Question: Need help with this problem. Please show your work and if you do it in excel please upload screenshots. 4-24: DuPONT ANALYSIS: A firm has

Need help with this problem. Please show your work and if you do it in excel please upload screenshots.

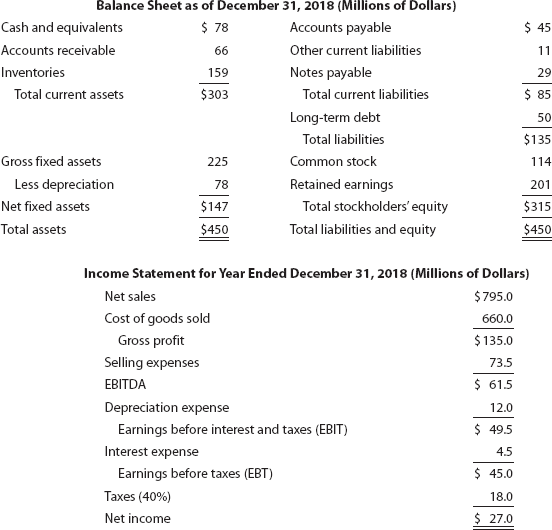

4-24: DuPONT ANALYSIS: A firm has been experiencing low profitability in recent years. Perform an analysis of the firms financial position using the DuPont equation. The firm has no lease payments but has a $2 million sinking fund payment on its debt. The most recent industry average ratios and the firms financial statements are as follows:

| Industry Average Ratios | |||

| Current ratio | 3x | Fixed assets turnover | 6x |

| Debt-to-capital ratio | 20% | Total assets turnover | 3x |

| Times interest earned | 7x | Profit margin | 3% |

| EBITDA coverage | 9x | Return on total assets | 9% |

| Inventory turnover | 10x | Return on common equity | 12.86% |

| Days sales outstanding | 24 days | Return on invested capital | 11.50% |

Income Statement for Year Ended December 31, 2018 (Millions of Dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts