Question: NEED HELP WITH THIS. PLEASE. Marker, Inc., wishes to expand its facilities. The company currently has 5 million shares outstanding and no debt. The equity

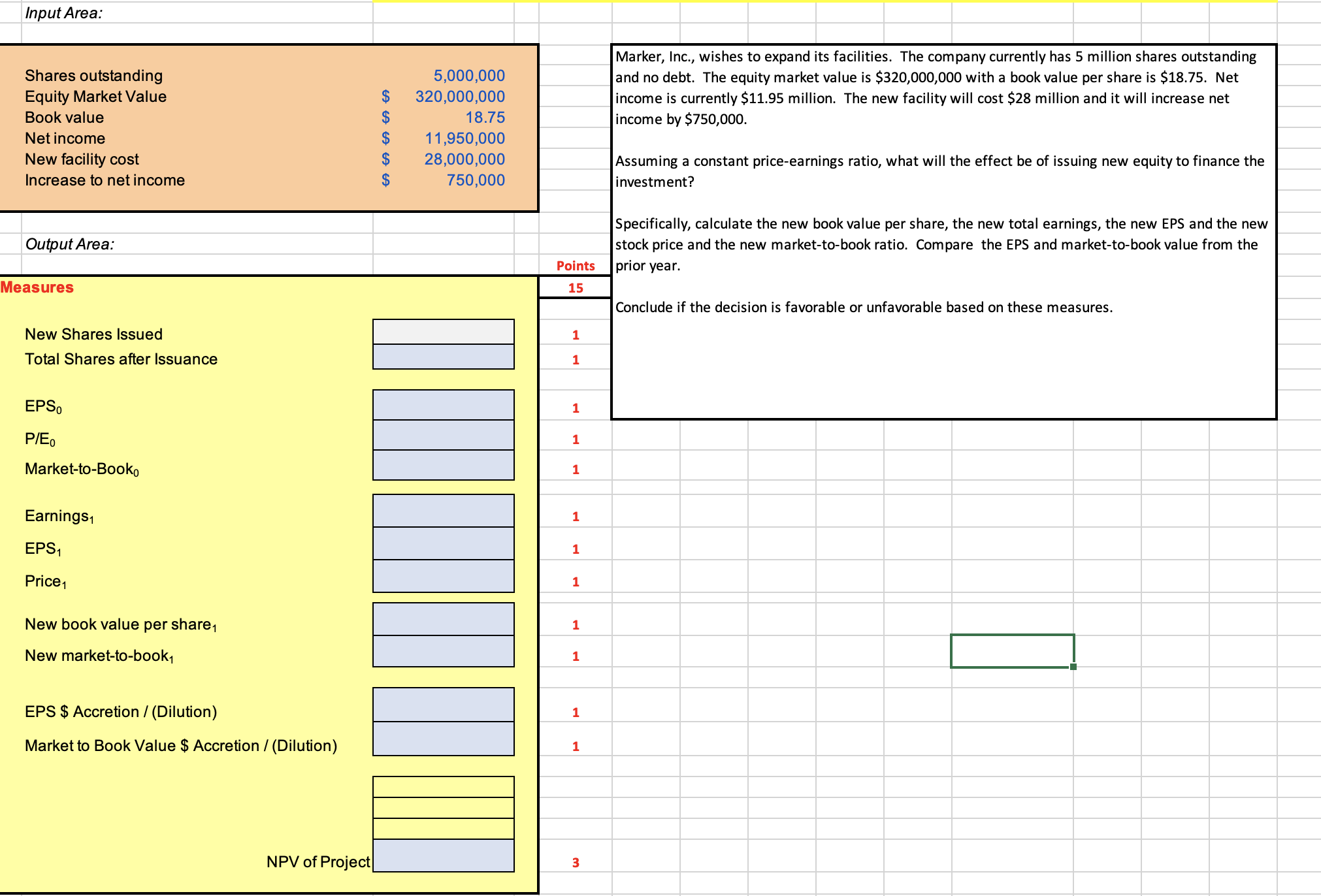

NEED HELP WITH THIS. PLEASE. Marker, Inc., wishes to expand its facilities. The company currently has million shares outstanding and no debt. The equity market value is $ with a book value per share is $ Net income is currently $ million. The new facility will cost $ million and it will increase net income by $

Assuming a constant priceearnings ratio, what will the effect be of issuing new equity to finance the investment?

Specifically, calculate the new book value per share, the new total earnings, the new EPS and the new stock price and the new markettobook ratio. Compare the EPS and markettobook value from the prior year.

Conclude if the decision is favorable or unfavorable based on these measures.Input Area:

Shares outstanding

Equity Market Value

Book value

Net income

New facility cost

Increase to net income

Output Area:

Marker, Inc., wishes to expand its facilities. The company currently has million shares outstanding

and no debt. The equity market value is $ with a book value per share is $ Net

income is currently $ million. The new facility will cost $ million and it will increase net

income by $

Assuming a constant priceearnings ratio, what will the effect be of issuing new equity to finance the

investment?

Specifically, calculate the new book value per share, the new total earnings, the new EPS and the new

stock price and the new markettobook ratio. Compare the EPS and markettobook value from the

prior year.

Measures

New Shares Issued

Total Shares after Issuance

EPS

MarkettoBook

Earnings

EPS

Price

New book value per share

New markettobook

EPS $ Accretion Dilution

Market to Book Value $ Accretion Dilution

Conclude if the decision is favorable or unfavorable based on these measures.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock