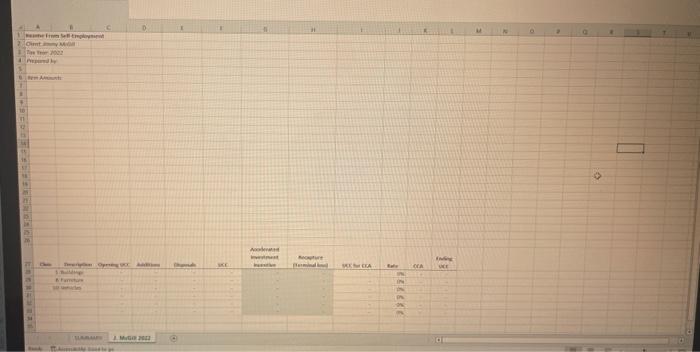

Question: need help with this one! this was the worksheet i was provided with, and am not sure how to fill out The Case: Jimmy McGill

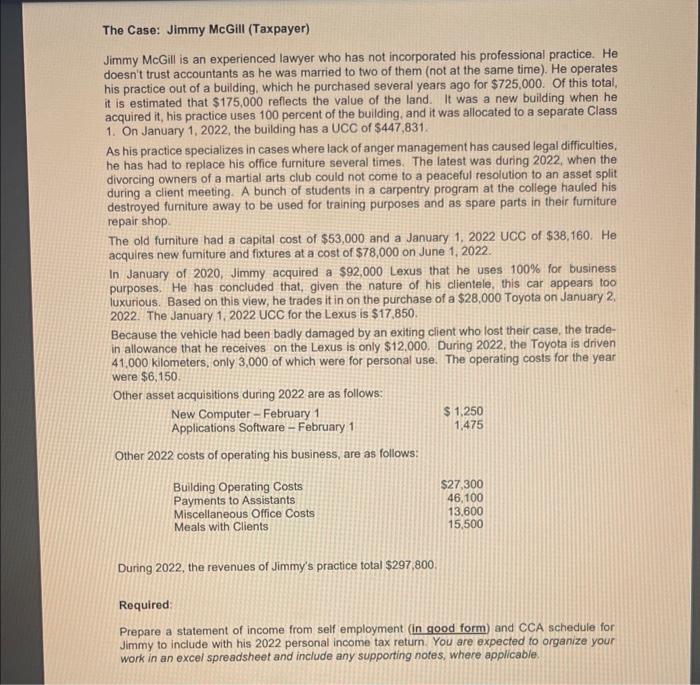

The Case: Jimmy McGill (Taxpayer) Jimmy McGill is an experienced lawyer who has not incorporated his professional practice. He doesn't trust accountants as he was married to two of them (not at the same time). He operates his practice out of a building, which he purchased several years ago for $725,000. Of this total, it is estimated that $175,000 reflects the value of the land. It was a new building when he acquired it, his practice uses 100 percent of the building, and it was allocated to a separate Class 1. On January 1,2022 , the building has a UCC of $447,831. As his practice specializes in cases where lack of anger management has caused legal difficulties, he has had to replace his office furniture several times. The latest was during 2022, when the divorcing owners of a martial arts club could not come to a peaceful resolution to an asset split during a client meeting. A bunch of students in a carpentry program at the college hauled his destroyed furniture away to be used for training purposes and as spare parts in their furniture repair shop. The old fumiture had a capital cost of $53,000 and a January 1,2022 UCC of $38,160. He acquires new fumiture and fixtures at a cost of $78,000 on June 1, 2022. In January of 2020. Jimmy acquired a $92,000 Lexus that he uses 100% for business purposes. He has concluded that, given the nature of his clientele, this car appears too luxurious. Based on this view, he trades it in on the purchase of a $28,000 Toyota on January 2 . 2022. The January 1, 2022 UCC for the Lexus is $17,850. Because the vehicle had been badly damaged by an exiting client who lost their case, the tradein allowance that he receives on the Lexus is only $12,000. During 2022, the Toyota is driven 41,000 kilometers, only 3,000 of which were for personal use. The operating costs for the year were $6,150. Other asset acquisitions during 2022 are as follows: Other 2022 costs of operating his business, are as follows: During 2022, the revenues of Jimmy's practice total $297,800. Required: Prepare a statement of income from self employment (in good form) and CCA schedule for Jimmy to include with his 2022 personal income tax return. You are expected to organize your work in an excel spreadsheet and include any supporting notes, where applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts