Question: Need help with this multipart question Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's

Need help with this multipart question

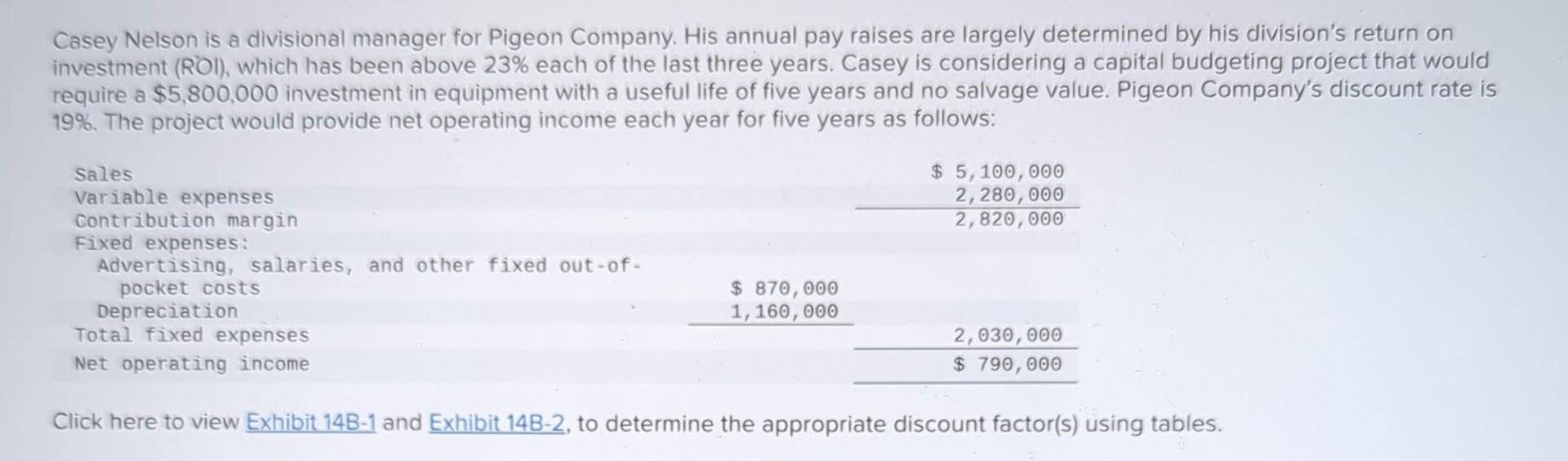

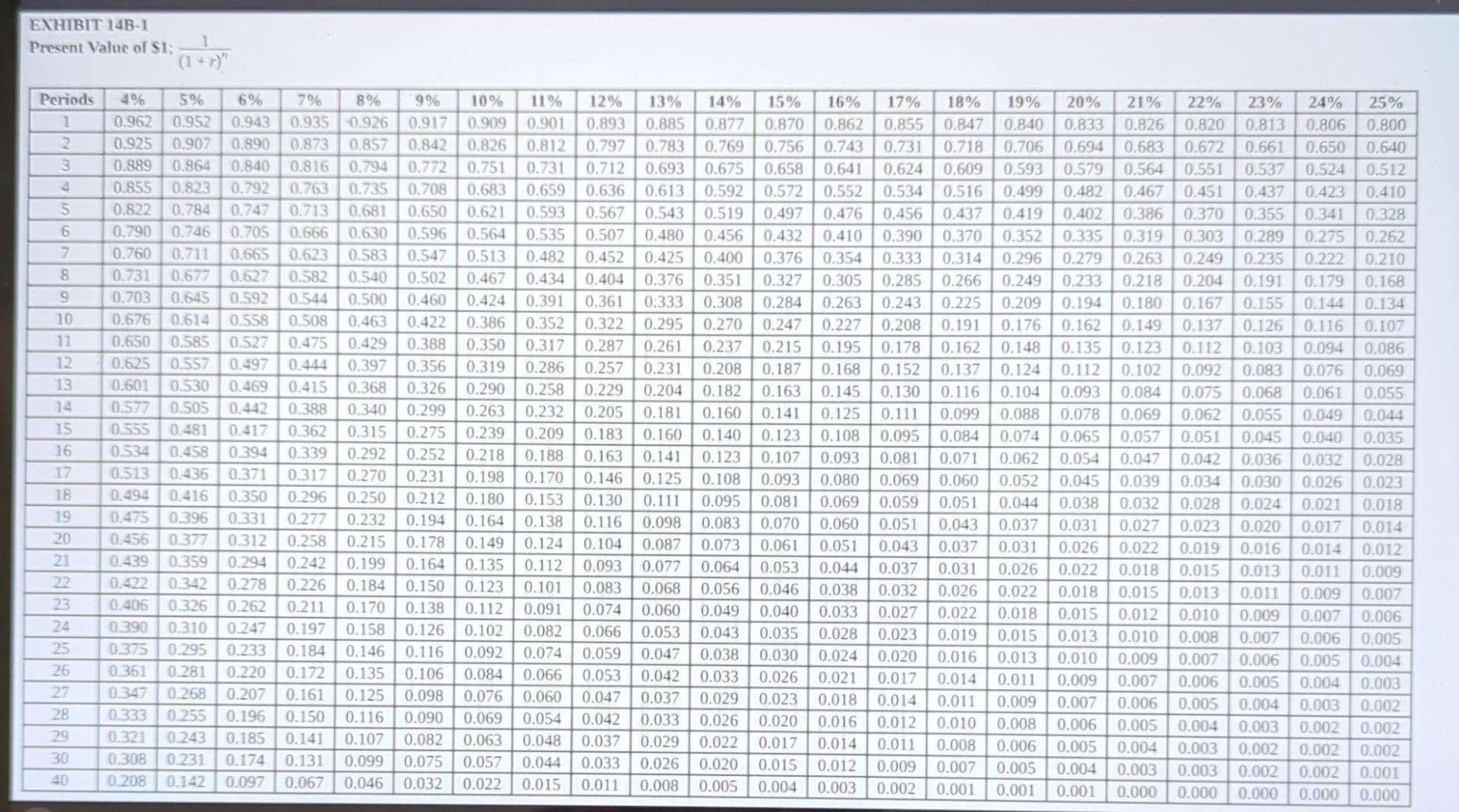

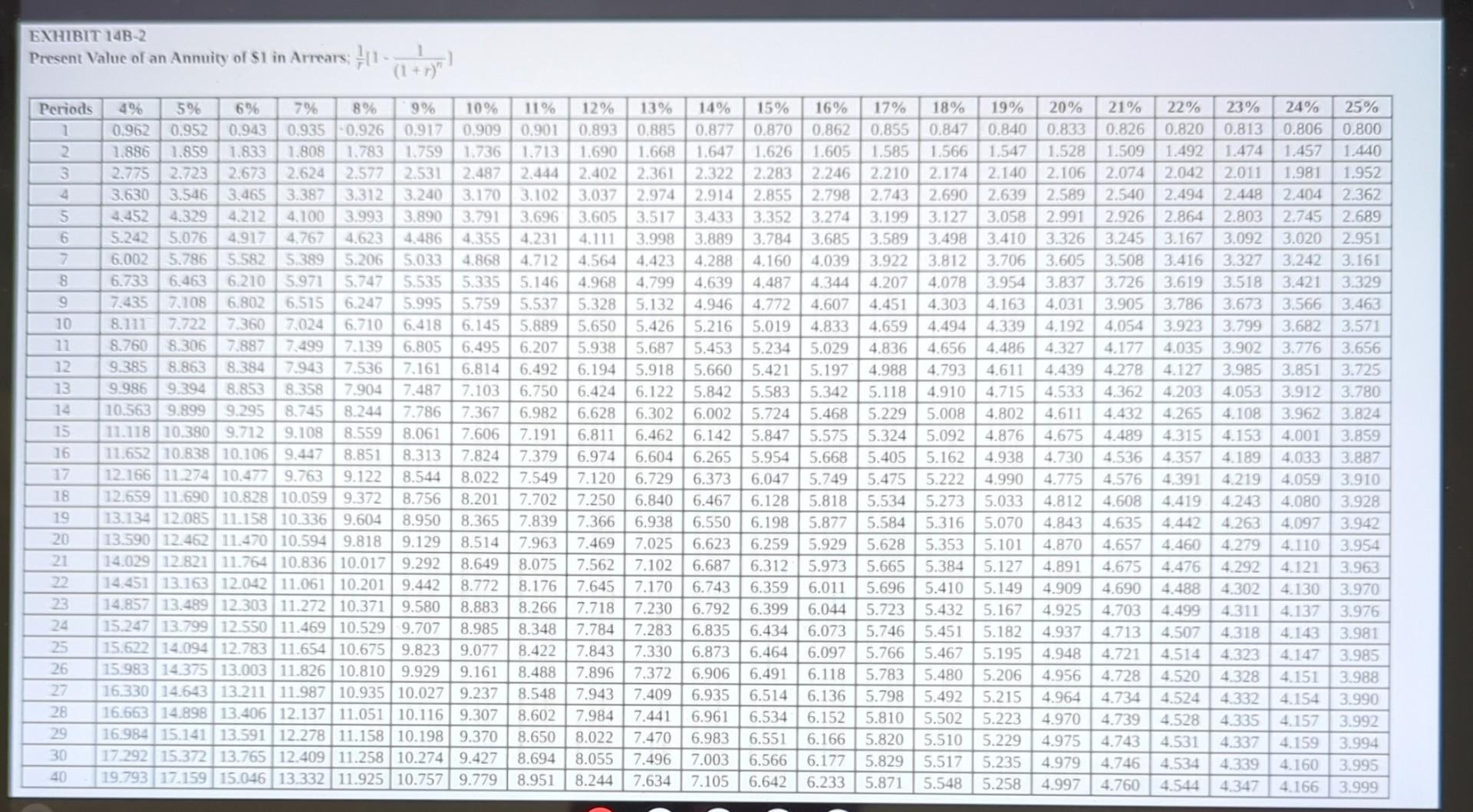

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 23% each of the last three years. Casey is considering a capital budgeting project that would require a $5,800,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 19\%. The project would provide net operating income each year for five years as follows: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. What is the project's net present value? What is the project's internal rate of return? considered as 12%.) What is the project's simple rate of return? Would the company want Casey to pursue this investment opportunity? \begin{tabular}{|l|} \hline Yes \\ \hline No \\ \hline \end{tabular} Would Casey be inclined to pursue this investment opportunity? \begin{tabular}{|l|} \hline Yes \\ \hline No \\ \hline \end{tabular} EXHIBIT 14B-1 Present Value of $1;n1+nn1 EXHIBIT 14B-2 Present Value of an Annuity of $1 in Arrears; r1[1(1+r)n1]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts