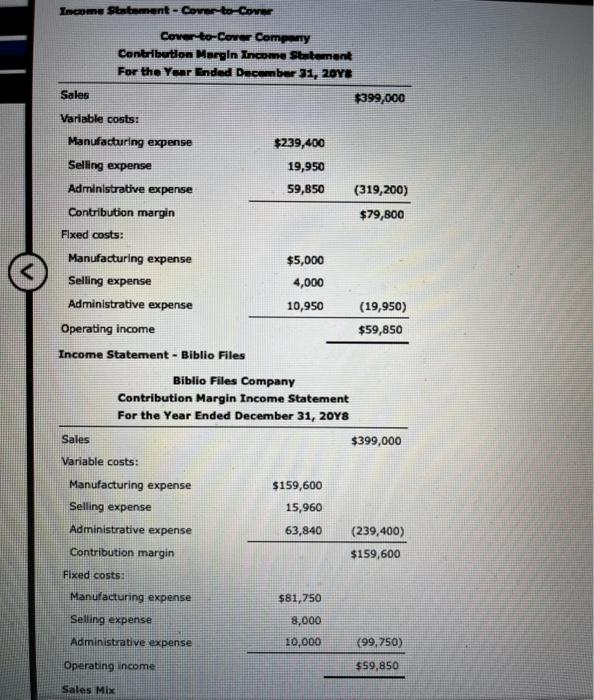

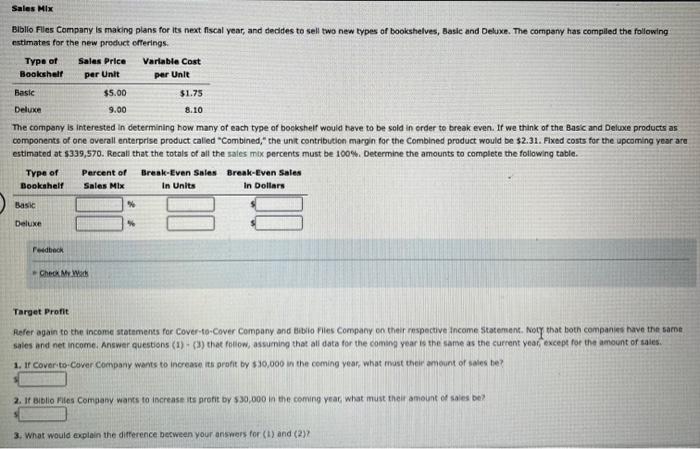

Mastery Problem: Cont-Volume-Pront Analysis Cost Behavlor Cover-to-Cover Company is a manufacturer of shelving for bosks. The company has complied the follawing cost data, and wants your help in determining the cost behovior. After reviewing the data, complete requirements (1) and (2) that follow. 1. Determine whether the costs in the table are variabic, fixed, mixed, or none of these. 2. For each cost, determine the fxed portion of the cost, and the per-unit variable cost. If there is ne amount or an omount is zero, enter "o: Recall that, for N in Number of Units Profuced, Total costs - (Variabie Cost Per Unit xN ) + Foxed Cost, Complece the following table with your answers. Round variable portlen of cost (per unit) answers to two decimal places Biblio Files Company is the chlef competitor of Cover-to-Cover Company in the booksheif business. Bblio Files is analyaing its manufacturing costs, and has compiled the following data for the first six months of the year. After reviewing the data, answer questions (1) through (3) that follow. 1. From the data prevlousfy provided, help Bbilo Files Company estimate the fixed and varable porbons of its total costs using the high-low method. Recall that total Costr (Variabie Cost Fer Unit x Number of Units Preduced) + Foved Cost. Complete the following tabic. Review the contribution margin Income statements for Cover-to-Cover Company and Bibllo Flies Company on their respective Income statements. Complete the following table from the date provided on the income statements. Each company sold 79,800 units during the year. Fendbeck = cheik Win Zncomi Stutement-Covre-to-Cown Cover-bo-Cover Compeny Centribetion Marpin Tincome Stakement For the Year Ended December 31, 2.KF, Sales $399,000 Variable costs: Manufacturing expense $239,400 Selling expense Administrative expense Contribution margin 59,850(319,200) $79,800 Flxed costs: \begin{tabular}{lrr} Manufacturing expense & $5,000 & \\ Selling expense & 4,000 & \\ Administrative expense & 10,950 & (19,950) \\ \hline Operating income & $59,850 \\ \hline \end{tabular} Income Statement - Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Sales $399,000 Variable costs: Manufacturing expense $159,600 Selling expense Administrative expense Contribution margin 63,840(239,400)$159,600 Fixed costs: Manufacturing expense $81,750 Selling expense Administrative expense Operating income Sales Mix Blbllo Flies Company is making plans for its next fiscal year, and dedides to sell two new types of bookshelves, Basic and Deluxe. The company has complied the following estimates for the new product efferings. The company is interested in determining how many of each type of bookshelf would have to be soid in erder to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product calied "Combined," the unit contribucion margin for the Combined product would be s2.31. Fixed costs for the upcoming year are estimated at 5339,570 . Recall that the totais of all the rales mix percents must be 100%. Determine the amounts to complete the following table. Target Profit Refer again to the income statements for Cover-to-Cover Company and Bibio files Company on their respective income statement, Noty that both companies have the same sales and net income. Answer questions (1) - (3) that foelow, assuming that all data for the coming year is the same as the current year, oxcept for the amount of sales. 1. If Covorito Cover Company wants to increase its profit by $10,000 in the coming year, what must their ameunt of sales be? 2. If Biblio files Comgany warts to iscrease its grofit by 530,000 in the coming veaf, what must their amount of saies be? 3. What would explain the difference berween your answors for (1) and (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts