Question: Need help with this please. PB10-3 Recording and Reporting Current Liabilities [LO 10-2] Sandler Company completed the following two transactions. The annual accounting period ends

Need help with this please.

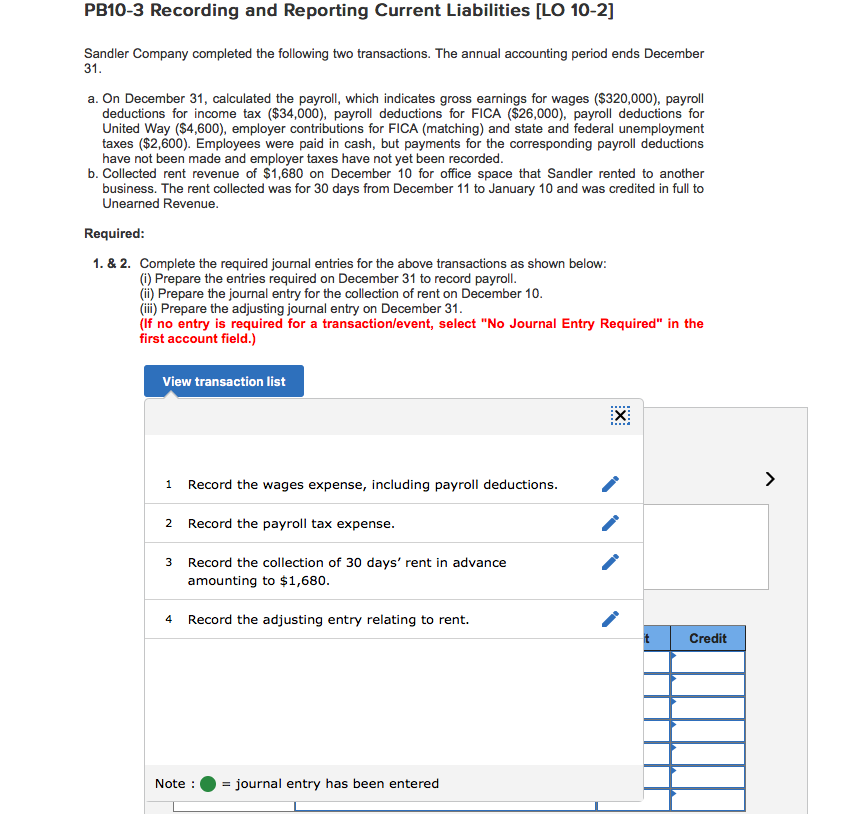

PB10-3 Recording and Reporting Current Liabilities [LO 10-2]

| Sandler Company completed the following two transactions. The annual accounting period ends December 31. |

| a. | On December 31, calculated the payroll, which indicates gross earnings for wages ($320,000), payroll deductions for income tax ($34,000), payroll deductions for FICA ($26,000), payroll deductions for United Way ($4,600), employer contributions for FICA (matching) and state and federal unemployment taxes ($2,600). Employees were paid in cash, but payments for the corresponding payroll deductions have not been made and employer taxes have not yet been recorded. |

| b. | Collected rent revenue of $1,680 on December 10 for office space that Sandler rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Revenue. |

| Required: |

| 1. & 2. | Complete the required journal entries for the above transactions as shown below: (i) Prepare the entries required on December 31 to record payroll. (ii) Prepare the journal entry for the collection of rent on December 10. (iii) Prepare the adjusting journal entry on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

|

PB10-3 Recording and Reporting Current Liabilities [LO 10-2] Sandler Company completed the following two transactions. The annual accounting period ends December 31 a. On December 31, calculated the payroll, which indicates gross earnings for wages ($320,000), payroll deductions for income tax ($34,000), payroll deductions for FICA ($26,000), payroll deductions for United Way ($4,600), employer contributions for FICA (matching) and state and federal unemployment taxes ($2,600). Employees were paid in cash, but payments for the corresponding payroll deductions have not been made and employer taxes have not yet been recorded b. Collected rent revenue of $1,680 on December 10 for office space that Sandler rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Revenue Required Complete the required journal entries for the above transactions as shown below (i) Prepare the entries required on December 31 to record payroll (i) Prepare the journal entry for the collection of rent on December 10 (ii) Prepare the adjusting journal entry on December 31 (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 1. & 2. View transaction list X: 1 Record the wages expense, including payroll deductions. 2 Record the payroll tax expense 3 Record the collection of 30 days' rent in advance amounting to $1,680 4 Record the adjusting entry relating to rent. Credit Note:-journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

![10-2] Sandler Company completed the following two transactions. The annual accounting period](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e98e31041a0_32066e98e30a9039.jpg)