Question: need help with this problem 1 1.66 points TPW, a calendar year taxpayer, sold land with a $555,000 tax basis for $850,000 in February. The

need help with this problem

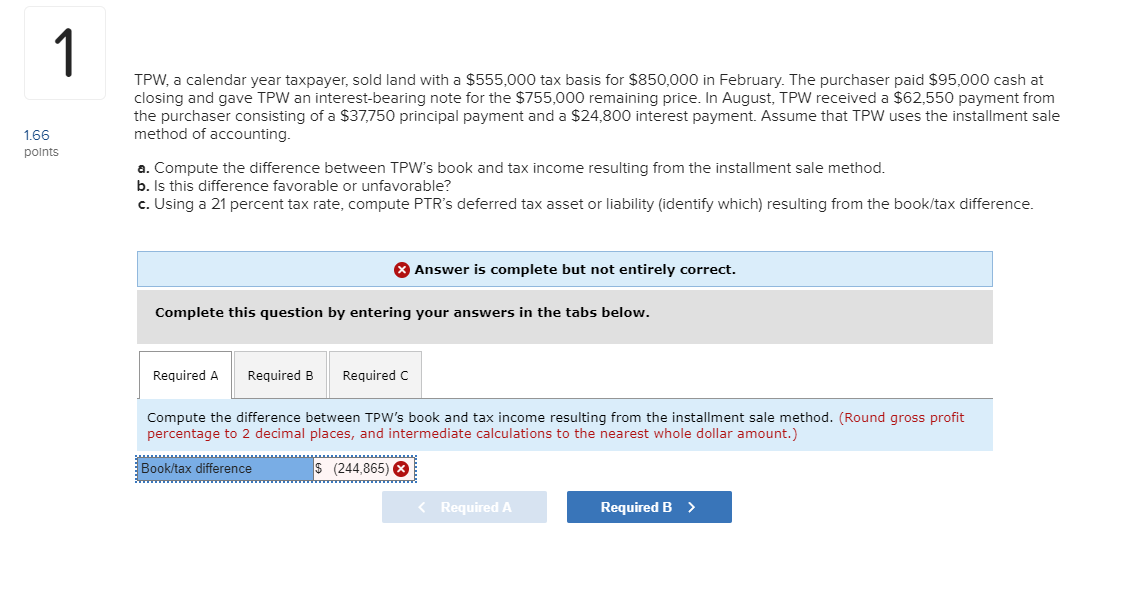

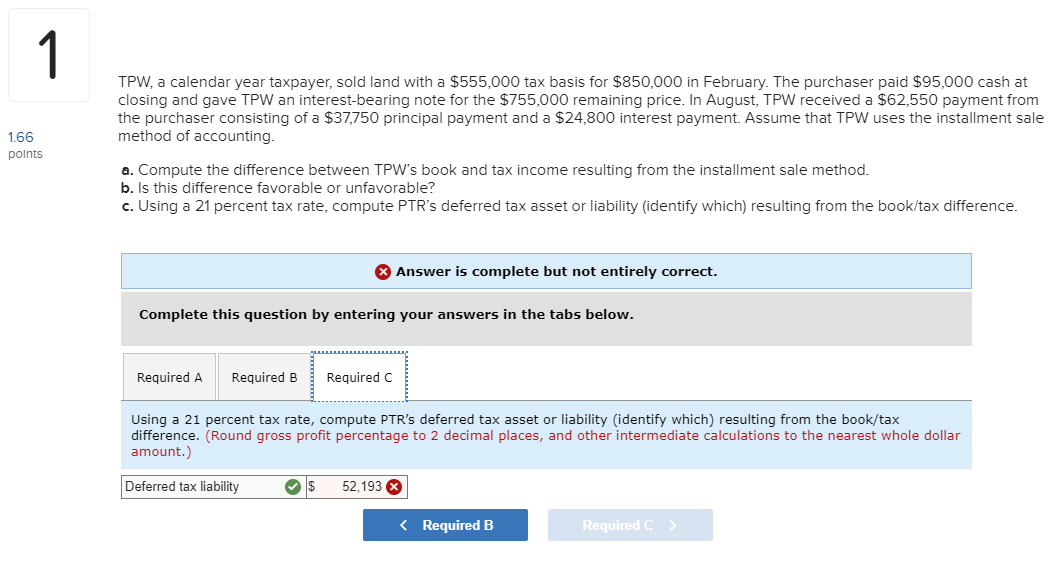

1 1.66 points TPW, a calendar year taxpayer, sold land with a $555,000 tax basis for $850,000 in February. The purchaser paid $95,000 cash at closing and gave TPW an interest-bearing note for the $755,000 remaining price. In August, TPW received a $62,550 payment from the purchaser consisting of a $37,750 principal payment and a $24,800 interest payment. Assume that TPW uses the installment sale method of accounting. a. Compute the difference between TPW's book and tax income resulting from the installment sale method. b. Is this difference favorable or unfavorable? c. Using a 21 percent tax rate, compute PTR's deferred tax asset or liability (identify which) resulting from the book/tax difference. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the difference between TPW's book and tax income resulting from the installment sale method. (Round gross profit percentage to 2 decimal places, and intermediate calculations to the nearest whole dollar amount.) Book/tax difference $ (244,865) X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts